BlackRock released a new report highlighting that cryptocurrencies have fully integrated into the global financial system and are no longer perceived as a narrowly speculative segment.

Twice a year, BlackRock’s senior portfolio managers and investment executives gather for a closed strategic forum to discuss the prospects for the global economy and financial markets over two days, as well as how these changes should be reflected in investment portfolios. The outcome of these discussions is the Global Outlook — the company’s key strategic guide, shaping its macroeconomic view and investment priorities.

The difference with the current outlook is that it does not attempt to fit developments into traditional market cycles. On the contrary, BlackRock explicitly notes that conventional analytical models are failing. The economy and markets are entering a phase of structural transformations, where so-called mega forces — long-term processes changing the very architecture of the financial system — play a decisive role.

The mega forces concept, launched several years ago, has proven its practical value this year. It allows seemingly disparate phenomena to be connected: explosive investments in artificial intelligence, the energy transition, the transformation of financial markets, the growing role of private capital, and the fragmentation of the global economy. It is through the lens of these forces that BlackRock analyzes both risks and new sources of returns.

The central focus of Global Outlook 2026 is the contradiction between the scale of AI infrastructure investments and the uncertainty of future returns. These “clashing orders of magnitude” create tensions that are already affecting capital markets, energy, the technology sector, and the financial system as a whole. Importantly, AI is considered not in isolation but in close connection with other mega trends — primarily energy and the future of finance.

BlackRock: cryptocurrency is no longer an experiment

Special attention in the report is given to BlackRock’s view on digital assets. A few years ago, cryptocurrencies were considered by large institutional players as a niche, high-risk experiment. In Global Outlook 2026, they are described as a developing component of financial infrastructure.

BlackRock — the world’s largest asset manager with over $9 trillion under management — no longer questions the existence of the crypto market itself. The discussion has shifted from “whether” to “how and where.”

Stablecoins going mainstream

According to BlackRock, stablecoins are becoming a key bridge between traditional finance and the crypto economy. Their role extends far beyond speculative instruments. In several jurisdictions, they already serve as a unit of account, a store of value, and a cross-border payments tool.

In countries with unstable currencies or limited banking access, stablecoins can partially displace local money. This creates direct competition with government currencies and changes the logic of monetary circulation in emerging markets.

Pressure on traditional banks

BlackRock notes increasing pressure on the banking sector. Stablecoins and crypto products are drawing deposits away, offering users alternative ways to store funds and earn yield outside the traditional banking system.

This is not an immediate crisis, but a slow structural liquidity outflow that over time may change banks’ business models, particularly in retail and cross-border operations.

Crypto as infrastructure, not speculation

The focus is shifting from volatile trading to practical use. The report emphasizes the growing importance of blockchain as infrastructure for settlements, liquidity management, and tokenization of real assets. The crypto market is increasingly viewed as a technology layer on which new financial services are built.

This fundamentally changes institutional investors’ perspective: they begin to analyze crypto not as an “asset” but as a financial rail along which capital will move in the future.

Institutional recognition

The launch of BlackRock crypto ETFs itself is a marker of the new reality. For the world’s largest asset manager, this is not an experiment but a product for long-term capital. Digital assets thus gained implicit institutional recognition and access to conservative investors’ portfolios.

AI as the primary market driver

BlackRock clearly identifies AI as a major driver of capital allocation. It affects not only the technology sector but also energy, infrastructure, labor markets, and overall economic productivity. Investments in AI require massive resources, which increases capital concentration and changes market structure.

The end of classic market cycles

The report effectively acknowledges that the traditional “growth — overheating — decline — recovery” model no longer reflects reality. Long-term structural shifts, where scale, capital access, and infrastructure control are key, are taking its place.

The illusion of diversification

One of the most alarming conclusions is the illusion of diversification in traditional portfolios. Many assets previously considered independent now depend on the same macro factors: rates, liquidity, geopolitics, and technological mega trends. As a result, risk protection is weaker than investors expect.

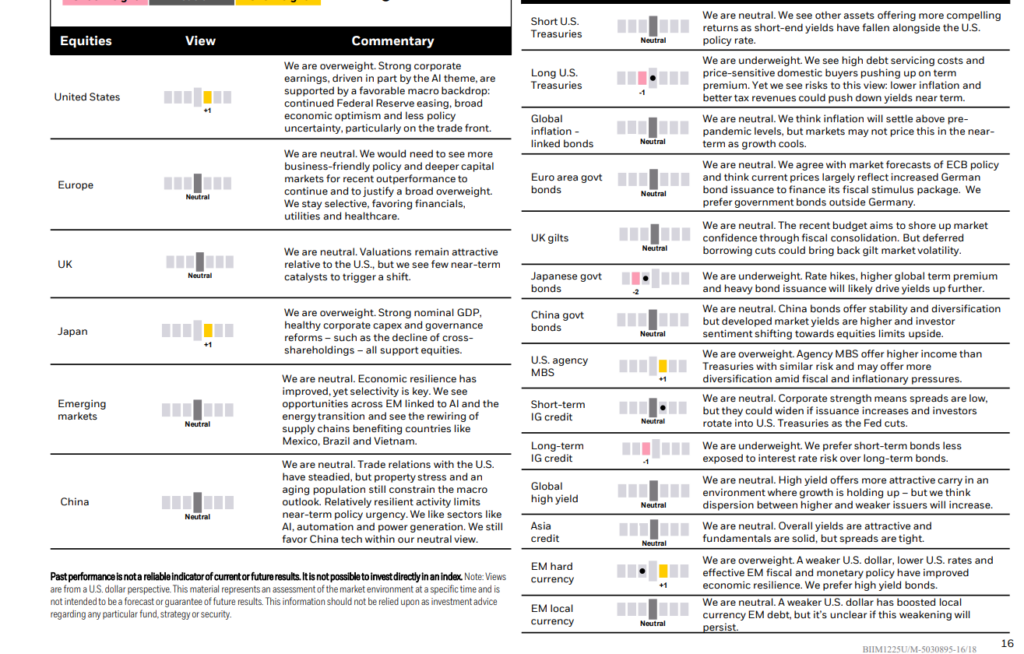

Tactical 6–12 month forecasts for individual assets versus broad global asset classes, by conviction level, December 2025. Source here.

Conclusion:

Global Outlook 2026 marks an important shift: cryptocurrencies, AI, and new forms of finance are no longer on the periphery. They are becoming part of the core structure of the global economy. For BlackRock, this is no longer a matter of belief or ideology but of adapting portfolios to a new reality, where old rules are increasingly ineffective and new ones are still emerging.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.