🛡️ The largest institutional holder of Bitcoin, Strategy, has taken two major steps at once, strengthening its position amid heightened volatility in the cryptocurrency market. The company created a dollar reserve of $1.44 billion intended to cover dividend payments and debt servicing, while simultaneously increasing its Bitcoin holdings to 650,000 coins, continuing its strategy of aggressive accumulation of the digital asset.

Creating the Dollar Reserve: Why Strategy Did It

Michael Saylor’s company formed a new financial buffer that will be used to cover dividends on preferred shares and interest payments on debt instruments. The reserve was created through the sale of Class A common shares under an open market placement program.

Essentially, Strategy is creating a second safety cushion — not in Bitcoin, but in dollars. This allows the company to remain resilient regardless of short-term cryptocurrency market volatility.

Currently, the reserve covers approximately 21 months of dividend obligations. The company emphasizes that it plans to increase it to a level sufficient for 24 months or more, thus creating nearly a two-year buffer.

Continuing the Bitcoin Strategy

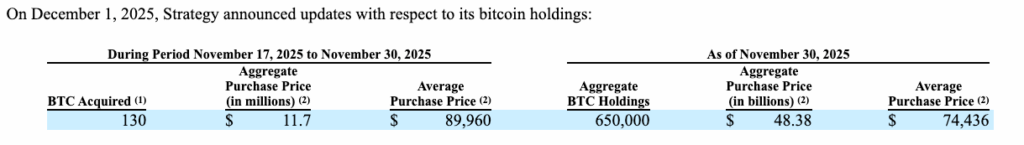

Alongside the formation of the dollar reserve, Strategy disclosed the purchase of an additional 130 BTC for $11.7 million, bringing its total holdings to an impressive 650,000 BTC. This is approximately 3.1% of the total Bitcoin supply, capped at 21 million coins.

The company’s total investments in Bitcoin have reached $48.38 billion. Thus, Strategy is not just the largest corporate holder of digital gold — it is strengthening its status as a strategic institutional player influencing the entire Bitcoin ecosystem.

Excerpt from Strategy’s Form 8‑K. Source: SEC

CEO and President Phong Le emphasized that the company understands its role in the global Bitcoin infrastructure and aims to maintain investor confidence — both shareholders and debt holders. Creating a dollar reserve is an important part of this strategy.

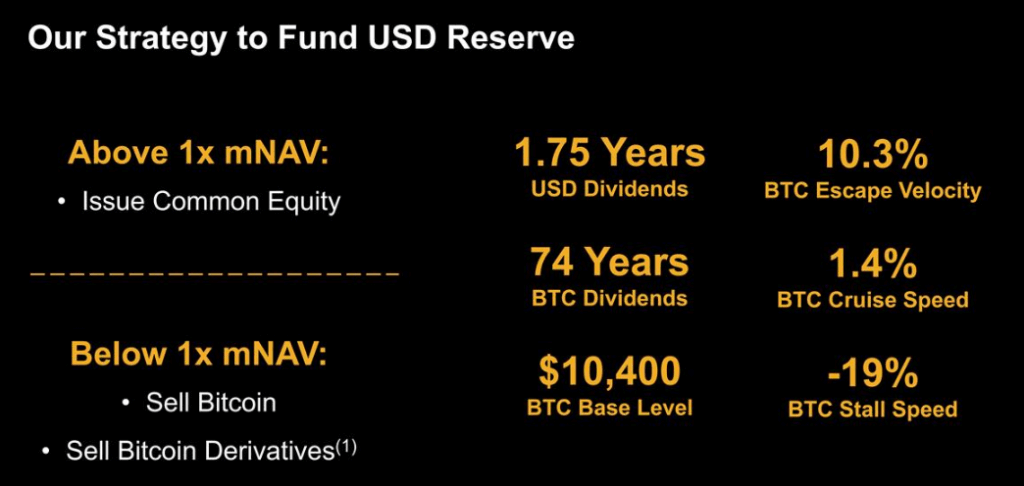

Assessing the New Reserve Instrument

The $1.44 billion reserve is not just “money in the account.” Strategy views it as a central element of its financial architecture, strengthening investor confidence, especially given the scale of the company’s Bitcoin exposure.

To grasp the scale:

- the reserve represents 2.2% of Strategy’s corporate value,

- 2.8% of its stock value,

- 2.4% of its Bitcoin assets.

The company emphasizes that this structure enhances the attractiveness of preferred shares, corporate bonds, and common stock, increasing their protection against cryptocurrency market volatility.

Raising $1.44 billion in less than nine trading days demonstrates both the high liquidity of MSTR shares and institutional investors’ trust in the company’s strategy.

Adjusting Target Metrics

Alongside expanding reserves and increasing Bitcoin holdings, Strategy simultaneously lowered its performance forecasts for 2025. The adjustment is significant and reflects a more conservative view of the market.

The company now expects:

- Bitcoin returns for the year of 22–26%,

- BTC price by December 31 in the range of $85,000–$110,000,

- Bitcoin profit in the range of $8.4–$12.8 billion (previously forecasted at $20 billion),

- Operating profit of $7–9.5 billion, significantly lower than the original $34 billion forecast.

These adjustments show that Strategy is preparing investors for a more moderate market scenario without losing long-term optimism.

Dollar Reserve Formation, Strategy. Source: Strategy.

🔸 Conclusion

Creating a dollar reserve and further increasing Bitcoin holdings underline Strategy’s strategy: combining aggressive investments in digital assets with conservative financial management.

The company strengthens its resilience, enhances its appeal to investors, and continues shaping the institutional Bitcoin market.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.