Capricor Therapeutics is showing impressive stock growth +535% at the peak, closing the trading day at 29.96 dollars, which is +371% relative to the previous closing price. Such a sharp jump was caused by the publication of breakthrough results from the HOPE-3 clinical trial, dedicated to the therapy of Duchenne muscular dystrophy, a rare and severe genetic disease that leads to progressive loss of muscle strength and serious heart problems.

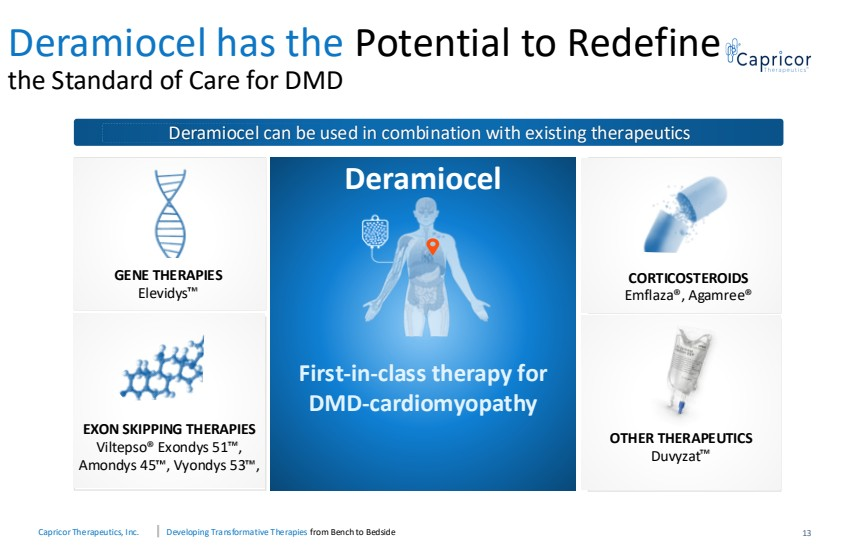

What actually happened? The company presented new data on the drug Deramiocel, showing a significant slowdown in disease progression.

In particular, the study demonstrated:

- A slowdown in the deterioration of skeletal muscle condition by 54%, which means that patients retain the ability to move and be independently active much longer.

- A slowdown in the development of cardiac pathology by 91%, which is critically important since cardiac complications are the main cause of death in patients with Duchenne dystrophy.

- A potential improvement in long-term patient survival, which opens hope for a significant increase in life expectancy and quality of life.

These results are especially significant against the background of the FDA’s September refusal, when the agency did not grant approval for the drug. The new data significantly increase the chances of Deramiocel receiving authorization and pave the way for commercialization, making the company particularly attractive to investors focused on the biotechnology sector.

For investors, it is important to understand the following aspects:

- Growth drivers: a unique therapy that addresses a critical medical problem; a huge rare-disease market where treatment costs are high; and the strong clinical effect of the drug, which can set Capricor apart from competitors.

- Risks: high stock volatility, limited historical trading, strong dependence on regulatory decisions, and possible difficulties in scaling production.

- Investment strategy: in the short term, the stock attracts speculative interest from traders seeking to lock in quick profits following the news release. In the long term, the company’s success depends on official FDA approval and successful market introduction of the product, which could potentially lead to stable stock price growth.

Conclusion: Capricor has every chance to become one of the notable stars of the biotechnology market, but investors need to consider existing risks and strictly follow portfolio diversification principles to minimize potential losses.

We continue to monitor upcoming FDA updates, clinical trial dynamics, and stock fluctuations, as they will determine the company’s investment potential in the coming months.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.