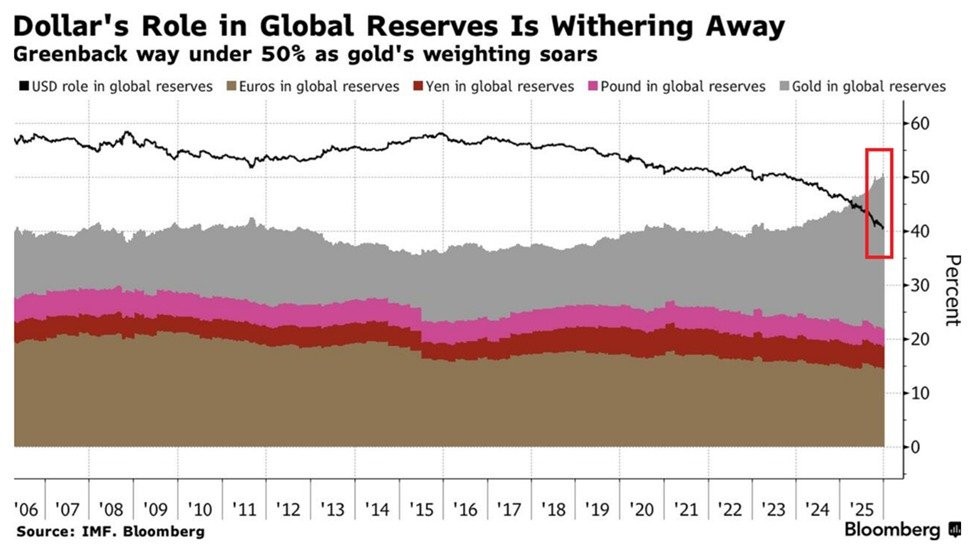

Today, the US dollar accounts for about 40% of global foreign exchange reserves. Formally, this is still first place, but in reality it is a historical low, at least over the past two decades. Over the last ten years, the dollar’s share has declined by as much as 18 percentage points. For a currency that for decades was considered without alternative, this is not just statistics. It is a signal.

At the same time, a mirror process is taking place. Over the same period, gold’s share of global reserves has increased by 12 points, reaching 28%. This is the highest level since the early 1990s. Moreover, today gold accounts for a larger share of reserves than the euro, the Japanese yen, and the British pound sterling combined. Not long ago, such a comparison would have sounded provocative. Today, it is plain accounting.

It is important to understand that this is not speculative demand and not a short-term trend. It is a deliberate decision by central banks. In recent years, they have been systematically reducing their dependence on the US dollar while simultaneously accelerating the accumulation of gold in their vaults. The reason is simple and uncomfortable for the dollar. A currency is always someone’s promise. Gold is an asset without an issuer, without credit risk, and without a political center of control.

The world is entering a phase in which political risks have once again become a key factor. Sanctions, the freezing of reserves, trade wars, and the fragmentation of the global economy have made obvious what many previously preferred not to say out loud. Reserves must be not only liquid, but also sovereign in the most literal sense of the word. Gold in a vault is an asset that cannot be switched off with a button and cannot be blocked by someone else’s decision.

The market reacted to this shift predictably. In 2025, gold prices rose by 65%. This was the largest annual increase since 1979, that is, since the collapse of the Bretton Woods system and the era of high inflation. At the same time, the US dollar index declined by 9.4%, posting its worst annual result in the past eight years. These movements are neither random nor independent of each other. They are two sides of the same process.

We are witnessing a gradual but steady dismantling of the dollar-centric reserve system. Not in the form of a sudden collapse, but in the form of a quiet reallocation. The dollar does not disappear and does not lose its status as a global currency overnight. But it ceases to be the only anchor. Central banks vote not with statements, but with balance sheets, and their choice is becoming increasingly clear.

In this system, gold plays the role of a universal insurance asset. It does not pay a coupon, does not promise returns, and does not directly participate in economic growth. But precisely for this reason, it is becoming central again. In a world with too many promises and too many risks, what is valued most is what depends on no one’s words.

That is why the rise of gold is not just a rise in price. It is a reflection of distrust in the financial architecture of the past. When gold occupies a larger place in reserves than the major currencies of developed countries, it means the world is preparing for a harsher, more fragmented, and less predictable reality.

Gold does not make revolutions. It simply survives them. And judging by the numbers, this is exactly the scenario central banks are preparing for today.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.