Since 2021, Tesla shares have looked formally solid, rising by around 59%. For the stock market, this is a respectable result, especially against the backdrop of turbulent years. But if you dig deeper, the picture becomes far less optimistic.

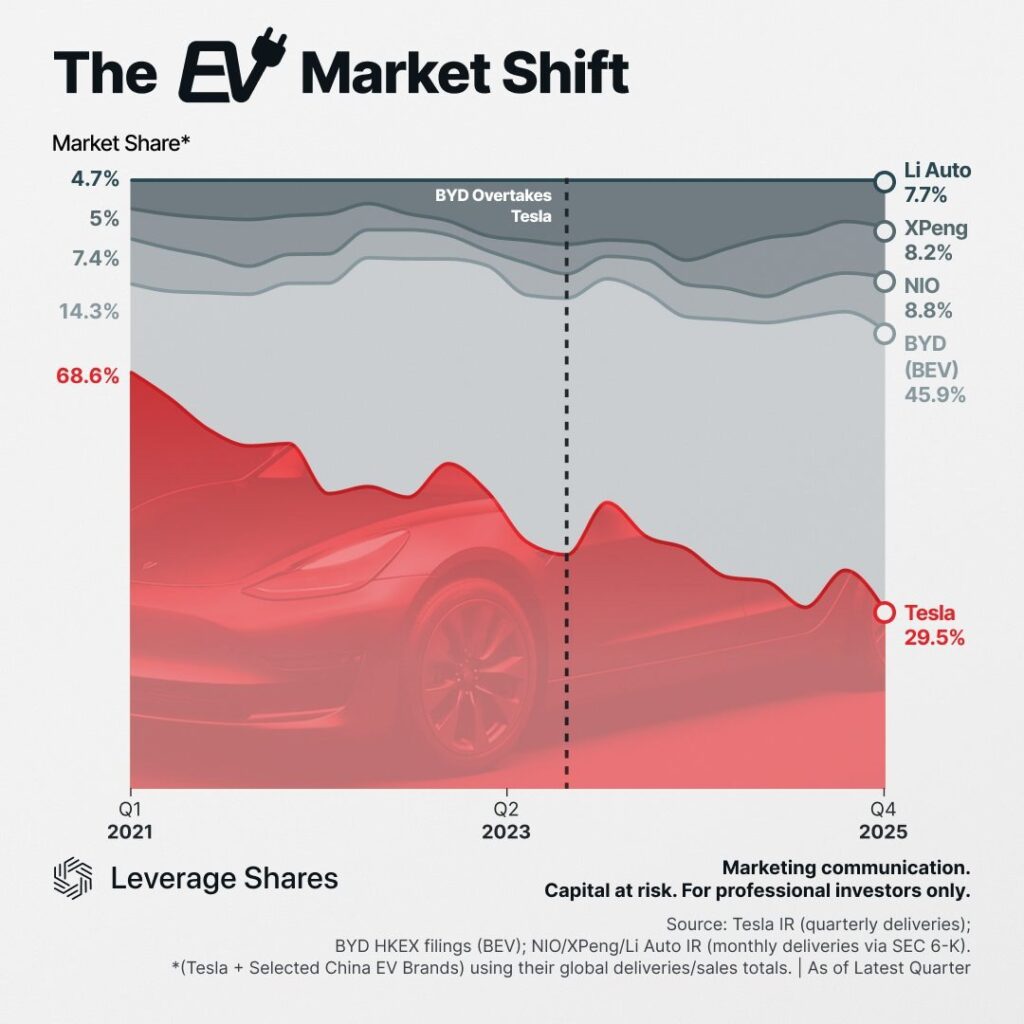

Over the same period, Tesla’s share of the electric vehicle market collapsed from 68.6% to 29.5%. In other words, the company lost more than half of its market. This is no cosmetic correction, but a structural shift.

The end of the monopoly era

At the beginning of the decade, Tesla was almost synonymous with the electric car. Competitors either did not exist or looked like experiments for enthusiasts. Today, the situation is radically different.

Chinese manufacturers – BYD, NIO, XPeng, Li Auto – are consistently and methodically taking market share. Not through hype, but through scaled production, aggressive pricing, a broad model lineup, and deep integration with local supply chains.

Notably, BYD overtook Tesla back in 2023, and the gap has only widened since then. By 2025, BYD’s share of the BEV segment is approaching 46%, while Tesla is steadily moving in the opposite direction.

Share price growth without leadership growth

Tesla’s key paradox today is that the rise in its stock price has become detached from the dynamics of its core business. The market increasingly values Tesla less as a car manufacturer and more as a bet on the future.

In practice, investors are not buying cars, but promises of AI, robotaxis, humanoid robots, autonomous driving, and “Tesla as a platform”.

The problem is that the automotive business is the only source of real, large-scale cash flow here and now. And it is precisely this business that is losing ground.

The China factor: the main blow

The decline in Tesla’s market share is neither an accident nor a temporary demand weakness. It is the result of the fact that:

- Chinese brands have learned to make electric vehicles just as well,

- they are cheaper,

- they are updated faster,

- and they are perfectly adapted to local markets.

Tesla no longer dictates the rules of the game. It is forced to react – cutting prices, sacrificing margins, and defending volumes rather than expanding its share.

What remains for Tesla

At the current trajectory, Tesla will almost certainly remain a major player. The brand has a strong name, a loyal customer base, infrastructure, and capital. But the status of an undisputed leader appears to be lost forever.

The company now faces a binary crossroads:

- Either Elon Musk’s bet on AI, autonomous driving, and robotics truly pays off, and Tesla ceases to be just an automaker.

- Or the market will eventually return to a reality in which an auto company with a declining share and shrinking margins cannot be worth a trillion dollars.

Conclusion:

Tesla today is no longer a story of dominance, but a story of transformation. The electric vehicle market has become mature, competitive, and tough. And now Tesla is not playing for EV leadership, but for the right to rewrite its own business model.

If the AI bet fails, talk of a $1 trillion-plus valuation will remain a beautiful myth of the era of cheap money. And the market, as practice shows, knows how to wait. But it does not pay for promises forever.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.