The situation surrounding the future chair of the US Federal Reserve has unexpectedly taken on an internal intrigue. Until quite recently, Kevin Hassett’s candidacy was viewed by the market as an almost guaranteed replacement for Jerome Powell, whose term expires in May. However, according to sources familiar with the discussions, noticeable resistance to this option has emerged within Donald Trump’s inner circle.

Paradoxically, Hassett’s main problem is precisely the same factor that previously made him the frontrunner. He is too close to the president. As director of the National Economic Council, Hassett is in constant contact with Trump and is perceived by markets as a person from the “inner circle.” For some of the president’s advisers, this has become an alarming signal. They understand that for financial markets it is critically important to preserve at least the appearance of the Fed’s independence from the White House.

According to sources, this resistance may explain the strange maneuvering around candidate interviews. In early December, meetings with contenders were suddenly canceled and then, at least in the case of Kevin Warsh, rescheduled and resumed last week. This looked like an attempt to regroup and search for an alternative that would satisfy both the president and the markets.

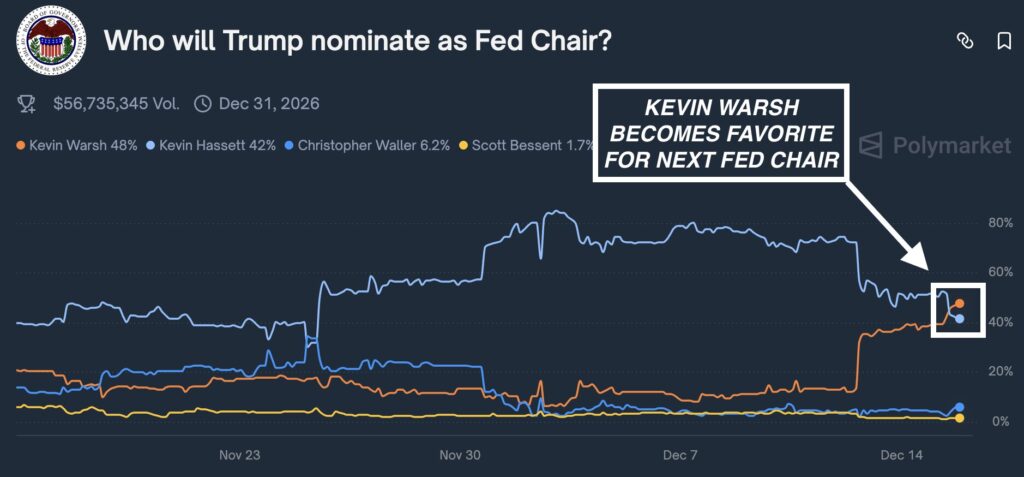

Additional uncertainty was introduced by Trump himself. Not long ago, he told reporters that he already knew whom he would appoint as Fed chair. However, in an interview with the Wall Street Journal on Friday, he unexpectedly said that former Federal Reserve Governor Kevin Warsh had moved to the top of the race alongside Hassett. For investors, this came as a surprise and was immediately reflected in forecasts.

On the Kalshi prediction markets platform, Hassett’s odds fell sharply. If at the beginning of December his probability of appointment exceeded 80%, by Monday it had dropped to 51%. At the same time, Warsh significantly strengthened his position: his odds rose from around 11% at the start of the month to 44%. Formally, Hassett remains the favorite, but the gap between the candidates has narrowed to a minimum.

Interestingly, criticism of Hassett has been mostly indirect. He is not attacked outright; instead, Warsh is carefully promoted as a more “market-friendly” and independent figure. At a JPMorgan event last week, CEO Jamie Dimon spoke positively about both candidates, but his wording led many in the audience to interpret his remarks as implicit support for Warsh, a former Fed official with experience inside the system.

As recently as late November, Bloomberg reported that Hassett had emerged as the leading contender to replace Powell. But as December progressed, resistance to his candidacy intensified. The main concern centers on the reaction of the bond market. There are fears that if investors perceive Hassett as too dependent on the president, the bond market could eventually “revolt.”

The logic is simple: if the Fed is seen as a politically managed institution, long-term yields could move higher. Investors would begin to price in the risk that the regulator might not fight inflation aggressively enough in the future, especially if it were to accelerate again. As a result, the effect could be the opposite of what Trump wants: rising rates, pressure on the economy, and tighter financial conditions.

Against this backdrop of criticism, Hassett appears to have adjusted his rhetoric. In an interview with CBS News over the weekend, he emphasized the importance of Fed independence much more forcefully. According to him, the president may hold strong and well-founded views on economic policy, but final decisions must be made by an independent regulator together with the Board of Governors and the Federal Open Market Committee.

Hassett also stressed that the president’s opinion carries no more weight than that of any other individual if it is not based on data. When asked directly whether Trump’s view would be equivalent to the vote of a central bank member, he answered no, emphasizing that it is merely an opinion that is taken into account only if it is grounded in facts and economic indicators.

As a result, a curious situation is taking shape. Trump’s allies do not want the next Fed chair to be someone too close to Trump. In order to preserve market confidence and the Fed’s status as an independent institution, they are prepared to promote another candidate from the same circle but with a more “neutral” background. And now Kevin Warsh is gradually emerging as the leading contender for a position that influences not only US monetary policy, but also global financial markets.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.