Let’s imagine the situation without unnecessary lyricism. You are not 65, you do not need to urgently turn capital into rent-like income, you are psychologically stable, and you are not going to burn through the money in two years. This is important, because the strategy for “young and self-sufficient” is radically different from the strategy “I need to live off interest starting tomorrow.”

The first and most dangerous enemy is the desire to be smarter than the market. When money arrives unexpectedly, almost everyone switches to the same script: “I should enter gradually,” “I should pick the best stocks,” “I should find a smart advisor.”

It sounds reasonable. In practice, statistics are cold and merciless.

DCA (buying in parts) loses in most cases if you already have the full amount. The market rises most of the time, and every month of waiting is a month when capital is not working. DCA is good when you receive income gradually. When the money is already in the account, it is more often a way to reduce anxiety rather than increase returns.

Picking individual stocks is a game with negative mathematical expectation. Even professional managers with access to insider information, models, and analysts underperform the index in the long run. A private investor has no statistical advantage here at all, only the illusion of control.

A financial advisor is a separate topic. Most of them earn not from the growth of your capital, but from fees, turnover, and “active management.” History knows few examples where this consistently beat the index after all costs.

What dry statistics say. If you discard emotions, opinions, and beautiful presentations, one fact remains: a broad stock market index is the most reliable strategy for a long horizon.

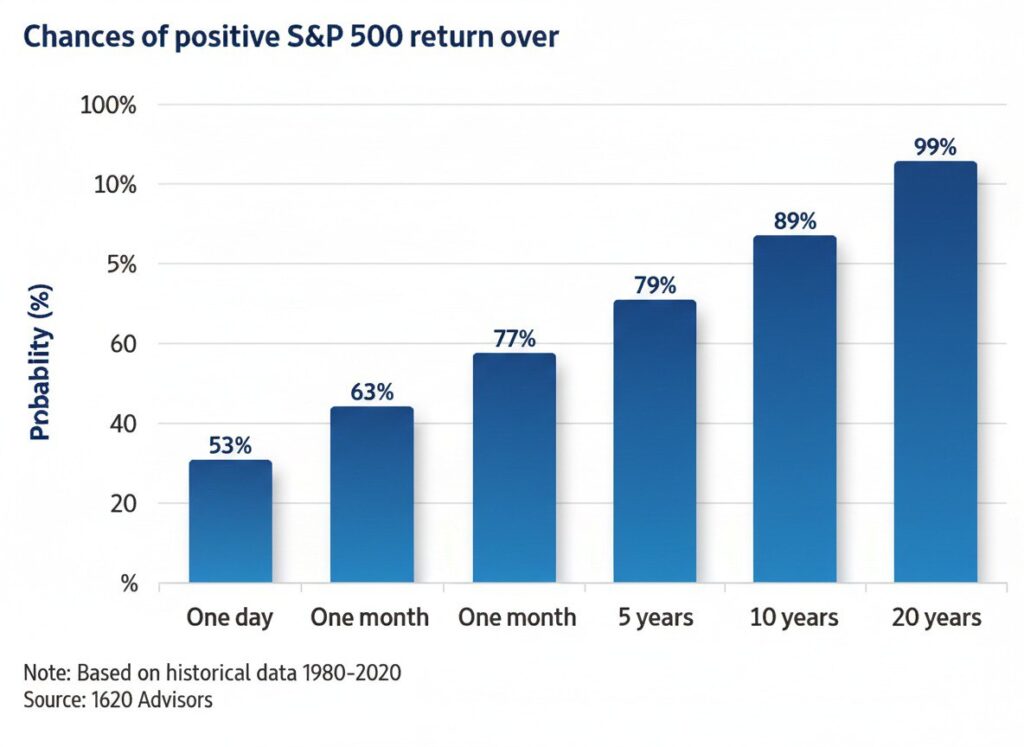

Buying a stock index with the entire amount at once has historically shown the best results. With a horizon of:

- 5 years or more, the probability of being in profit is about 79%

- 10 years — above 90%

- 20 years — about 99%

This is not magic and not a guarantee. It is mathematics supported by decades of data. The stock market grows not because it is “kind,” but because the economy develops, businesses earn money, inflation erodes nominal values, and corporate profits increase over the long term.

The risk of buying at the peak. Yes, you can buy at the very top. Yes, the market can then go negative for years. This is psychologically unpleasant, but not mathematically critical if you have a long horizon and no need to pull money out at a bad moment.

The main mistake of most investors is not declines, but attempts to avoid them. Waiting for the “perfect entry” almost always ends with the market moving higher without you. Time in the market is almost always more important than timing the market.

Why an index and not “something smarter.” By buying a broad index, you:

- do not bet on individual companies

- automatically participate in the growth of the entire economy

- regularly get rid of dying businesses and gain growing ones

- minimize fees and the human factor

It is boring. That is exactly why it works. A small but important warning: not all indices are equally useful.

The S&P 500 has outstanding historical statistics. But the world has seen other examples. Japan’s Nikkei 225, after the 1989 bubble, took more than 30 years to get back to zero. Formally, the index exists, the money is invested, but the result is zero, and inflation-adjusted it is catastrophic.

Therefore, before pressing the “buy” button, it is worth understanding: which economy you are buying, what it historically grew on, and whether it has demographics, innovation, and business dynamics.

Conclusion

If you suddenly have $1 million and you are not obliged to spend it in the coming years, the most rational path looks boring and not Instagram-friendly:

- choose a reliable broad stock index

- invest the entire amount at once

- do not twitch

- let time do its job

Everything else is either an attempt

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.