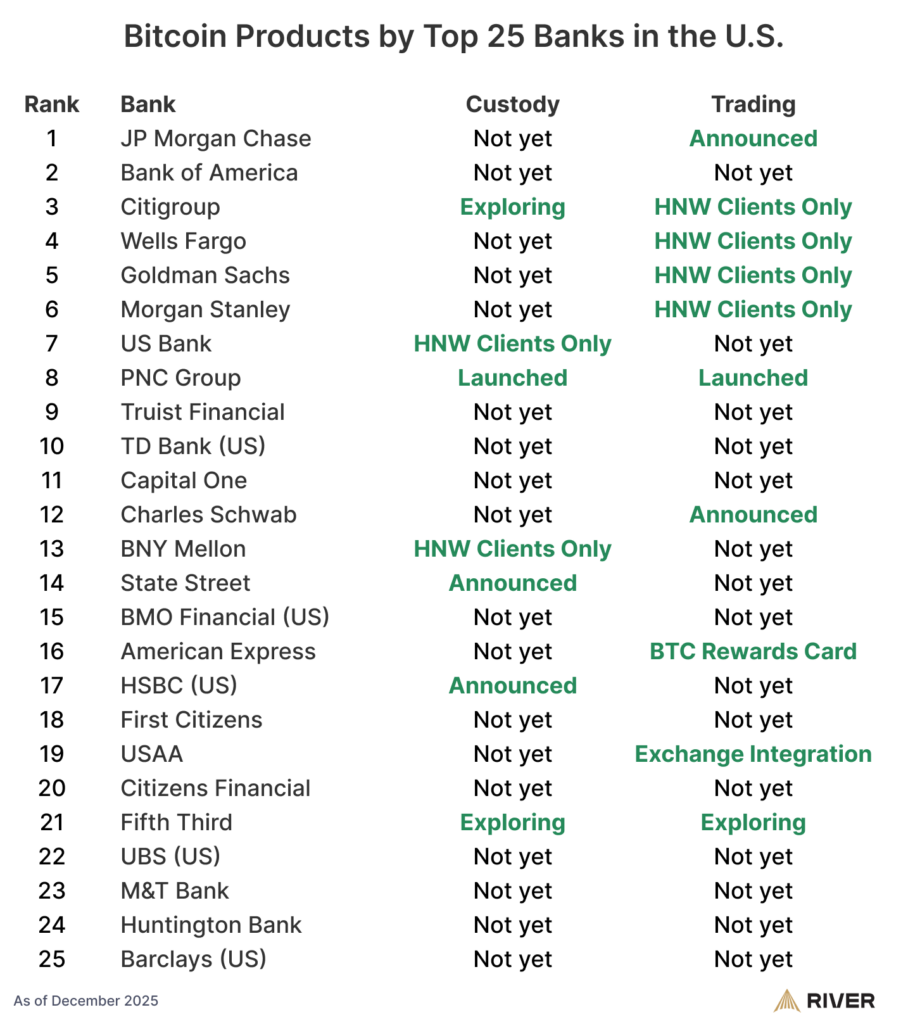

14 out of the 25 largest U.S. banks are already involved in developing and launching products related to Bitcoin. This is confirmed by analysts at River. And we are not talking about theoretical discussions or “check-the-box working groups,” but about practical work — from custodial solutions and structured products to ETF infrastructure and institutional client services.

It’s important to note a key shift. Banks are no longer debating whether Bitcoin is a needed asset class. That stage is behind us. Now the main question is: how to integrate BTC into the existing financial system and make money from it without violating regulations or risking reputation. When the world’s largest conservative institutions move from philosophical debates to margin calculations, it is always a signal that the asset has entered a new league.

Almost everywhere, the process follows a similar scenario. In the first phase, access to Bitcoin products is given to wealthy clients, family offices, hedge funds, and institutional investors. Banks offer them custodial services, ETF participation, structured products with capital protection, or exposure to BTC growth. Retail clients, meanwhile, continue to hear about volatility, risks, and the “early stage” of the market. Formally — all correct. In reality — the infrastructure is already being built, just not for everyone at once.

A key nuance deserves emphasis. Most banks still do not offer direct Bitcoin trading or custody for retail clients. But this does not mean a lack of interest or lagging behind. On the contrary, nearly all of them are already inside the process: conducting research, launching pilot projects, aligning models with regulators, testing partnerships with crypto companies and custodians. In banking terms, this is the pre-mass launch stage.

The reason for caution is obvious. Mistakes are costly for traditional financial institutions. They need maximum regulatory clarity, legally sound structures, and confirmation that client demand is stable, not situational. But once this switch is flipped, the process will move fast. Banks don’t like to be first, but they dislike being late even more.

Historical experience suggests a simple pattern. When major banks begin offering a new investment product en masse to a broad audience, the underlying asset’s price is already significantly higher than the levels at which institutional interest started. This was the case with tech stocks, gold ETFs, and other alternative assets. Retail investors almost always arrive last — when the product is already “system-approved” and packaged in a familiar form.

This is why the current stage is particularly telling. While public statements focus on risks and volatility, behind the scenes, methodical work is quietly underway. When banking apps start offering Bitcoin with a single click, the question “why is it so expensive” will become rhetorical. At that moment, it will be clear that everything happened strictly by the book — without fuss, but with cold calculation.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.