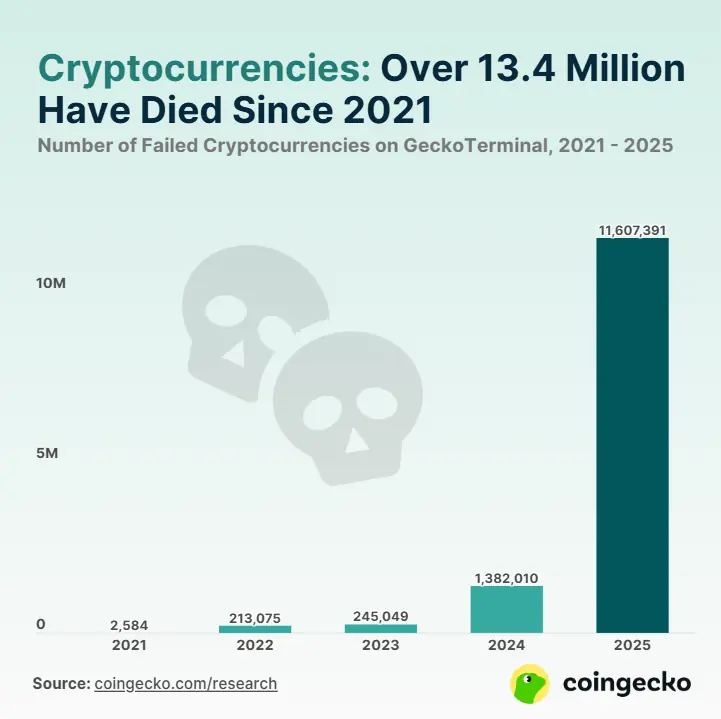

According to CoinGecko, over the past four years, the cryptocurrency market has experienced an unprecedented wave of project closures — more than 13.4 million tokens and platforms ceased to exist between 2021 and 2025. These figures clearly demonstrate how harsh recent market cycles have been for new participants and small projects attempting to establish themselves in a rapidly changing industry.

Statistics show a sharp acceleration in project liquidations: if only 2,584 projects disappeared in 2021, by 2022 the number had grown to over 213,000, in 2023 — 245,000, in 2024 — more than 1.38 million, and in 2025, the number of failed initiatives reached a record 11.6 million. What began as isolated cases during a “bull” market and heightened investor interest eventually turned into a mass market “cleansing”: liquidity disappeared, and speculative demand dried up.

The main reasons for this scale lie in the industry’s characteristics:

- Low barriers to entry allowed almost any startup or individual enthusiast to launch digital assets without significant infrastructure or vetting.

- Exaggerated hype and marketing campaigns created the illusion of high demand and drove short-term waves of activity.

- Short-term incentives and quick-profit schemes often outweighed strategic planning and sustainable development.

As a result, many projects lacked stable financial models, active development, long-term strategy, or genuine user demand. When market prices began to fall, these weaknesses became critical, and projects exited the market en masse.

The particularly sharp spike in liquidations in 2025 is explained by the fact that a large number of long-abandoned or inactive tokens were officially classified as “dead”. This also reflects stricter accounting standards, improved market monitoring and analytics, and the industry’s effort to separate genuinely functioning projects from “digital junk.”

Overall, the collapse of over 13 million projects confirms a key pattern of the crypto market: most initiatives do not survive a full market cycle. Volatility, competition, capital flows, and shifting demand inevitably weed out tokens and platforms that cannot maintain relevance, liquidity, or investor trust.

This trend highlights the difference between temporary experiments and long-term viability: some tokens last only a few months or years, while others, like Bitcoin and Ethereum, endure crisis cycles and strengthen their positions. For investors and developers, this is a signal that survival in the crypto industry requires strategic planning, financial stability, and continuous development, and the market has matured to the point where the survival threshold has reached a historic high.

Thus, mass project closures demonstrate not only the dangers of speculative booms but also the natural process of innovation selection in the crypto space, where strong and in-demand ideas remain, while weak ones disappear forever, making room for new players and sustainable growth.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.