The largest corporate holder of Ethereum, BitMine, has begun 2026 by significantly increasing its ETH holdings. This time, the company purchased Ethereum worth $105 million, strengthening its position in the crypto industry and confirming its strategic approach to digital asset management. The total amount of staked Ethereum now exceeds $2.87 billion, while BitMine still holds significant cash reserves — $915 million — allowing the company to maintain flexibility and respond quickly to market opportunities.

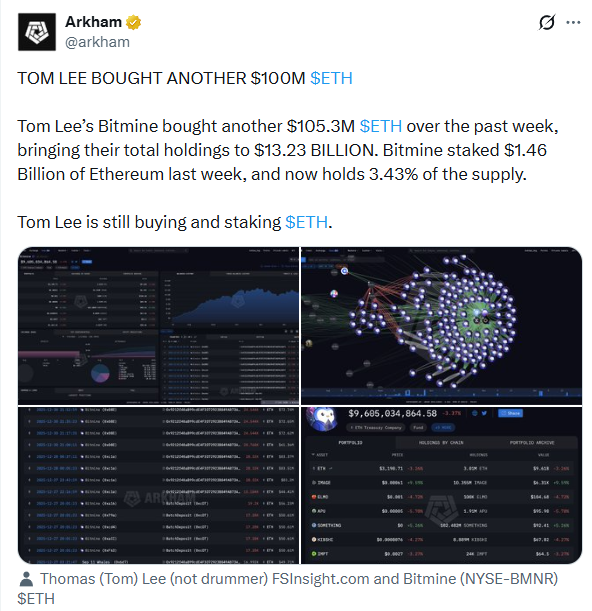

BitMine’s Ethereum reserve management arm, BitMine Immersion Technologies, purchased 32,938 ETH on Tuesday, while crypto markets remained relatively subdued in the last days of 2025. According to the analytics platform Nansen, after this transaction, BitMine’s total Ethereum holdings reached 4.07 million coins, valued at approximately $12 billion at current prices. The scale of these operations reinforces BitMine’s status as one of the leading institutional participants in the ETH market.

Additionally, the company continued its staking strategy by staking another 118,944 ETH. This not only increases returns on existing investments but also provides passive income for shareholders. Tom Lee, responsible for Ethereum strategy at BitMine and founder of the analytics firm Fundstrat, links the relatively muted crypto asset prices to year-end sales for tax-loss harvesting in the U.S.

According to Lee, at the end of the year, investors traditionally realize losses to reduce taxable income, which puts pressure on cryptocurrency and crypto-stock prices. The strongest effect is observed from December 26 to 30, when a significant portion of market activity comes from sales aimed at minimizing taxes. During this period, institutional investors temporarily step back from the market, allowing trading bots to dominate, which also restrains price growth. In the last two weeks of 2025, the total crypto market capitalization remained around $3 trillion, confirming the temporary stagnation of assets.

Since last Monday, BitMine has accumulated over 77,400 ETH, significantly widening its lead over competitors. Lee notes that the company is the largest Ethereum buyer due to new cash flows, purchasing more than 40,000 ETH per week for at least 10 consecutive weeks. This demonstrates the company’s systematic and long-term approach to increasing its Ethereum portfolio share.

BitMine’s purchases coincided with sharp criticism within the crypto community regarding a proposed tax reform in California, which would impose a 5% wealth tax on billionaires. Former Kraken CEO Jesse Powell warned that such a measure could be the last straw, forcing billionaires to relocate spending, charitable donations, and job creation to other regions. The proposal also includes taxation of unrealized gains, raising concerns among entrepreneurs about a potential outflow of capital and investment activity from the tech-focused state.

Thus, BitMine is not just increasing its Ethereum reserves, but is operating within a complex macroeconomic and regulatory environment, demonstrating a strategy of long-term growth and passive income for shareholders, while simultaneously strengthening its position in the global cryptocurrency market.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.