Top countries by Bitcoin (BTC) ownership in 2025

By 2025, Bitcoin had finally ceased to be a “geek toy” and turned into a full-fledged strategic asset, which states consider no less seriously than gold and foreign exchange reserves. If earlier the question “who owns the most BTC” sounded more like a curious fact, today it resembles a geopolitical quiz: behind the numbers hides influence, trust in technology, and countries’ readiness to look into the future.

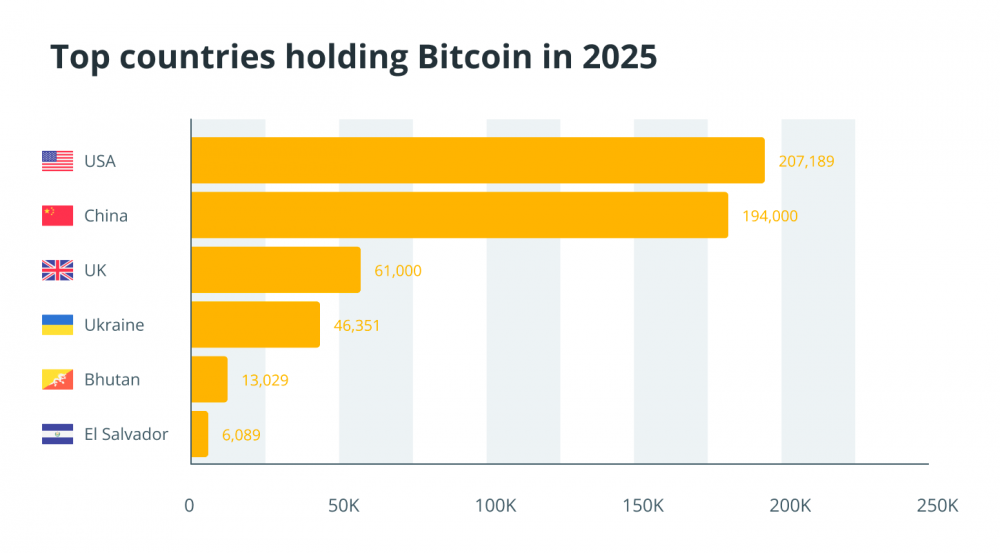

The first group includes states that either consciously accumulated cryptocurrency or ended up owning significant volumes after seizing funds from cybercriminals. In 2025, the absolute leader remains the United States, which holds several strategic Bitcoin reserves on its balance sheet. Part of these reserves emerged after years of operations against hackers and darknet platforms. The irony of fate is simple: Bitcoin was created as independent money, and now its largest owner is a country with the most powerful financial system in the world.

Next comes China, which officially likes to ban cryptocurrencies but carefully accumulates BTC through state structures. The approach “we don’t approve, but let it be” works surprisingly effectively: the country holds the second position in the global ranking by the number of bitcoins under government control.

Third and fourth places are shared by the United Kingdom and Germany. Both countries follow a practical approach: if an asset is valuable — let it sit. A significant portion of their reserves also originated from confiscations, but in the West they long ago realized that throwing away Bitcoin is about as sensible as burning a fireplace of euros.

Special attention deserves countries that build their crypto policy on long-term strategic calculations. For example, Switzerland uses Bitcoin as part of its innovation economy. Singapore remains an Asian hub where crypto is not just allowed — it is integrated into the financial infrastructure. These countries still lag behind the global leaders in BTC quantity, but they lead in speed of technology adoption.

An interesting 2025 trend is the revival of developing countries, which see Bitcoin as a way to protect their currencies from inflation. In regions where national currencies cannot withstand pressure, people begin to trust digital gold far more than paper money. And the higher the inflation, the faster the number of private BTC holders grows.

In the end, the global ranking of Bitcoin ownership is not just a table of numbers. It is a map of the world’s attitude toward the financial future. Some countries accumulate BTC as a strategic reserve, others as insurance against economic storms, and still others as an innovation tool. The main point is that the world is gradually coming to a single conclusion: regardless of politics, regulation, and opinions, Bitcoin is becoming part of the global financial architecture. And that means the race for the digital asset will only accelerate.

If the trend continues, by 2030 the list of leaders may change drastically — because Bitcoin, like life, loves surprises. But even now, one thing can be said with confidence: the countries that started accumulating BTC first have gained a noticeable advantage, and the market sees it clearly.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.