A decision by the US Supreme Court on Donald Trump’s tariffs could become the very trigger that sharply changes the agenda in global markets as early as today. This is a rare case where a legal verdict is capable of triggering not just short-term volatility, but a full chain reaction – from the US budget to investor sentiment around the world.

The case concerns tariffs introduced by Trump based on the International Emergency Economic Powers Act (IEEPA). At the time, this instrument was used extremely broadly – tariffs were imposed not only on China, but also on Mexico, Canada, and effectively on most US trading partners. The formal justification was national security, including the fight against drug trafficking. It is precisely this logic that is now raising the greatest doubts among the judges.

A few days ago, Trump himself publicly acknowledged the scale of the potential consequences. According to him, if the Supreme Court rules against the tariffs, the United States will have to return hundreds of billions of dollars. And this is only the direct part of the problem. In addition to refunding the funds already collected, the country could face a wave of lawsuits and compensation claims from companies and governments that invested billions in building factories, logistics, and equipment in order to bypass tariff barriers. Taken together, Trump estimates the total could already reach trillions of dollars. He explicitly called such a scenario “total chaos” and stated that in the event of a negative ruling, the United States would be “in trouble”.

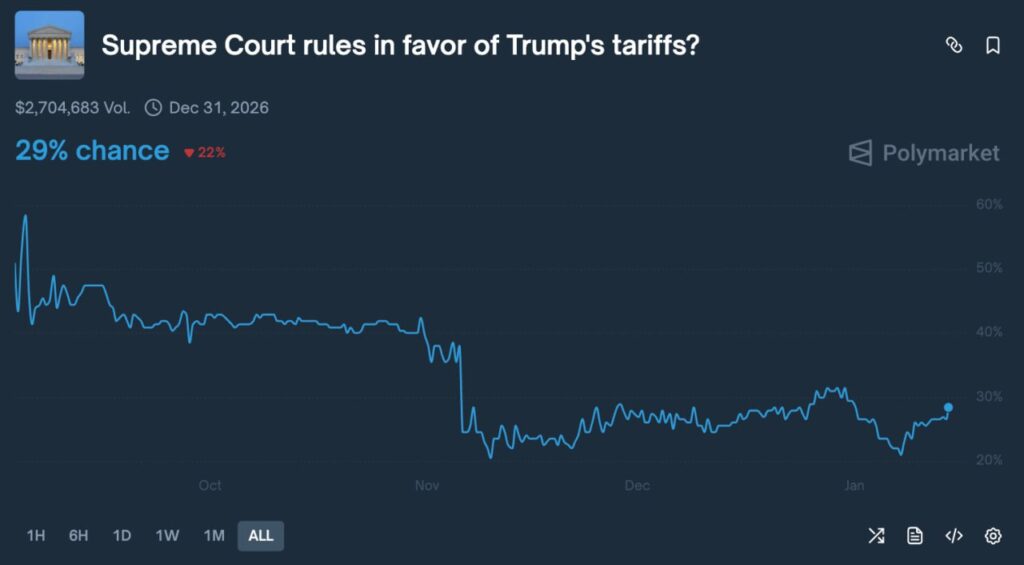

The market appears to be taking these words seriously. According to the Polymarket platform, the probability that the Supreme Court will deem the tariffs legal is estimated at just 29%. This means that the majority of bettors are already pricing in a negative scenario for the administration. For markets, this is an extremely sensitive point: if the tariffs are overturned, investors will have to urgently reassess fiscal risks, the budget deficit, borrowing prospects, and the stability of dollar liquidity.

Against this backdrop, even traditionally important macroeconomic data fade into the background. The Non-Farm Payrolls report, which under normal circumstances could have set the tone for markets, now looks almost secondary. Forecasts point to an improvement in labor market conditions in December, but for Federal Reserve decisions such data matter only under “normal” conditions. And the current situation looks increasingly far from normal. In the event of a legal blow to a key element of the White House’s trade policy, the Fed could face an extraordinary set of factors in which classic indicators lose their weight.

The behavior of large capital confirms this. Over the past week, investors have withdrawn about $9.9 billion from the SPDR S&P 500 ETF Trust (SPY). These are preliminary figures, and the final number may be revised. Theoretically, it could even look slightly better. But when this outflow is combined with the record withdrawal of $20.1 billion a few weeks earlier – the largest since March – it gives the impression not of local profit-taking, but of a systemic step back by major players. In such moments, “smart money” prefers not to guess the outcome, but simply to move to a safe distance.

The situation itself clearly demonstrates the vulnerability of the US two-party system. In calm periods, it does indeed serve as an effective system of checks and balances, limiting abuses of power. But at critical moments in history, the very same system can lead to decision paralysis and a sharp rise in uncertainty. When a country’s key economic policy hinges on a single court verdict, markets inevitably react nervously.

During oral arguments, judges – including both the conservative majority and the progressive wing – openly expressed doubts that IEEPA grants the president such broad authority to impose sweeping tariffs. This is an important signal: the issue is not a partisan line, but a fundamental question about the limits of executive power. That is precisely why the outcome of the case is so difficult to predict and so dangerous to ignore.

If the Supreme Court sides with Trump, markets will likely see a sharp relief rally – at least due to the removal of one of the biggest sources of uncertainty. But if the ruling is negative, the consequences could be far deeper. Refunds, potential compensation, a rising deficit, pressure on the dollar, a reassessment of rate expectations, and a flight from risk – all of this could unfold almost simultaneously.

That is why today looks far more important for markets than any single macroeconomic report. This is not just a legal case. It is a test of the resilience of the entire structure of US economic policy in recent years. And under such conditions, even the largest investors prefer to stay on the sidelines, watching events unfold from a distance.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.