A former Bank of England employee, Helen McCow, has issued an unexpected but symptomatic warning: financial regulators should prepare in advance for a potential economic crisis that could be triggered by an official statement from the White House confirming the existence of intelligent extraterrestrial life. This is not science fiction, but a discussion about how markets might react to an unprecedented informational shock, The Times writes.

McCow, who worked at the Bank of England until 2012 as a senior analyst for financial stability, sent a letter to the governor of the regulator, Andrew Bailey. In it, she proposes treating the scenario of an official confirmation of extraterrestrial life as a systemic risk comparable in scale to global financial crises or major geopolitical conflicts. Her core message is simple and alarming: even if the probability of such an event is low, its potential consequences could be so destructive that ignoring them would be a strategic mistake.

At the heart of McCow’s argument lies not biology or astronomy, but psychology and trust. The modern financial system is built not only on balances of assets and liabilities, but also on a collective belief in the predictability of the world. An official acknowledgment of intelligent extraterrestrial life would undermine the very foundation of that predictability. It would call into question the role of states, security institutions, religious and scientific narratives, and with them the stability of economic expectations.

According to McCow, such a statement could trigger a chain reaction: a sharp rise in uncertainty, panic among the population, массов withdrawals of deposits, and a flight of capital from traditional instruments. In an extreme scenario, this could lead to the collapse of individual banks, disruptions in payment systems, and civil unrest driven by fear and disorientation.

Notably, McCow identifies not risky assets but classic defensive instruments as potential victims of the crisis. Government bonds and gold, which for decades have been considered “safe havens” during periods of instability, could lose their appeal. The logic here is paradoxical but consistent: if the very architecture of human civilization and statehood is called into question, then government obligations and the symbolic values of the past lose part of their meaning.

Against this backdrop, the analyst highlights cryptocurrencies. In her view, decentralized digital assets could unexpectedly become beneficiaries of a crisis of trust. Their value in such a scenario would lie not so much in technological advantages as in the absence of a central decision-making authority and independence from state structures. In conditions where trust in institutions collapses, the very idea of an uncontrolled, issuance-limited asset may become psychologically attractive.

This thesis cannot be dismissed as entirely far-fetched. The history of recent years shows that cryptocurrencies often benefit from crises of trust – whether banking turmoil, sanctions wars, or sharp shifts in monetary policy. However, the “alien factor” potentially surpasses all previous informational shocks. This is not about currency devaluation or a change of government, but about a reassessment of humanity’s place in the universe.

The context in which McCow’s letter appeared is also noteworthy. Interest in UFOs and extraterrestrial life intensified after public remarks by Donald Trump, who as early as 2024 allowed for the existence of life beyond Earth (“There’s no reason not to think that there isn’t life on Mars and all these planets”). These words alone were not sensational, but they fell on fertile ground shaped by a growing number of leaks, investigations, and media projects dedicated to unidentified aerial phenomena.

An additional impulse came from the release of the documentary The Age of Disclosure, whose creators claim that within the American establishment there is demand for partial or full disclosure of information about such phenomena. Against this backdrop, activity surged sharply on the Polymarket platform at the end of 2025, where participants placed bets on the likelihood that the Trump administration would declassify UFO-related files. Financial markets, as usual, began to “price in” the scenario long before any official announcements.

It is important to emphasize that in recent weeks there have been no new confirmed statements from the White House. The discussion is based solely on assumptions, expectations, and interpretations of earlier comments. Nevertheless, it is precisely such expectations that often become triggers for market movements.

The reaction of the financial sector to McCow’s letter remains unknown. Central banks traditionally model crises related to recessions, debt bubbles, wars, and climate disasters. However, a scenario involving a global informational shock of an existential nature falls outside standard stress-testing frameworks. In this sense, McCow’s appeal reflects a broader trend – growing attention to unconventional and hard-to-formalize risks.

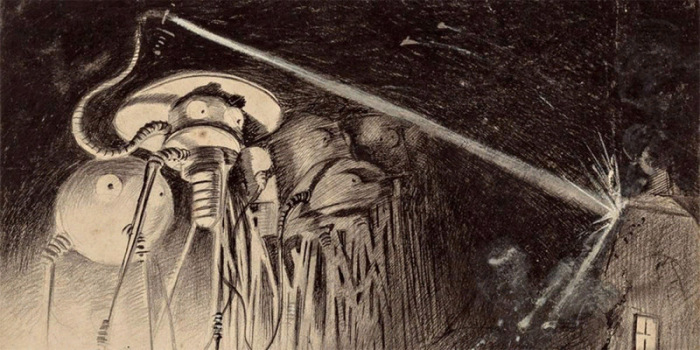

From the perspective of data analysis and behavioral economics, her forecast fits well into the concept of “black swans” – events with low probability but extreme consequences. History offers examples where informational shocks triggered mass panic without objective grounds. One need only recall the 1938 radio broadcast of The War of the Worlds, which caused waves of fear and chaos, or more recent cases where a single tweet or rumor led to multi-billion-dollar capital movements.

A particularly important role in the potential scenario is played by the speed of information dissemination. Social networks can amplify the effect many times over, turning a local statement into a global crisis of trust within hours. The irony is that the very preparation of regulators for such a scenario, if it becomes public, could itself increase anxiety and trigger a self-fulfilling prophecy.

Ultimately, the issue raised by McCow goes far beyond the topic of UFOs. It concerns the ability of the modern financial system to adapt to a world in which informational shocks become as dangerous as economic or military ones. And if regulators truly want to be prepared for anything, they may have to acknowledge that in the 21st century even the strangest scenarios no longer look impossible.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.