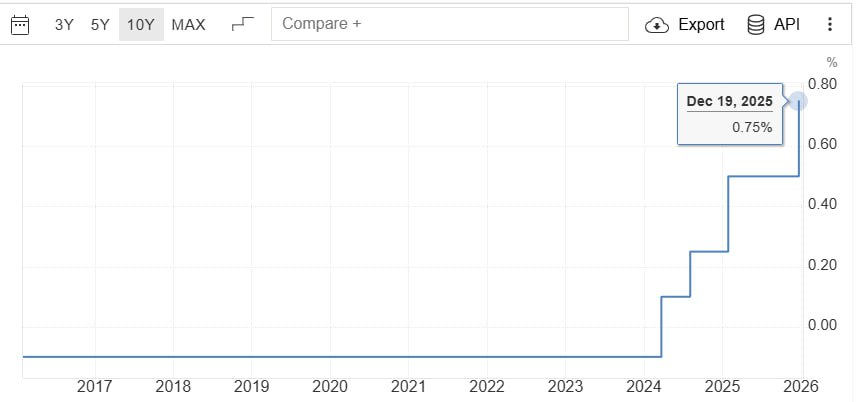

The Bank of Japan raised its interest rate to 0.75%. Formally, such a move is considered negative for risk assets, including stocks and cryptocurrencies, since rate hikes typically imply tighter financial conditions and reduced liquidity. However, in practice, the market responded with growth, which may seem paradoxical at first glance but actually fits well within the logic of current expectations.

The key point is that the rate hike was almost entirely priced in ahead of time. Markets had assigned roughly a 98% probability to such a decision, so there was no surprise. When an event is anticipated, it ceases to act as a trigger for sell-offs. Under such conditions, investor attention shifts from the fact of the decision itself to its interpretation and the accompanying signals from the regulator.

The decisive factor was the tone of the Bank of Japan’s governor. The regulator indicated that further monetary tightening is possible, but it would be extremely gradual, cautious, and highly data-dependent. This immediately eased fears of a sudden shift in financial conditions and, importantly, reduced concerns about a rapid unwinding of the yen carry trade.

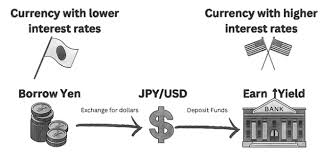

The yen carry trade is a strategy in which investors borrow yen at low interest rates and invest the proceeds in higher-yielding assets outside Japan.

In recent years, this strategy has actively involved not only equity markets but also cryptocurrencies. A sharp rate hike in Japan could have made this strategy less profitable and triggered a mass exit from risk assets. However, the regulator’s soft and cautious signal indicated that a sudden shutdown of this scheme is not expected in the near term.

Earlier in December, many market participants seriously feared that the Bank of Japan’s decision could trigger a sharp drop in Bitcoin, even below $70,000. These concerns were accompanied by discussions about global liquidity tightening and potential chain reactions in other markets. In reality, the market did what it often does in such situations: it priced in the negative scenario ahead of time and started rising once the anticipated decision was confirmed.

In the end, we see classic market logic. Central bank decisions alone do not move prices; expectations, their realization, and future signals do. Liquidity, regulatory rhetoric, and the pace of changes continue to exert far more influence on market dynamics than the mere fact of a rate hike or cut.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.