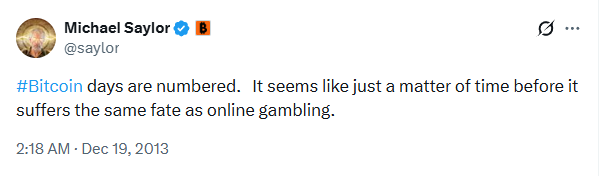

Fact of the day: today marks exactly 12 years since Michael Saylor publicly “buried” Bitcoin, stating that its days were numbered and that it would repeat the fate of online gambling. In 2013, this sounded very much in line with the spirit of the time: Bitcoin was associated with grey markets, experiments by IT enthusiasts, and something temporary, fashionable, but not serious. Back then, many people made similar statements — bankers, IT executives, and economists alike. The only difference is that Saylor later went down in history for a completely different reason.

Seven years passed. In August 2020, his company, then still called MicroStrategy, unexpectedly for the market began buying Bitcoin. This site has a chart showing the entire history of their purchases.

The first purchase — worth $250 million — became the starting point of one of the most aggressive and consistent corporate BTC accumulation strategies in history. From that moment on, the company methodically, without pauses or sentimentality, kept buying Bitcoin during corrections, rallies, panic, and euphoria.

Today, the average purchase price of this entire position is about $29,803 per Bitcoin — a figure that looks like an unattainable dream for most retail investors, and like a textbook example of long-term thinking for institutions. On the balance sheet of the now-renamed Strategy there are 671,268 BTC. This makes it the largest public holder of Bitcoin in the world, by a wide margin ahead of any other company.

The irony of the situation is almost perfect. The man who publicly wrote Bitcoin off in the end became its loudest corporate evangelist. And not in words, but on the balance sheet. His company has essentially turned into a proxy bet on Bitcoin for the stock market, and Saylor himself has become a symbol of a radical shift in views.

This case is good not only as a meme and not only as a source of quotes. It perfectly illustrates one of the key ideas of markets: it does not matter what you said before, what matters is what you did in time and how consistently. You can be wrong. You can bury assets. But if you have the courage to admit a mistake and turn around, history can be rewritten.

Over these 12 years, Bitcoin has survived everything that, in theory, should have killed it: bans, exchange collapses, regulatory wars, the 2017 bubble, and the 2022 crash. And now it sits on the balance sheets of public companies and is used as a strategic reserve.

Online gambling, by the way, has not gone anywhere either. It has simply changed its form.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.