This evening, the attention of global financial markets will be focused on one of the key events of the year – the announcement of the U.S. Federal Reserve’s (Fed) decision on the benchmark interest rate. Against the backdrop of slowing economic growth, declining inflationary pressure, and instability in the labor market, investors are expecting a signal about how the central bank will adjust monetary policy in the coming months.

The market has already priced in its expectations

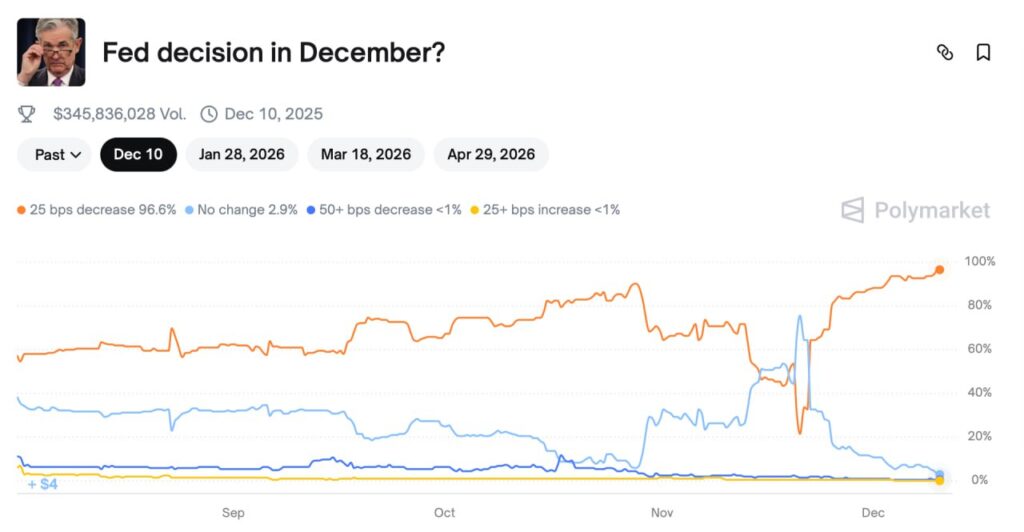

According to the Polymarket platform, the probability of a 25 basis point rate cut is estimated at nearly 97%, maintaining the current rate – less than 3%, and a sharp 50 bps cut is almost completely ruled out. Thus, nearly all market participants are confident in a moderate easing, although the key factor will not be the rate cut itself, but the tone of Fed Chair Jerome Powell’s comments during the press conference.

What major agencies and analysts say

- Reuters: most economists expect a 25 bps cut. The main argument is the weakening labor market, slower job creation, and rising unemployment in certain sectors. Experts emphasize that the Fed is acting cautiously, given the weakness of economic activity.

- Bloomberg: the inflation impulse is weakening, consumer activity is falling, which pushes the Fed toward a softer tone. Markets expect Powell to hint at the trajectory of future rate cuts so they can adjust portfolios and risk exposure.

- The Wall Street Journal (WSJ): it is not so much the rate decision itself, but the tone of the press conference that will determine market direction. Powell’s sentiment may set the tone for all of 2026 and influence the dynamics of stocks, bonds, and cryptocurrencies.

Features of the current meeting

Unlike previous meetings, the current one is complicated by the absence of fresh statistical data for October. The federal government shutdown from October 1 to November 12 prevented the collection of complete employment and inflation data. The U.S. Bureau of Labor Statistics will publish these reports only on December 16 and 18, respectively, after the Fed meeting. This means that FOMC members will make their decision without up-to-date information, adding uncertainty and making Powell’s tone especially important for market participants.

It is worth noting that on October 29 the Fed already cut the rate by 25 bps, bringing the key range to 3.75-4%. This became the second consecutive easing after the September cut, which previously supported stock indices and crypto assets. Today, investors are looking for a signal on whether the Fed will continue the easing cycle or pause for the entirety of 2026.

What experts say

- Bank of America: expects a 25 bps cut today and two additional cuts in 2026, including effects from the change in Fed leadership.

- Bloomberg / Politico: political pressure is rising, with former President Donald Trump openly demanding immediate rate cuts from the new Fed Chair.

- CNBC: forecasts a “hawkish cut” – the rate will be lowered, but Powell’s rhetoric will be cautious and balanced.

- Goldman Sachs: Powell will likely emphasize the positions of FOMC members who oppose further easing, maintaining a balance between economic support and inflation control.

- NY Fed: the weak labor market outweighs the risks of rising inflation, supporting the case for possible rate cuts early next year.

Markets and risk assets

Today’s Fed decision will become an important guide for all financial market participants, especially for holders of risk assets – equities, high-yield bonds, and cryptocurrencies. Any hint of a pause or acceleration of easing may trigger rapid price swings. Investors are closely watching Powell’s remarks to assess the trajectory of monetary policy for all of 2026.

Conclusion

The evening promises to be eventful and important for the global economy. A 25 bps cut is almost guaranteed, but the main intrigue will be the Fed’s rhetoric, which will determine market dynamics for the coming months. In the absence of fresh inflation and employment data, market participants will be especially sensitive to Powell’s words. All attention is focused on the U.S. central bank, and the outcome of the meeting will serve as a guide for investors’ strategic decisions for the entire next year.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.