💰 Tether CEO Paolo Ardoino called bitcoin the perfect form of money and hinted that USDT itself may become unnecessary in the future.

The head of Tether, Paolo Ardoino, once again surprised the market. In a fresh interview with Simply Bitcoin, he stated that bitcoin is the “perfect form of money”, while the USDT stablecoin is only a temporary tool, something like a transitional bridge for users who are not yet ready to step into the world of true digital independence.

According to him, the current role of USDT is to give people a safe “harbor” next to the dollar while they figure out how bitcoin works and what advantages it gives. But in the long-term perspective – when cryptocurrencies become a mass phenomenon – the need for stablecoins may gradually disappear. In other words, Tether is building a bridge that one day may no longer be needed. Well, in the old-fashioned way: built it, helped people cross, bowed, and left.

USDT – a giant that can become a victim of bitcoin’s success

Today, USDT is the largest stablecoin in the world and the third-largest cryptocurrency by market cap after bitcoin and ether. Its market value already reaches about 184 billion dollars, while its closest competitor – USDC from Circle – barely reaches 74 billion.

According to Ardoino, at the beginning of the year Tether had more than 500 million users. And it’s no surprise: stablecoins have become a kind of digital dollars for the world, but without bank fees and currency restrictions.

This is especially noticeable in Latin American countries, where local currencies turn into pumpkins faster than gold becomes more expensive. During the pandemic, the demand for digital dollars soared: people needed to preserve at least something. And, ironically, the rise of USDT became a mirror of other people’s economic problems – the company’s success turned out to be a “sad fact”, as Ardoino put it.

Tether is building the next bridge – a golden one

Ardoino sees the next stage of the evolution of money this way: developing countries use USDT, more affluent markets switch to the gold-backed token XAUT, and only then, as the final stage, users come to bitcoin.

Tether’s gold tokens should become “insurance” for those who fear that the dollar may suffer from endless issuance. USDT is a “digital dollar for those who need the dollar”. XAUT is “digital gold for those who need peace of mind”. And bitcoin is the final stop. A maximalist’s dream.

A wallet for Rumble and expansion in the USA

Despite his cautious look at the future of stablecoins, Tether is actively expanding its infrastructure. In the USA, the company is betting on the social network Rumble, in which it invested 775 million dollars.

A non-custodial crypto wallet is now being jointly developed, thanks to which 50 million users will be able to easily use bitcoin, USDT, and gold tokens XAUT.

Everything is fair: if you want independence – use BTC, if you’re worried about the dollar – take XAUT, if regular money is more convenient – stay in USDT.

Tether’s reserves already look like those of a whole country

Tether is actively buying bitcoin and investing in mining. The company has:

- billions of dollars in BTC,

- 80 tons of gold in its own vault in Switzerland (part of it backs XAUT),

- and USDT reserves are mainly represented by US Treasury bonds.

According to Ardoino, Tether ranks 17th in the world among holders of US government debt. Some people have a cupboard with fine china, others have a cupboard with US Treasuries. Everyone has their own traditions.

In 50 years USDT may no longer be needed?

Ardoino does not rule out that stablecoins will fade into the past just as naturally as cassette recorders or teletype machines. When the world understands the advantages of bitcoin, stablecoins will no longer be necessary – they are just a way to make the dollar fast-accessible and less “heavy” in circulation.

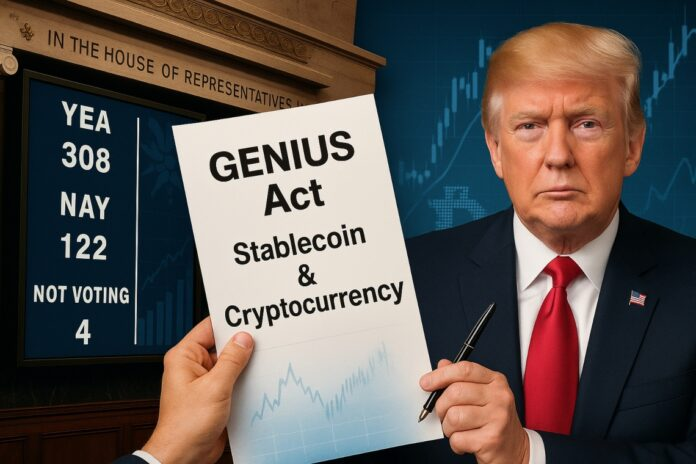

This idea is also connected with the GENIUS Act adopted in the USA, which became a turning point in the regulation of stablecoins. It establishes clear rules, which sharply increased competition among issuers. According to Ardoino: “Everyone this year wants to issue their own stablecoin under the GENIUS Act. And competition is good.”

📌 Conclusion

Tether officially says what many thought but did not say out loud: USDT is needed by the world today. Gold tokens may occupy their niche tomorrow. And in the perspective of decades – bitcoin may replace everyone, becoming an independent global financial system.

Sounds ambitious, but in the crypto world ambition is a tradition as old as the belief that “in the next cycle bitcoin will surely hit a million”.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.