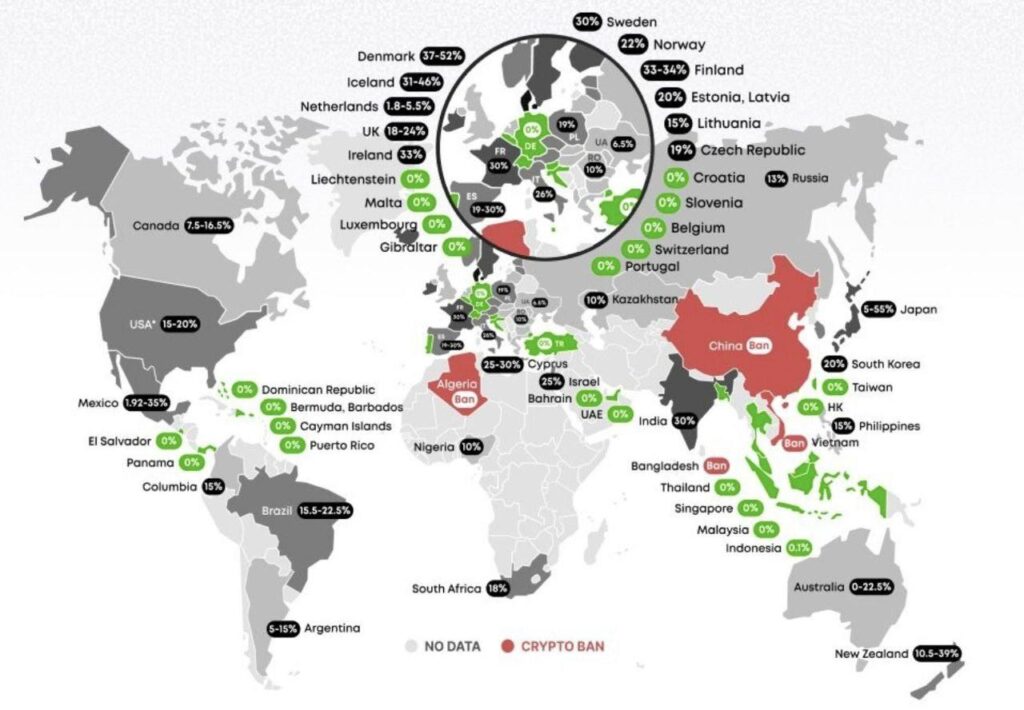

As cryptocurrencies become a mainstream financial instrument, the attention of tax authorities worldwide is intensifying. Governments are introducing new rules, reporting requirements, automatic data exchange, and separate taxation regimes for digital assets. However, the global picture is not uniform. Alongside tighter regulation, an alternative camp is forming – jurisdictions that deliberately bet on the crypto industry and offer zero or near-zero taxation on crypto income.

In 2025, there is a number of countries and territories where profits from cryptocurrency transactions are either fully tax-exempt or not taxed under certain conditions. These jurisdictions are becoming magnets for traders, long-term Bitcoin holders, Web3 entrepreneurs, DeFi investors, and founders of crypto businesses.

It is important to understand that “zero tax” does not always mean a complete absence of rules. Most often, it means that cryptocurrency is not recognized as a taxable asset; there is no capital gains tax for individuals; income from long-term holding is not taxed; transactions with digital assets are not considered entrepreneurial activity below certain thresholds; and a territorial taxation principle applies.

In 2025, the most well-known crypto-friendly countries include:

UAE

One of the most popular crypto jurisdictions in recent years. Individuals are not subject to income tax, and capital gains from cryptocurrencies are not taxed. The country is actively developing crypto zones, licensing exchanges and Web3 projects. The UAE focuses on institutional and corporate crypto business.

Cyprus

In some cases, cryptocurrency income is not taxed, especially when it involves private investments rather than professional trading. Cyprus remains an attractive option within the EU due to its mild regime and developed financial infrastructure.

Portugal

For a long time, it was considered a European crypto haven. For private investors, long-term holding of cryptocurrency can still be tax-exempt. However, the rules are gradually becoming more complex, and residency status plays a key role.

Panama

Applies the territorial taxation principle. Income earned outside the country, including crypto income, is generally not taxed. This makes Panama popular among crypto entrepreneurs and digital nomads.

Singapore

Cryptocurrency is not subject to capital gains tax for individuals. At the same time, professional trading and business activities may be taxed. Singapore focuses on transparency and the institutional market.

Malta

One of the first countries to develop comprehensive crypto regulation. In certain structures, legally minimal or zero taxation is possible, especially for long-term investments.

Barbados, Bermuda, Cayman Islands

Classic offshore jurisdictions with no capital gains tax or personal income tax. Actively used by funds, DAOs, and crypto startups.

Hong Kong

Under certain conditions, investment income from cryptocurrencies is not taxed. The jurisdiction seeks to regain its status as Asia’s crypto hub.

Mauritius, Vanuatu

Offer simple tax residency regimes, no capital gains tax, and a favorable attitude toward crypto assets.

Gibraltar, Liechtenstein, Switzerland

Jurisdictions with a high legal culture where crypto income for private investors may be tax-exempt, especially for long-term holding. Often used by family offices and high-net-worth investors.

Slovenia

In some cases, individual income from cryptocurrencies is not taxed if the activity is not classified as entrepreneurial.

Uruguay

Follows the territorial principle, making the country attractive to crypto investors with foreign income.

El Salvador

The first country to recognize Bitcoin as legal tender. For foreign investors, crypto income is effectively tax-exempt.

Puerto Rico

A special tax regime for residents, including full exemption from capital gains tax if program conditions are met.

Why These Countries Benefit

Jurisdictions with zero crypto tax attract capital; highly mobile professionals; technology startups; investment funds; payment and blockchain projects.

For governments, this is a way to compensate for the lack of taxes through capital inflows, job creation, and the development of financial ecosystems. For investors, it is an opportunity to preserve returns amid global tightening of tax pressure.

What to Pay Attention To

Zero crypto tax does not mean the absence of obligations. It is necessary to correctly determine tax residency, comply with reporting requirements, follow AML and KYC rules, and understand where the tax obligation arises.

In 2025, crypto tax planning is no longer an option but a necessity. That is why zero-tax countries are turning from an exotic choice into a strategic one for an increasing number of investors.

Conclusion

Cryptocurrencies were originally created as a tool of financial freedom. And although it is no longer possible to completely escape regulation, the world still offers legal spaces where crypto profits remain with the investor. The only question is who is ready to study the rules and act one step ahead.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.