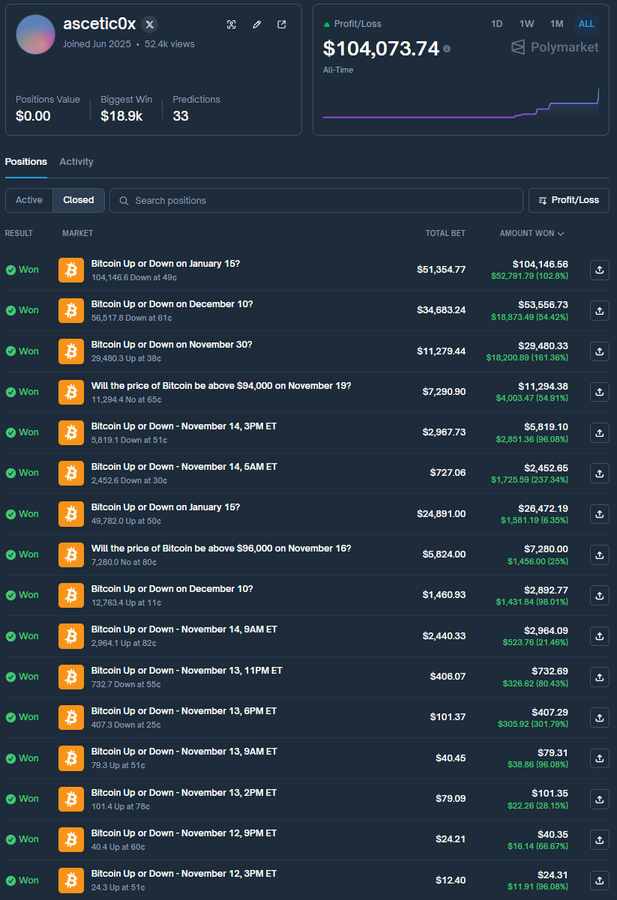

A story has emerged in the crypto community that instantly went viral on social media and sparked yet another debate about where calculation ends and pure gambling begins. A user of the decentralized prediction platform Polymarket, known by the nickname ascetic, started with a deposit of just $12 and turned it into roughly $100,000 in a single month.

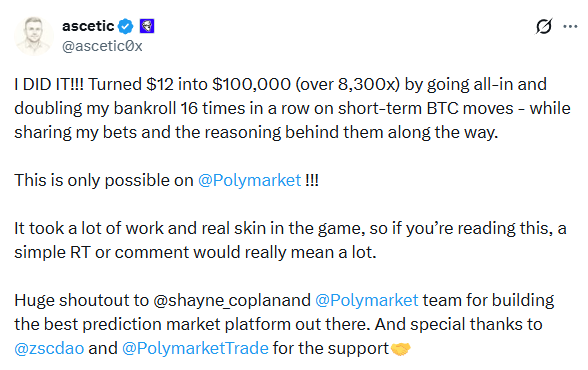

The mechanics were extremely simple and, at the same time, maximally risky. Ascetic bet on short-term upward moves in Bitcoin’s price. After every win, he doubled the stake and went all-in, without taking profits or reducing risk. Over the course of one month, he made 16 consecutive winning bets, each doubling the bankroll. The result – a more than 8,300x increase in capital.

The user publicly confirmed the outcome and outlined the strategy on X (Twitter), emphasizing that every bet was backed by reasoning and market analysis. He stressed that this was not a “random click,” but a series of deliberate decisions based on short-term BTC movements. According to him, the key factor was the ability to place such bets specifically on Polymarket, where prediction markets allow for fast and flexible reactions to price changes.

Why This Story Resonates So Strongly

Cases like this fit perfectly into the mythology of the crypto market: a tiny starting capital, extreme risk, absolute all-in, and an unbelievable outcome. It echoes the classic early Bitcoin legends, when a few hundred dollars turned into fortunes – with the difference that here everything happened within just a few weeks.

Professional market participants, however, view this story far more coldly. The strategy of doubling after every win has been known for decades and has a simple name – the Martingale. Its mathematical property is straightforward: the probability of eventually taking a loss approaches 100%. One wrong prediction at any stage wipes out the entire deposit.

In ascetic’s case, a rare combination of factors came together: a favorable market environment, a streak of good entries, discipline in following the strategy, and, undeniably, an element of luck. Sixteen consecutive wins in short-term bets on a highly volatile asset like Bitcoin is statistically extremely rare.

Polymarket and the Platform Effect

The Polymarket platform itself deserves special attention. It is a decentralized prediction market where users place bets on events, including political decisions, macroeconomic indicators, and asset price movements. Unlike classic trading, there are no margin requirements or liquidations, but the risk of losing the stake remains absolute.

Ascetic explicitly thanked the Polymarket team, noting that the platform’s architecture made such a series of trades possible. In practice, he used a prediction market as a tool for ultra-aggressive short-term trading, once again highlighting how blurred the lines are between investing, betting, and speculation in the crypto economy.

The Other Side of Success

It is crucial to understand that behind every such case there are thousands of similar attempts that ended with a complete wipeout at the first or second step. Success stories become public; failures do not. This is the classic survivorship bias, which distorts risk perception for newcomers.

Ascetic himself emphasized that he experienced intense psychological pressure throughout the process and was fully aware that a single mistake would erase the entire result. His success is not proof of the strategy’s sustainability, but rather a demonstration that the market sometimes rewards extreme risk – though never on a systematic basis.

Conclusion:

The story of turning $12 into $100,000 is neither a guide to action nor an argument for “easy money” in crypto. It is a rare example of how a combination of luck, precise timing, and extreme risk can lead to a phenomenal result.

The market loves such stories because they fuel hope. But the market is also ruthless toward those who confuse an exception with a rule. In the long run, it is not those who go all-in who win, but those who can survive bad days and preserve capital.

In this sense, the ascetic case is not about profit, but about the limits of risk. And that is exactly why it will be remembered so well by the crypto community.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.