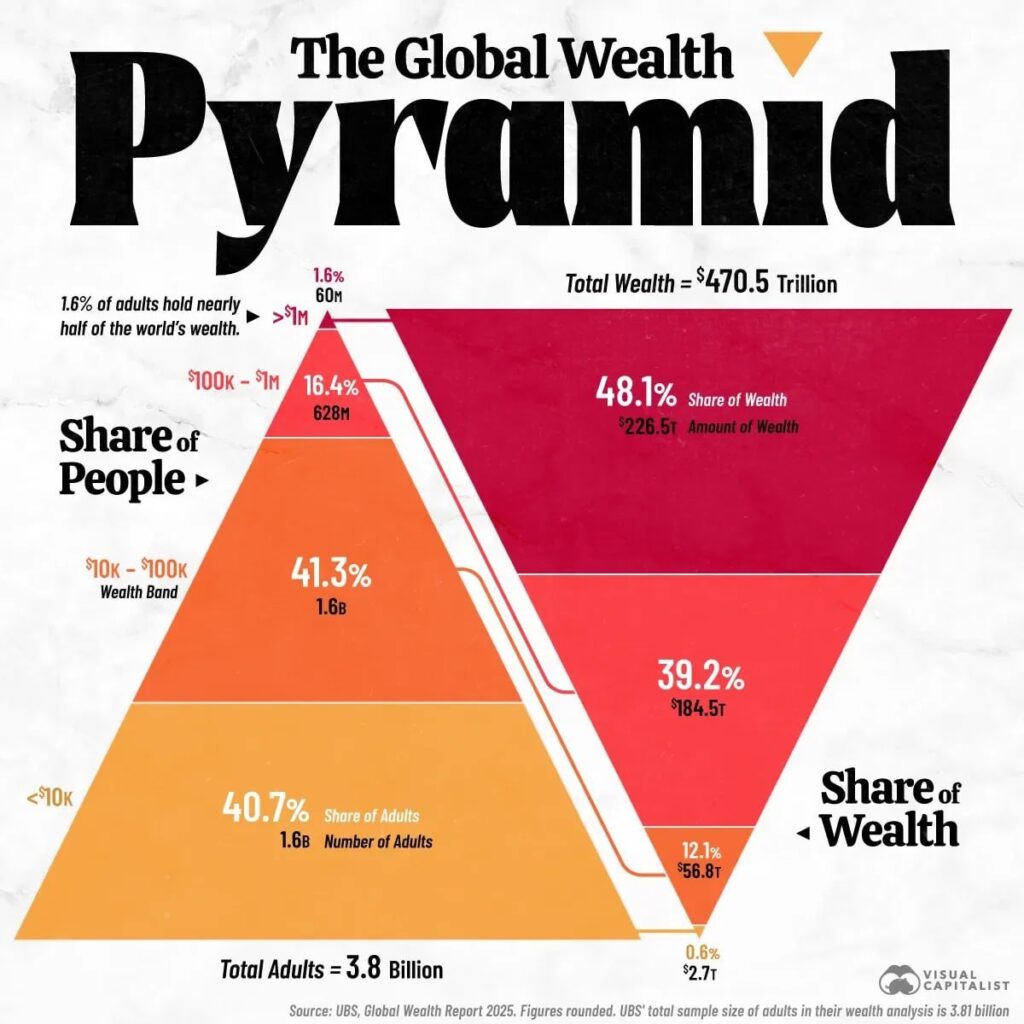

If you break down global wealth, the picture becomes clear and, to put it mildly, skewed. The total volume of private capital in the world is estimated at approximately $470.5 trillion and is distributed extremely unevenly.

Top of the pyramid: Top 1% of the world population

About 1.6% of the wealthiest people on the planet own assets of $1 million or more. They hold nearly half of all the money in the world — around $226.5 trillion, or 48% of global wealth. In absolute numbers, this is about 70 million people.

This group includes corporate owners, major investors, top managers, hereditary wealth, and families controlling businesses across multiple generations. Their wealth is formed not only through personal savings but also through ownership of stakes in companies, commercial and residential real estate in financial centers around the world, and involvement in strategic sectors of the economy — technology, energy, finance, and defense.

According to the Global Wealth Report, the combined influence of this group is such that their assets are equivalent to more than 20% of global GDP. For context: the ten richest people in the world control capital comparable to the annual budgets of dozens of countries. This makes the top 1% not just wealthy individuals, but a real economic force capable of influencing markets, currencies, and even politics.

Middle class with capital: from $100,000 to $1 million

The next level of the pyramid is about 16.4% of the adult population of the planet. These people own capital in the range of $100,000 to $1 million and control 39.2% of global wealth, which is about $184.5 trillion.

Numerically, this is the most “economically active” group. It includes about 1.2 billion people: skilled professionals, owners of small and medium businesses, entrepreneurs, doctors, lawyers, managers, and IT specialists. They form consumer demand, pay the bulk of taxes, and support the economic stability of developed countries.

At the same time, their financial situation is not always as stable as it may seem. High taxes, loans, mortgages, education and medical expenses often prevent rapid capital accumulation. For example, in the U.S., only about 30% of this group have substantial retirement savings, despite having formally high income. This class often balances between growth and stagnation: one crisis and they can fall to the next level.

Accumulated capital below average: from $10,000 to $100,000

The largest part of the pyramid — 41.3% of the adult population of the world. This is about 3.5 billion people whose assets range from $10,000 to $100,000. Despite their numbers, they own only 12.1% of global wealth, or approximately $56.8 trillion.

Most of this group depend on salaries rather than investments or passive income. Their savings are often held in bank deposits, cash, or low-liquidity real estate. In developing countries, the situation is worsened by inflation, currency risks, and limited access to financial instruments.

For example, in India only about 20% of people with savings up to $100,000 have more than $50,000 in reserves. Reasons include high inflation, a complex banking system, and low financial literacy. In Latin America and parts of Asia, this group is most vulnerable to economic shocks and is the first to feel the impact of crises.

Base of the pyramid: assets up to $10,000

The poorest category includes 40.7% of the adult population of the planet — about 3.2 billion people. Their total assets amount to only 0.6% of global wealth, or approximately $2.7 trillion.

These are people living paycheck to paycheck, often without access to banking services, investments, or stable labor markets. Many are employed in the informal economy or rely on social assistance. In sub-Saharan Africa, more than half of the population does not have bank accounts, and in some regions property ownership is rare.

For example, in Nigeria only about 1% of people with assets up to $10,000 own their own home. This makes this group extremely vulnerable to price increases, economic crises, and political instability.

What has changed in recent years

The main trend of recent decades is accelerating stratification. Over the past 10 years, the share of wealth concentrated in the hands of the top 1% has increased by approximately 15%. For other groups, growth has been minimal or even negative, accounting for inflation.

The reasons are well known: rising financial asset and real estate values, capital globalization, digitalization of the economy, and access to sophisticated investment instruments mainly used by wealthy segments of the population. Added to this were recent crises, the pandemic, and an inflation spike, which hit the savings of middle and lower classes.

In 2022, about half of all global assets were controlled by the richest 1% — a concentration level comparable to the early 20th century. Rising real estate prices in megacities, rising stock prices, and capital outflows from developing countries only reinforced this imbalance.

The conclusion is simple: the global wealth pyramid is becoming increasingly acute. The top grows faster, the base expands, and the space for upward mobility between levels narrows each year. The economy changes, but the old rule remains unchanged: money attracts money.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.