World Liberty Financial, connected to Donald Trump’s ecosystem, has taken a significant and largely illustrative step by applying for a U.S. national trust bank license. This is a de novo format — creating a new bank from scratch through its subsidiary, World Liberty Trust Company, under the supervision of the Office of the Comptroller of the Currency (OCC).

What is happening

Obtaining a national trust bank license opens fundamentally new possibilities for World Liberty Financial. The company will be able to independently issue, hold, and redeem the USD1 stablecoin at a $1 nominal value without relying on third-party commercial banks.

Unlike traditional banks, trust banks do not accept retail deposits, do not treat the public as depositors, and focus on asset custody, settlements, custodial, and payment services.

This is why this format has become particularly attractive to crypto companies that value:

- regulatory legality,

- direct access to banking infrastructure,

- minimal intermediaries.

Effectively, World Liberty Financial aims to integrate its stablecoin into the very fabric of the U.S. financial system rather than exist on its periphery.

Why this matters for the stablecoin market

Stablecoins have long ceased to be just auxiliary trading tools. Today they represent:

The national trust bank model addresses these questions directly — under the supervision of a federal regulator within the U.S. banking system.

- a settlement layer for the crypto market,

- a bridge between TradFi and DeFi,

- infrastructure for cross-border payments.

Obtaining a banking license means that USD1 can be positioned not as a conditional “crypto token with a dollar promise” but as a regulated financial instrument with a clear legal status.

For regulators, this is a crucial point. Stablecoins have been at the center of debates in recent years: who has the right to issue them, where reserves must be held, and who is responsible in crisis situations.

The national trust bank model addresses these questions directly — under the supervision of a federal regulator within the U.S. banking system.

A trend broader than one company

World Liberty Financial is not a pioneer here but part of a larger movement. Major crypto asset issuers and infrastructure companies are increasingly seeking federal banking licenses, moving away from gray schemes through partner banks, and pursuing direct regulatory integration.

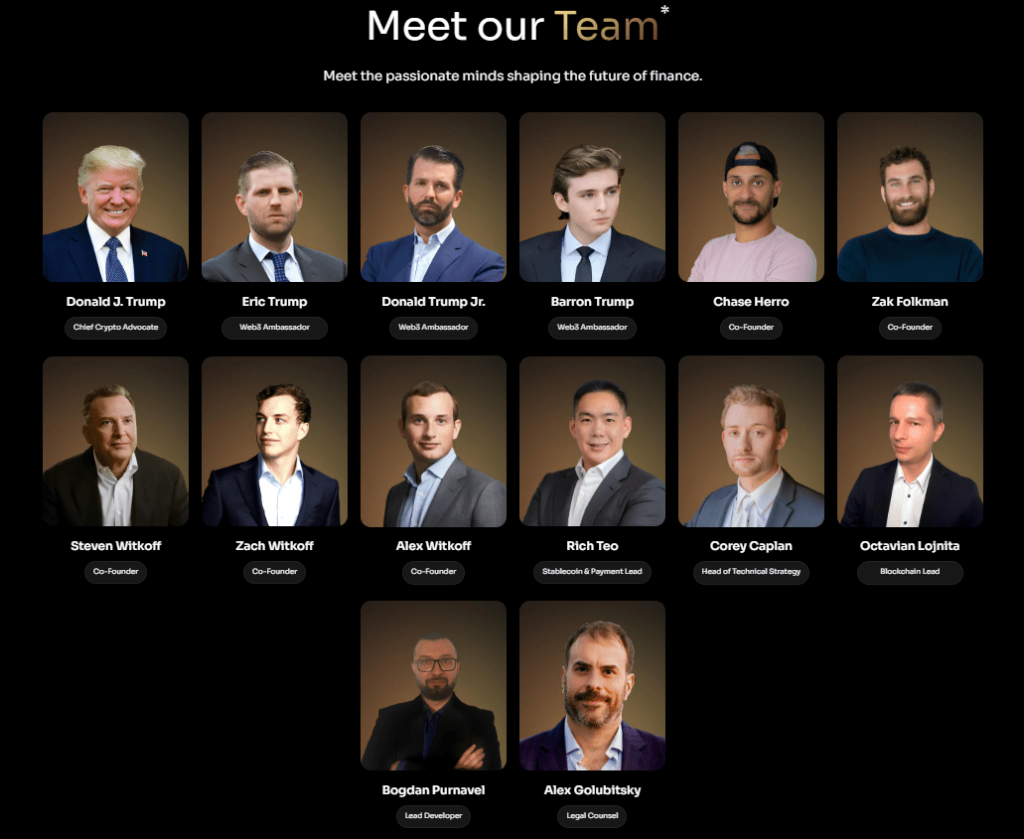

The World Liberty Financial Team. Source: WLFI

The reason is simple — the “Wild West” era in crypto is ending. Institutional money demands clear rules, legal accountability, and reserve protection. Those who do not fit this logic risk being left out of the new financial cycle.

Blurring the lines between TradFi and crypto

World Liberty Financial’s trust license application clearly demonstrates how the line between traditional finance and blockchain infrastructure is disappearing.

This is no longer a confrontation: banks versus crypto, regulators versus decentralization. It is a merging process, where blockchain serves as the technology layer, banks as the legal shell, and stablecoins as the settlement instrument.

In this format, USD1 becomes not just a medium of exchange but an element of a next-generation official dollar infrastructure.

What this means for investors and traders

The market signal is clear:

- the role of stablecoins will only grow,

- projects with regulatory transparency benefit,

- access to the banking system becomes a competitive advantage.

Whether you view the market from a TradFi or crypto perspective, one thing is clear — regulated bank-issued stablecoins change the flow of capital. Money begins to circulate faster, cheaper, and with fewer legal risks.

If before the question was “will stablecoins survive?”, now the question is — who will control their issuance and infrastructure. World Liberty Financial clearly aims to be among these key players.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.