🔥 El Salvador purchased $100M in Bitcoin amid a major market dip — and once again stirred the crypto community.

On November 18, El Salvador made one of the loudest moves in recent months: the country bought 1,090 BTC for around $101M. This was announced by President Nayib Bukele — and, as always, sparked a storm of discussions from Telegram channels to analytical platforms.

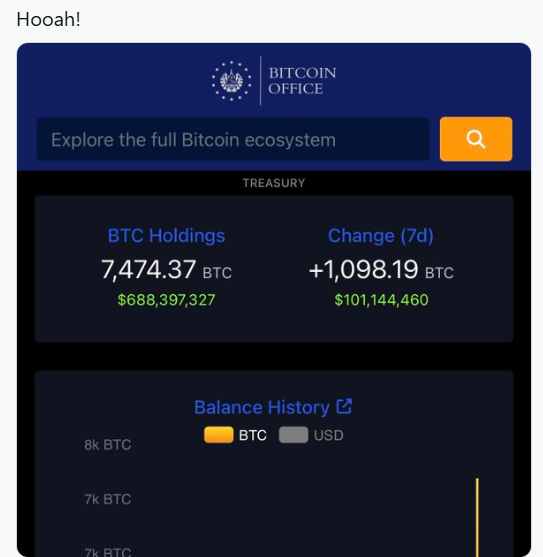

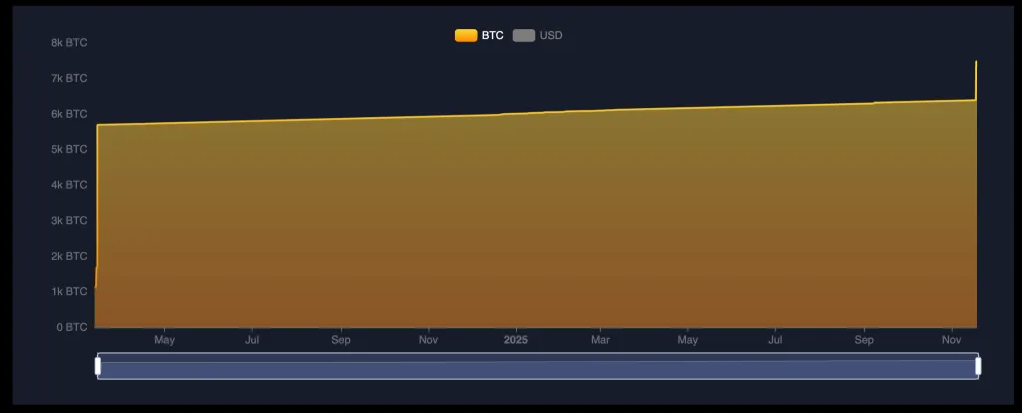

Now, 7,474 BTC worth over $688M are under state control. Interestingly, back in late August, the authorities distributed these reserves across 14 new addresses, citing potential threats that quantum computing might create in the future. Essentially, this is a preventive measure to protect the crypto reserve from technologies that aren’t yet mainstream.

The purchase coincided perfectly with Bitcoin’s sharp drop below $90,000. The market trembled: liquidation pressure, surge in selling, overall sentiment of “crypto panic.”

At the time of publication, BTC is trading around $91,400, down:

- about 4% in 24 hours,

- and 13% over the week.

Hourly BTC/USDT chart, Binance. Source: TradingView.

Bukele bought precisely at the moment when most investors are “nervously refreshing charts,” waiting for the price to stop falling.

But it’s not so straightforward: crypto-detective level “El Salvador”

Exactly when the president reports a major purchase, the main question arises: is El Salvador actually buying Bitcoin?

Here begins a real financial thriller:

- In August, the IMF stated that since signing the credit agreement in December 2024, El Salvador has NOT purchased Bitcoin.

- Yet on-chain data shows daily purchases of 1 BTC allegedly during the whole period.

Source: Bitcoin Office.

Where’s the discrepancy?

Government version: “It’s wallet peculiarities”

Bitcoin Office representatives explained the discrepancy by features of the national Chivo wallet:

- the app does not track the exact amount of Bitcoin in user accounts,

- and does not adjust its reserves according to these figures.

Since Chivo doesn’t sell anything, small deviations occur (usually up to 1%).

These deviations create the appearance that the state is slowly but steadily accumulating BTC — even if it isn’t actually doing so.

Bukele’s version: “We’ll buy, whether the IMF likes it or not”

The President of El Salvador has repeatedly emphasized that he does not intend to stop.

This directly contradicts a document the Finance Minister sent to the IMF in July, officially stating that purchases ceased in February.

Reality in politics and crypto — as usual — depends on who tells the story.

Another important factor: mining on volcanoes

Since 2021, El Salvador has been mining Bitcoin using geothermal energy from volcanoes. Yes, literally on volcanoes — Bukele loves symbolism.

In 2023, the national mining pool Lava Pool was launched, which produced 474 BTC over three years.

It’s possible that part of the BTC appearing on the state balance comes from domestic mining — not open market purchases.

So the country can “replenish its reserve” even without official purchases, which further complicates analysis.

🔍 Summary

El Salvador remains the only country in the world that:

- holds billions of dollars in Bitcoin,

- buys on dips (or at least claims to),

- mines BTC with volcanic energy,

- and simultaneously engages with the IMF, which urges “behave more calmly.”

Bukele continues to play the long game — loudly, boldly, and as always, in full view of the global market.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.