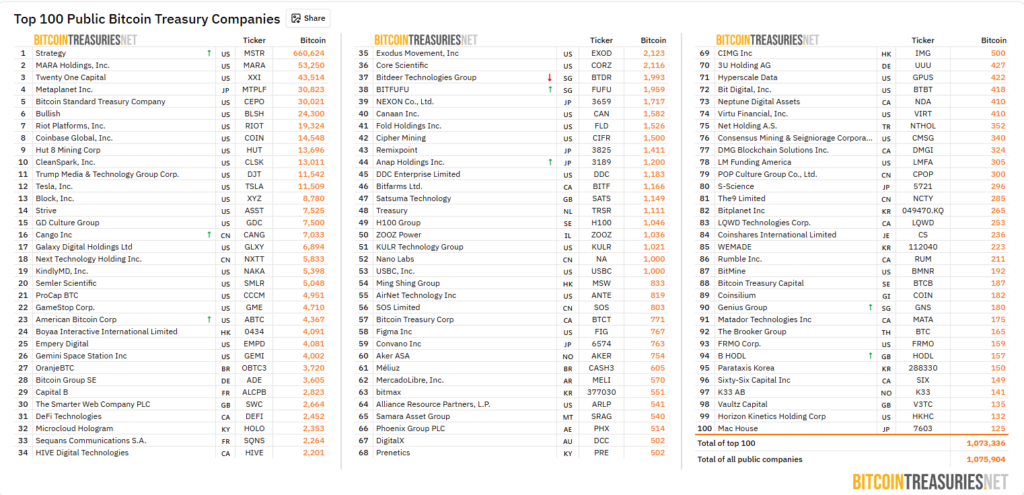

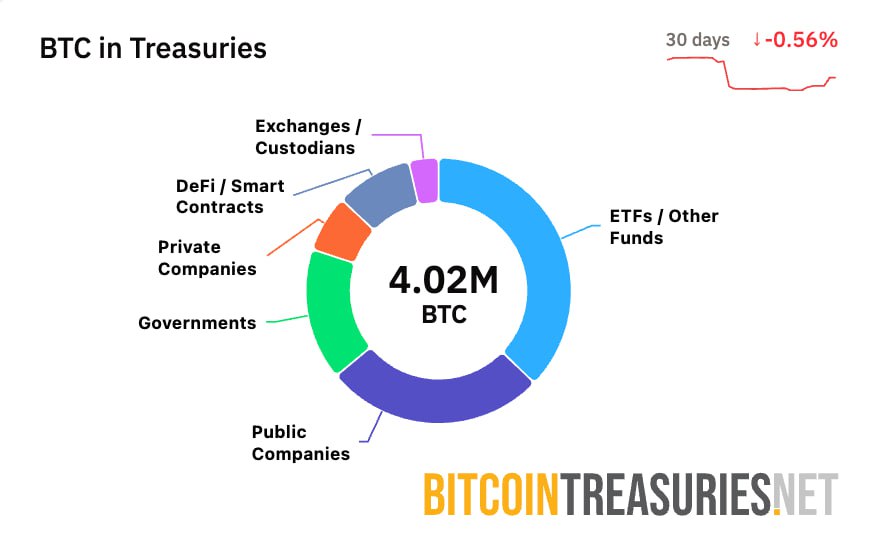

According to data from the BitcoinTreasuries portal, more than 4,000,000 bitcoins are currently held on the balance sheets of various institutional market participants. This includes exchange-traded funds (ETFs), public and private companies, institutional investors, government entities, and sovereign wealth funds. At the current exchange rate, this is equivalent to roughly 360 billion dollars, making their holdings one of the largest concentrations of bitcoin in history.

This group of holders controls roughly 19% of the entire BTC supply, highlighting the growing institutionalization of the market. Their behavior exerts noticeable pressure on the cryptocurrency’s price, creating both potential support zones and sources of volatility.

A notable example here is billionaire Michael Saylor and the company MicroStrategy (now Strategy). Saylor transformed the software developer into a kind of “corporate bitcoin fund”, directing the company’s free cash into acquiring BTC. Today, Strategy’s market capitalization exceeds 100 billion dollars, which is 1.6 times more than the market value of the bitcoins it holds. This example demonstrated to other corporations that cryptocurrency can serve as a tool for storing capital and even as an active element of corporate strategy.

Following Strategy, companies from the United States, Japan, France, and several other countries are becoming increasingly active. They issue stocks and bonds and convert the proceeds into bitcoin, creating a new class of corporate reserves. These actions by institutional players are gradually making them a significant force in the crypto market, capable of influencing trends and shaping long-term price dynamics.

It is important to note that the concentration of bitcoin among major players has a dual effect. On one hand, institutional purchases create additional demand and increase confidence in BTC as an asset. On the other hand, a high share of ownership of a limited supply can lead to intensified volatility if large holders decide to liquidate part of their reserves.

Thus, a new reality is taking shape in the market: bitcoin is ceasing to be solely an instrument for retail investors and enthusiasts, becoming instead a strategic asset for global corporations and funds. This process underscores the market’s maturity and strengthens the role of institutional players in defining its future.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.