Bitcoin confidently rose above the $92,000 mark, reacting to a sharp escalation of the situation in Venezuela. The rally occurred over the weekend, when traditional financial markets were closed, which increased traders’ attention to cryptocurrency as an early indicator of global risk. Over two days, BTC gained about 2%, consolidating above a key technical level and reinforcing expectations of sharp moves after futures and equity markets reopen.

1-day BTC/USD chart. Source: Bitstamp

$92,000 as a key resistance level

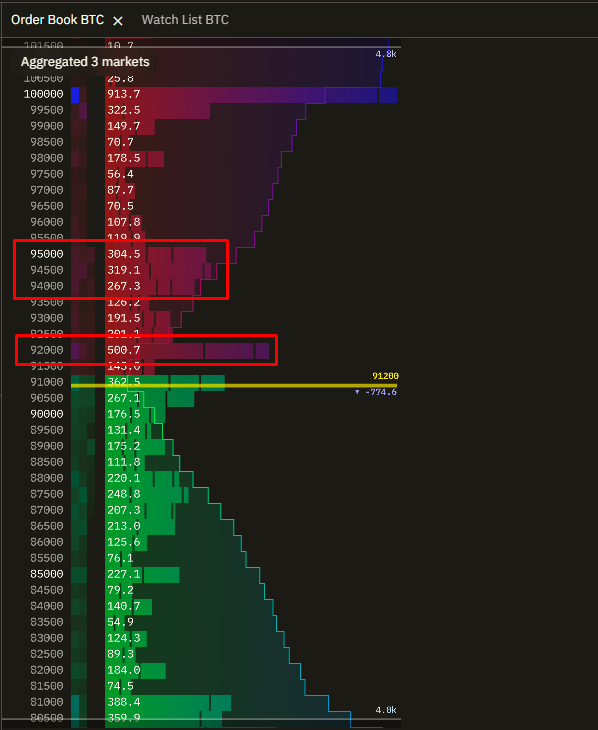

The $92,000 level has long been viewed by market participants as an important resistance zone. This is where Bitcoin repeatedly faced profit-taking in previous months, forming a wide sideways range. A breakout above this level could become a technical signal for an exit from prolonged consolidation.

Analyst Daan Crypto Trades draws attention to the liquidity structure. According to his assessment, the largest cluster of buy orders is concentrated below the start-of-year level, around $88,000. This means that in the event of a sharp pullback, the price could quickly return to that zone. At the same time, the area above $92,000 remains relatively “clean,” increasing the likelihood of an impulsive move if demand persists. According to the analyst, $92,000 coincides with the upper boundary of the range in which Bitcoin has been trading for a long time, and it is precisely here that the question of the market’s next direction is being decided.

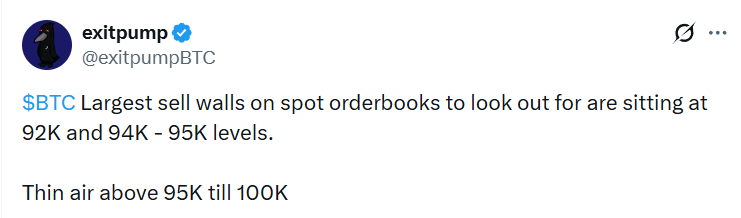

An additional argument in favor of increased volatility was provided by trader Exitpump. He noted that order books above $95,000 show thin liquidity. Under such conditions, even a moderate inflow of capital could trigger accelerated price movement, potentially leading to a quick retest of the $100,000 level.

Technical picture: breakout from a pattern

From a technical perspective, the market is also sending signals of a potential continuation of growth. Trader Alan Tardigrade reported that on the two-hour timeframe, Bitcoin broke out of a symmetrical triangle, a classic volatility compression pattern. Such formations often end with a sharp directional move, especially when they coincide with fundamental news.

It is important to note that the breakout occurred amid low weekend liquidity. This amplifies the effect but also increases the risk of a false breakout if investor sentiment changes sharply after traditional markets reopen.

The Venezuelan factor and expectations of market reaction

The main fundamental driver of the current move has been the situation in Venezuela. Traders and analysts expect that the opening of futures markets could be accompanied by increased volatility not only in cryptocurrencies, but also in oil, gold, and equities.

The analytical resource The Kobeissi Letter warns of a high probability of turbulence, emphasizing that events in Venezuela have the potential to affect the global economy. The country remains one of the key players in the Latin American oil market, and any military or political actions involving the United States could alter the balance of supply and demand in commodity markets.

Analysts also draw special attention to Venezuela’s gold reserves, the largest in the region. Uncertainty surrounding these reserves adds pressure to the gold market, which had already weakened toward the end of the year amid renewed interest in cryptocurrencies and Bitcoin’s rise.

Bitcoin versus gold: a shift in the narrative

Well-known crypto trader and analyst Michaël van de Poppe notes positive dynamics of Bitcoin relative to gold. According to him, the BTC/XAU pair is beginning to form an upward trend, which may signal a gradual shift in investor preferences. He emphasizes that forming a higher high would confirm bullish divergence and strengthen the case for further cryptocurrency growth.

An additional factor supporting this scenario is the state of technical indicators. Van de Poppe points out that Bitcoin’s weekly RSI values have fallen to levels last seen at the end of the 2022 bear market. Historically, such levels have often marked a turning point or the beginning of a medium-term upward move.

Bitcoin as a leading macro indicator

From a broader analytical perspective, Bitcoin’s current reaction to events in Venezuela appears telling. Historical data indicate that geopolitical tensions in Latin America have often been accompanied by increased interest in alternative assets. Over recent years, Venezuela has effectively become a testing ground for the use of cryptocurrencies under conditions of currency and financial crisis. The local population actively uses Bitcoin and stablecoins as a store of value and an alternative to the national currency.

The paradox of the current situation is that the cryptocurrency market is reacting to geopolitics faster than traditional instruments. Crypto exchanges operate around the clock, while oil, gold, and equity indices wait for trading sessions to open. As a result, Bitcoin is increasingly acting not just as a speculative asset, but as a kind of leading indicator of global risk.

The open question remains whether this means Bitcoin has definitively transformed into a full-fledged macroeconomic barometer capable of competing with gold and government bonds as a hedging instrument. The market is likely to begin forming an answer in the coming days, when traditional venues reopen and reveal their reaction to the Venezuelan factor.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.