Monero (XMR) breaks the $500 mark for the first time since 2021 amid competitor struggles, according to Bitfinex market data.

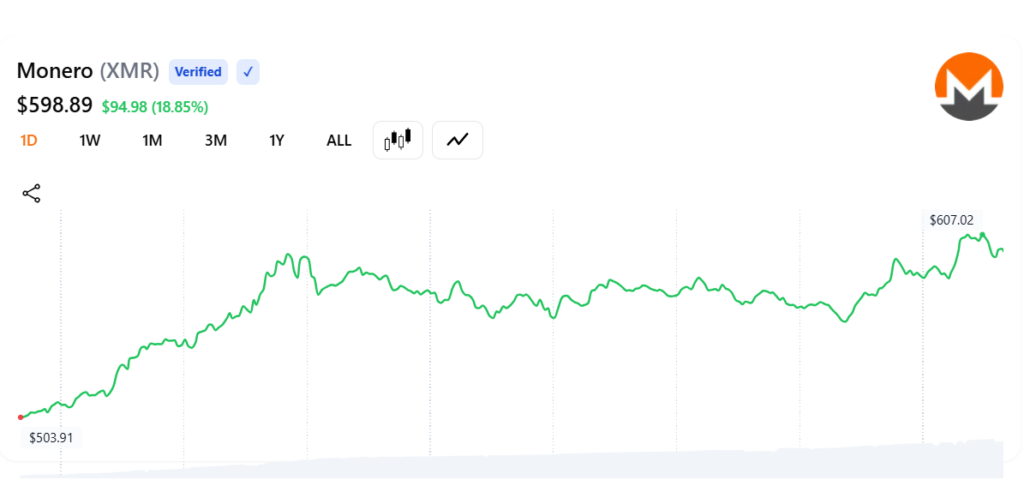

The privacy-focused cryptocurrency Monero (XMR) reached a record high of nearly $598.5 on the Kraken exchange in the night of January 12, 2026, marking a significant milestone for the coin given its long history of volatility. By 14:20 Moscow time the same day, the price had slightly retreated to around $580. The previous peak of XMR was recorded in May 2021 at just above $517.

Over the past 24 hours, XMR rose nearly 20%, while its closest competitor, Zcash (ZEC), increased only by 7%. By comparison, Bitcoin (BTC) and Ethereum (ETH) remained virtually unchanged, trading around $90.5k and $3.1k respectively, according to CoinMarketCap.

Since the beginning of 2026, XMR has risen over 30%, outperforming many major cryptocurrencies in percentage growth. During the same period, BTC increased about 2% and Ethereum about 4%.

History and Growth Dynamics

XMR’s growth in early 2026 continues the positive momentum observed in 2025, when the coin became one of the leaders in gains among top cryptocurrencies. Much of this growth has occurred without news events or institutional inflows, as was the case with Bitcoin, Ethereum, Solana, or BNB. This indicates sustained community and investor interest in privacy coins, based on Monero’s fundamental properties.

Currently, XMR ranks 12th by market capitalization on CoinMarketCap with about $10.5 billion and is the largest coin in the privacy sector, ahead of Zcash with a market cap of $6.6 billion. At times in 2025, ZEC outperformed XMR in market cap, but after November 2025, ZEC lost momentum — a local peak of $730 fell to $400. In early January 2026, pressure on ZEC increased after the departure of one of its development teams, causing the price to drop roughly 20% within hours.

Anonymity as a Core Feature and Regulatory Risks

Monero’s anonymity is a fundamental feature of all transactions: users cannot choose an alternative format for sending coins. This has led to major exchanges, including Binance, OKX, and Bybit, delisting XMR due to regulatory pressure. Liquidity in Monero markets has remained limited for some time, yet interest persists due to its unique privacy features. Analysts at 10x Research note that coins like XMR continue to attract investor attention despite high regulatory risks.

For instance, starting January 12, 2026, Dubai’s financial regulator DFSA is banning private cryptocurrencies, including Monero and Zcash, under the digital asset rules in the DIFC international financial zone. The ban is due to the inability to ensure full transaction transparency and compliance with anti-money laundering requirements and sanctions legislation.

Technical Features and Outlook

Monero remains one of the most technologically advanced privacy coins. Its ring signature system and confidential transaction protocols (RingCT) hide the sender, receiver, and transaction amount. These mechanisms make XMR nearly untraceable, which is both an advantage and a source of risk for exchanges and investors amid growing regulatory demands.

Historically, XMR has faced difficulties near record levels. Around the $500–$520 range, sharp pullbacks are possible if the coin cannot confidently surpass these levels. At the same time, sustained interest in privacy-focused cryptocurrencies among users seeking confidentiality and financial autonomy creates fundamental demand for XMR.

Thus, Monero continues to occupy a unique niche in the crypto market — combining technological leadership in privacy with volatile but potentially profitable investor interest. In the coming weeks, market attention will focus on maintaining the $500 mark and investor reactions to increasing regulatory pressure across jurisdictions.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.