They waited and finally received it: the Federal Reserve lowered the rate and effectively turned on the printing press, giving the markets the signal investors had been expecting for the past weeks. The key rate was reduced to the level of 3.75 percent, which means a quarter-point cut. At the same time, the regulator announced a large-scale liquidity support operation: over the next thirty days, it will purchase approximately forty billion dollars’ worth of government bonds. This is a direct injection of money into the system, capable of changing market dynamics already in the short term.

For the crypto industry such measures are traditionally viewed as favorable. Monetary policy easing weakens the dollar, lowers borrowing costs and makes risk assets more attractive. The history of recent cycles shows that such periods — periods of rate cuts and increased liquidity — often became the beginning of strong movements in bitcoin and the broader crypto market. Many analysts now believe that a combination of a weakening dollar, a likely improvement in sentiment and renewed demand from institutional investors may create conditions for a new trend.

But why did the Fed move to easing? Economic indicators provide a fairly unambiguous answer. GDP growth is slowing, the labor market is gradually cooling down, and the unemployment rate has risen to 4.5 percent. Inflation remains above the target level, and forecasts indicate that a return to two percent will not happen before 2028. In fact, the Fed has found itself under two pressures: on the one hand — the need to cool inflation, and on the other — the need to support an economy that is already showing signs of losing momentum. Under these conditions, the regulator chose moderate stimulus.

The long-term plan is also of interest. The Fed is not going to repeat the trajectory typical of past cycles, when a series of sequential steps was announced in advance. This time the regulator emphasizes that it will act solely “based on data”. Nevertheless, the current forecasts assume one more rate cut in 2026 and an additional one in 2027. This is an extremely restrained schedule, and it shows that the Fed wants to maintain balance between stimulating the economy and containing inflation, avoiding overly abrupt actions.

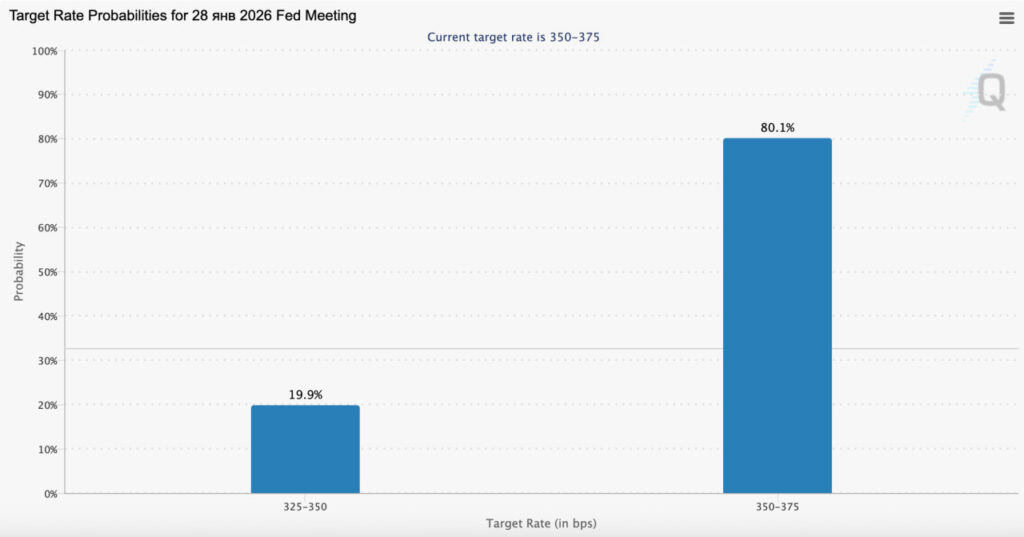

For the upcoming meeting on January 28, 2026, the market has far lower expectations. According to CME FedWatch, the probability that the rate will remain unchanged is around eighty percent. That means investors are almost certain that the December cut will be followed by a pause rather than a continuous sequence.

The market is pricing in the preservation of the current range of 3.50–3.75%. The probability of a cut is much lower, around twenty percent. This means there is far less optimism than there was around the latest decision.

Markets are already beginning to price in the effect of easing: strengthening of the equity sector, rising demand for risk assets and improving sentiment are visible across almost all segments. The only question is whether this impulse can be sustained or whether investors will become cautious again, considering the weak labor market, lack of control over inflation and uncertainty about the Fed’s further policy.

In any case, the regulator’s current step becomes the starting point of a new stage. Ahead lies a period with fewer predetermined benchmarks and more dependence on data, which means more volatility.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.