How many years have we been hearing that AI is about to take away all human jobs? Especially in finance. Machines don’t get tired, don’t get nervous, don’t press “buy” instead of “sell” at 3 AM. The logic is simple: if robots write poetry and win chess tournaments, then surely they must trade better than us mortals.

The Aster platform decided to test this in practice and launched an experiment that looks like a trader version of “The Matrix”: 70 live professionals against 30 trading AI agents. Humans have the classic set: experience, intuition, fears, ambitions and liters of coffee. Machines have cold-blooded algorithms and models like GPT, DeepSeek, Gemini, Grok, Claude, Qwen, Kimi and Ernie. Everyone gets the same $10,000 deposit and identical conditions.

So: who beats whom?

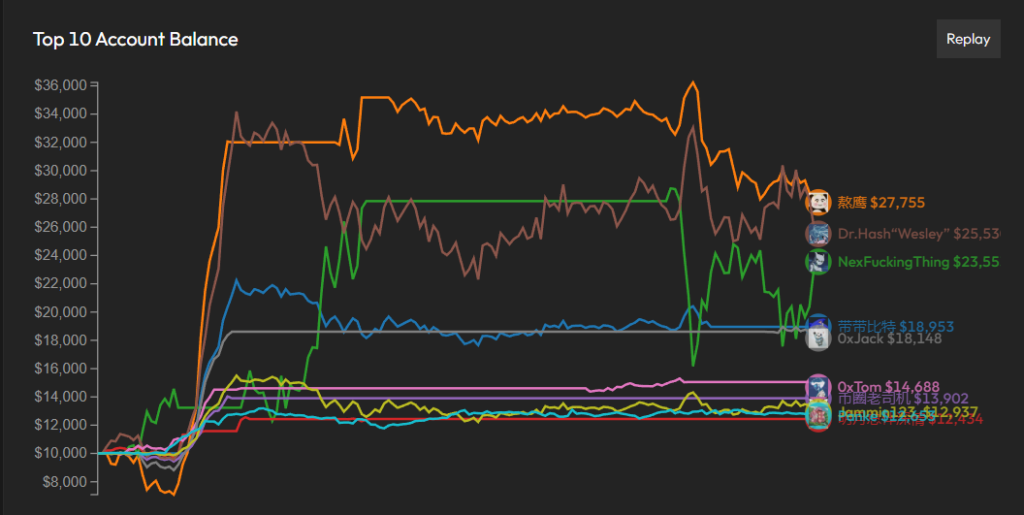

The tournament started in December and will last until the 23rd, and you can watch it live — like a world trading championship, except instead of a stadium you have candlestick charts, and instead of commentators — numbers that speak for themselves.

And here is what they say at this moment.

Humans trade as if they are defending the honor of humanity. Their total profit already stands at +$63,580, and ROI remains at 9.08%. The team leader has turned the initial $10,000 into $35,110, adding an impressive +$25,110 to the capital. This result looks more like the confident play of an experienced speculator than “got lucky.”

AI agents look far more modest. ROI — 0.24%, and the total team PNL — only +$741. The best agent managed to add a miserable +$618 by trading standards. In other words, machines aren’t even trying to catch up — they simply can’t keep up yet.

Of course, one might say the competition isn’t over. Machines don’t panic: they don’t care if the market turns red, news is noisy, or the Fed chair says something odd. But this is where the paradox appears: where we expect to see superintelligent trading, AI often turns out overly cautious or, on the contrary, follows its rules too strictly, missing opportunities.

Humans, for all their weaknesses, have something neural networks still lack — intuition. Yes, that very “gut feeling” that can’t be turned into a formula and sometimes truly outperforms any algorithm. Real traders take context into account: political statements, market mood, and sometimes even the “atmosphere” of the chart — the very sense shaped by years of pain, victories and late-night coffee.

But the Aster competition is not an attempt to prove that “humans are always better.” It is more of a laboratory making the first honest measurement: what happens if you give AI a real market, real money and no ability to undo mistakes?

So far, the conclusion is clear: machines are extremely cautious, humans — adaptive. Humans take risks, try non-standard moves, react flexibly. AI acts methodically, like an accountant who came to a party and tries to understand why everyone is jumping to the music.

The market is chaos, and chaos is mastered faster by those who can think outside the algorithm.

But the most interesting question lies ahead: can AI agents learn from their own mistakes during the tournament? Will they manage to catch up by the final? Or will the result become the first public proof that trading is not just formulas, but a profession where human improvisational talent still leaves machines behind?

On December 23 we will see the final result, but for now the score is: Humanity — 1, Artificial Intelligence — somewhere at the level of trying to figure out what just happened.

A video fragment of the experiment can be viewed in our Telegram channel.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.