Bitcoin has once again become the center of a loud media comparison: Bloomberg put on its front page a story with a striking headline claiming that the rise of the crypto market increasingly resembles a “digital tulip mania”. The contrast was highlighted even more sharply — against the backdrop of a confident gold rally, which, unlike the volatility of cryptocurrencies, behaves like a model student of financial markets.

When journalists compare Bitcoin to the legendary tulip mania, they refer to nothing less than the most famous speculative bubble of the 17th century. Back then, an ordinary tulip bulb could cost more than a house in Amsterdam, and weeks later — almost nothing. And now, centuries later, some observers see the same parallels: rapid growth of interest, sharp corrections, and debates over where innovation ends and gambling begins.

Merryn Somerset Webb, in her December 6 column, notes that despite the impressive performance of recent years, 2025 has been painful for Bitcoin, especially compared to gold, which during the same period has performed exceptionally well. Shortly before publication, BTC was about 16% below its six-month levels and still around 11% down even after a minor upward correction. Gold, however, has gained almost +60% over the year and +24% over the past six months.

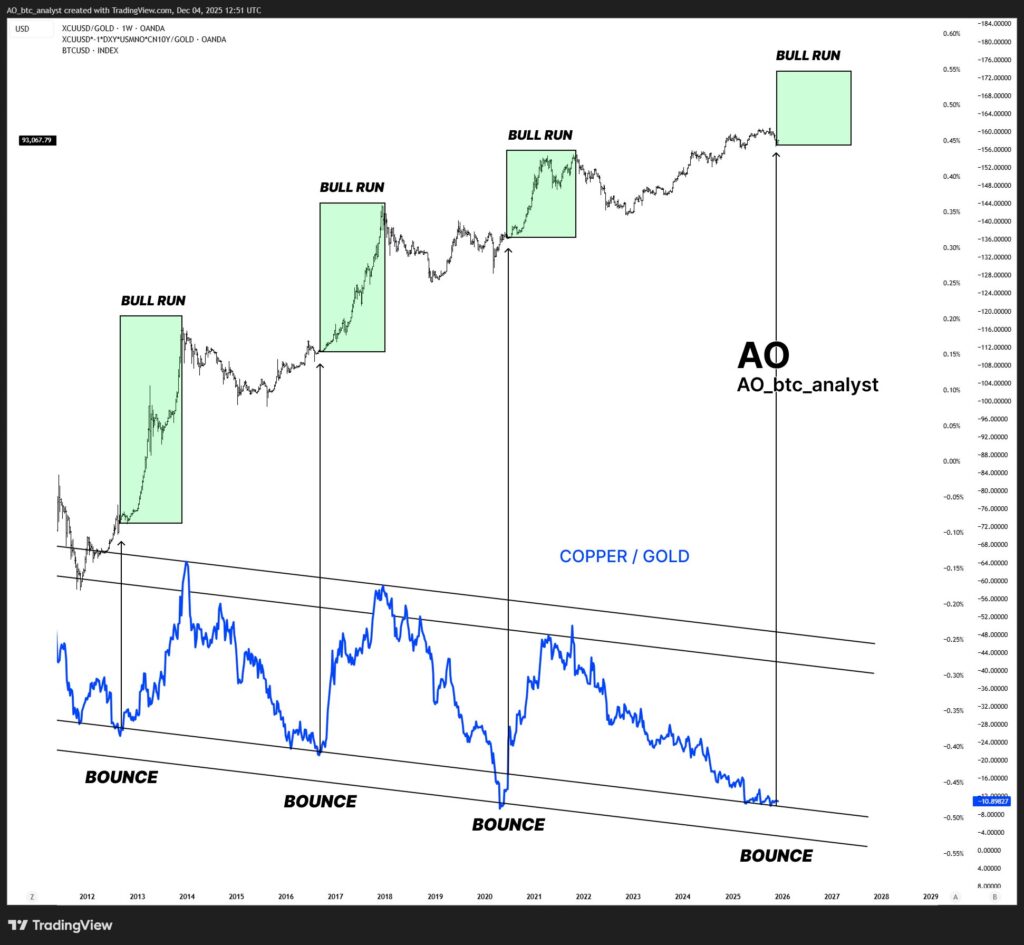

Every time the copper/gold ratio bounces off a historic low, Bitcoin enters a bull run. Right now, it is bouncing off that historic low again.

At the moment of writing, Bitcoin was trading around $89,600 – a significant number, but Webb uses it as an illustration of instability: the asset rises easily but just as easily loses large portions of its value, reacting to minimal changes in global expectations.

The columnist draws a simple conclusion for an average investor: long-term, Bitcoin has indeed delivered remarkable growth — over five years holders increased their capital nearly fourfold. The problem lies elsewhere: those who entered the market last year have felt the full weight of volatility, while those who chose gold received both profit and stability.

Webb also emphasizes another key point: what exactly drives Bitcoin now? Unlike gold, which predictably reacts to inflation, interest rates and global risk aversion, BTC depends on a mix of macro trends, speculative leverage, derivatives, and collective belief that “this time will be different”. It is a financial paradox: supposedly a hedge, but behaving like a high-risk asset.

Hence the comparison to digital tulips. Bitcoin does not generate cash flows, does not serve a stable economic function, and, unlike gold, is not present in central bank reserves or long-established family portfolios. Its price largely reflects expectations, emotions, and the hope that the next buyer will appear at the right time.

However, the journalist notes: it is too early to write Bitcoin off. A nearly fourfold increase over five years is a serious argument. But the main conclusion of her analysis sounds more cautious: Bitcoin may need a more honest place in investor portfolios. Is it still a capital protection tool? Or already pure risk?

As in the 17th century, tulips were beautiful. But not everyone managed to leave the garden in time.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.