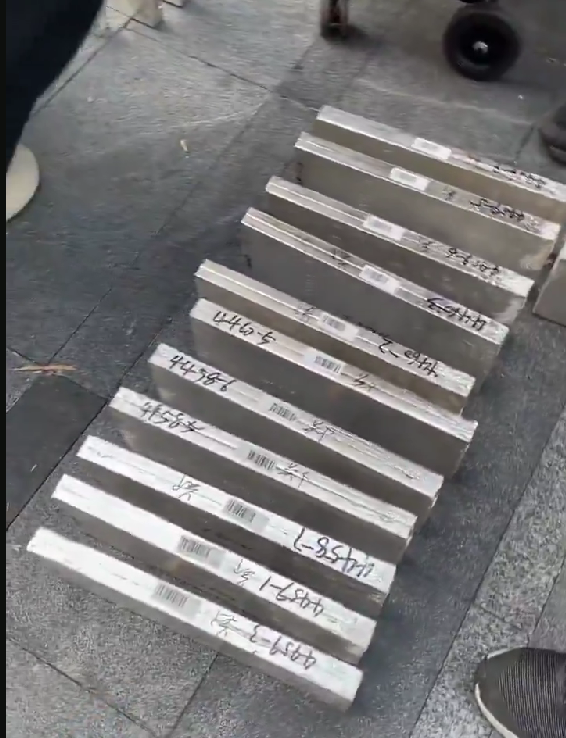

A video is actively circulating on social networks and messaging apps that allegedly shows silver bars being sold directly on the street in China. The footage shows sellers laying out metal bars that visually resemble investment-grade silver, while passersby show interest and examine the goods without the involvement of banks or official retail outlets. A video fragment of the sales can be viewed on our Telegram channel.

Such footage has already sparked discussion in investment communities, where what is happening has been labeled the beginning of a so-called “silver rush” amid a sharp rise in metal prices and a shortage of physical silver on the global market.

Based on the published footage:

- trading takes place outside the banking or jewelry infrastructure;

- silver is sold in the form of standard-looking bars rather than jewelry;

- the process resembles street trading of investment metal rather than a one-off private transaction;

- buyers interact directly with sellers, without intermediaries.

At the same time, the authenticity of the video and the exact filming location have not been officially confirmed, and there is no information about the metal’s purity, bar certification, or the legality of such transactions.

Even if the video does not reflect a mass phenomenon, the very fact of its appearance logically fits into the current market environment.

In 2025, the silver market is experiencing:

- a sharp rise in prices and increased volatility;

- a shortage of physical metal amid high demand from industry and investors;

- rising premiums for physical silver compared to exchange prices;

- growing interest among private investors in Asia in defensive assets amid macroeconomic uncertainty.

In China, demand for physical assets — gold, silver, and real estate — has traditionally been strong. During periods of instability, the population prefers tangible forms of savings, especially when trust in financial markets and currency instruments declines.

Historically, the emergence of street trading in investment metals is often perceived as a signal of overheating or shortage. Similar episodes have been observed:

- during currency crises;

- when access to banking instruments was sharply restricted;

- during periods of growing distrust in official sales channels.

If the video indeed reflects real practice, it may indicate a lack of official channels for purchasing physical silver; growth of the shadow or semi-legal market; attempts by sellers to bypass fees, taxes, or restrictions; and heightened speculative interest among private investors.

At present, there is no confirmation that:

- a large-scale “silver rush” has begun in China;

- street sales of silver are widespread or systematic;

- such practices are approved or ignored by regulators.

The video should be viewed as an isolated episode or a local phenomenon rather than an officially established market trend.

Conclusion:

The video of street sales of silver bars in China has become a visual reflection of tensions in the precious metals market. Even if this is not a mass phenomenon, the interest in such footage highlights the key point: demand for physical silver is growing, trust in “paper” instruments is declining, and the market is increasingly looking for alternative routes.

As always in such cases, a real “rush” begins not on the street, but at the moment when the metal disappears from official display cases.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.