Seventeen years ago, on January 12, 2009, an event took place that is now seen as the starting point of the entire crypto industry, although at the time almost no one paid attention to it. On that day, Satoshi Nakamoto sent the first transaction in the history of the Bitcoin network, transferring 10 BTC to cryptographer and developer Hal Finney. Back then, it looked more like a technical experiment between two enthusiasts than the birth of a new financial system. But from that moment on, Bitcoin stopped being just code and became a functioning economic network.

Hal Finney was one of the first people who not only read the Bitcoin white paper but actually ran the software. One day before the historic transaction, on January 11, 2009, he posted a short phrase on Twitter: “Running bitcoin”. Today, this tweet is quoted more often than many academic papers on economics. At the time, Finney was simply testing a new system, unaware that his name would forever be written into financial history.

According to Finney’s own recollections, the identity of Satoshi Nakamoto remained a mystery to him. He believed he was communicating with “a young man of Japanese origin, very intelligent and sincere”. There were no grand statements, no sense of a great mission. Just calm, technical correspondence about how to make the protocol work reliably. In hindsight, this is where the strength of the idea becomes clear. Bitcoin was not born as a marketing project. It was launched as an engineering solution.

Finney later admitted that he initially underestimated Bitcoin’s potential. In 2014, he described his early experience with irony and regret. In those days, the network difficulty was one, and mining was possible on a regular CPU, without GPUs, farms, or data centers. He mined blocks for several days but then turned off his computer because it was overheating and the fan noise annoyed him. At that moment, no one was thinking about millions or billions. Bitcoin was simply a program running in the background until it started interfering with everyday comfort.

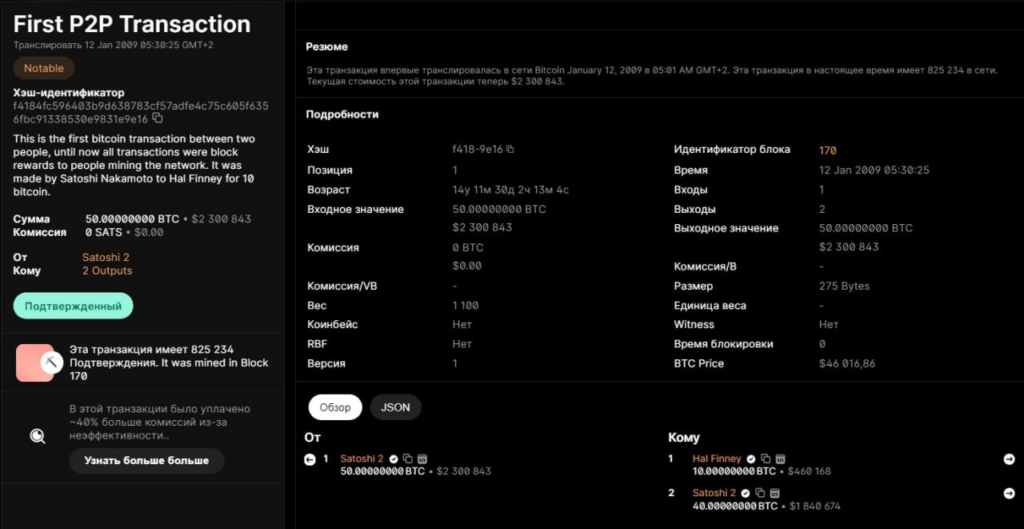

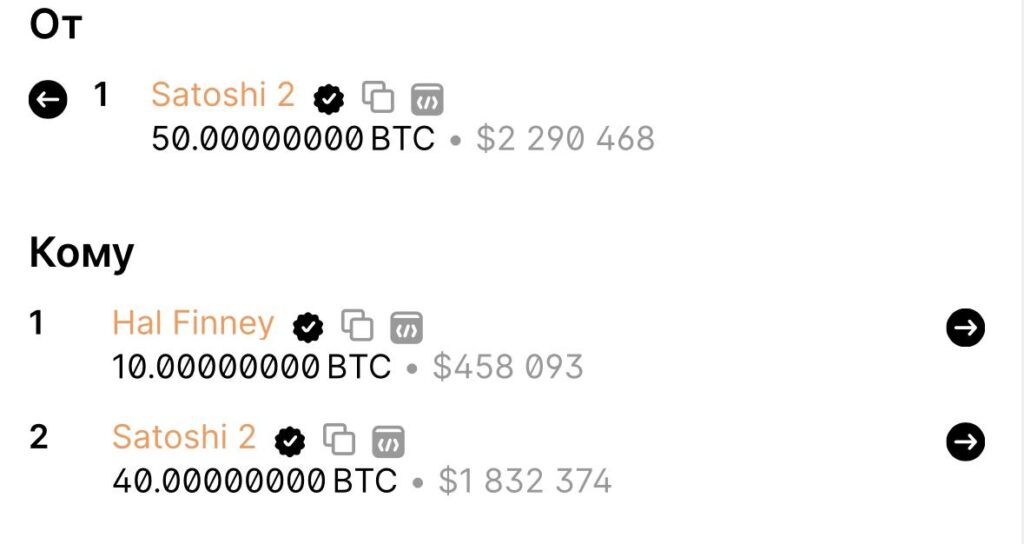

On January 12, 2009, Satoshi sent Finney 10 BTC. This transaction was included in block #170 and became a unique historical detail: it is the only known transaction that Satoshi personally sent to another individual. In the same block, a total of 50 BTC was transferred, and the miner reward was also 50 BTC. Transaction fees did not exist at all. The network’s economy was extremely simple and almost toy-like by today’s standards.

It is important to remember the context. The Bitcoin mainnet had been launched just a few days earlier, on January 3, 2009. On that day, Satoshi Nakamoto mined the genesis block and embedded in its hash the headline from The Times newspaper: “Chancellor on brink of second bailout for banks”. This was not a random line. Many rightly saw it as a direct criticism of the traditional financial system, based on bank bailouts funded by taxpayers and endless debt expansion. From the very beginning, Bitcoin was positioned not merely as a technological experiment, but as an alternative to the existing order.

At the time of the first transaction, Bitcoin had no market price. It could not be exchanged for dollars, euros, or gold. There were no exchanges, no wallets with polished interfaces, no institutional investors, and no talk of digital gold. There was only an idea, code, and a handful of people willing to test whether it worked at all. That is why the first transaction between Satoshi and Finney is now seen as a symbol of trust. Not trust in price or profit, but trust in the concept itself.

From the vantage point of 2026, this all seems almost absurd. A network that began with a computer being turned off because of fan noise has become a global financial infrastructure with a market capitalization of hundreds of billions of dollars. What was once worth nothing is now part of strategic reserves, institutional portfolios, and geopolitical discussions. Yet it is important to remember that at the core of all this lies not a price chart, but that very first transaction, sent without hype or expectations.

On January 12, 2026, exactly 17 years passed since Bitcoin was first used for its intended purpose. Not as an idea, not as a document, not as a promise of the future, but as a working system for transferring value. The history of Bitcoin did not begin with price growth or speculation. It began with 10 BTC sent between two people who simply wanted to see whether it was possible at all. And as time has shown, far more was possible than they could have imagined back then.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.