🛡️ The crypto exchange Binance demonstrates one of the lowest levels of interaction with illegal crypto wallets among all major centralized platforms. This was reported by company representatives, referring to fresh data from Chainalysis and TRM Labs.

According to analysts, over the past two and a half years the industry has grown significantly and has begun to treat compliance requirements much more strictly. From the beginning of 2023 to mid-2025, the volume of illegal activity on centralized exchanges has decreased significantly. The official statement notes that this trend reflects the “accelerated maturation of the industry” under the pressure of regulation, KYC/AML requirements, and increasing transparency.

As of June 2025, the share of direct transactions linked to illegal wallets at the seven largest centralized exchanges ranges from 0.018%-0.023% of total operations. This is already being called a historic progress in AML standards and in the effectiveness of detecting criminal activity in the crypto industry.

“Direct link means the share of the exchange’s total transaction volume that can be directly traced to wallets involved in confirmed illegal activity. These are extortion attacks, scam projects, sanctions violations, or hacks. Blockchain transparency makes it possible to measure this indicator precisely,” the Binance blog states.

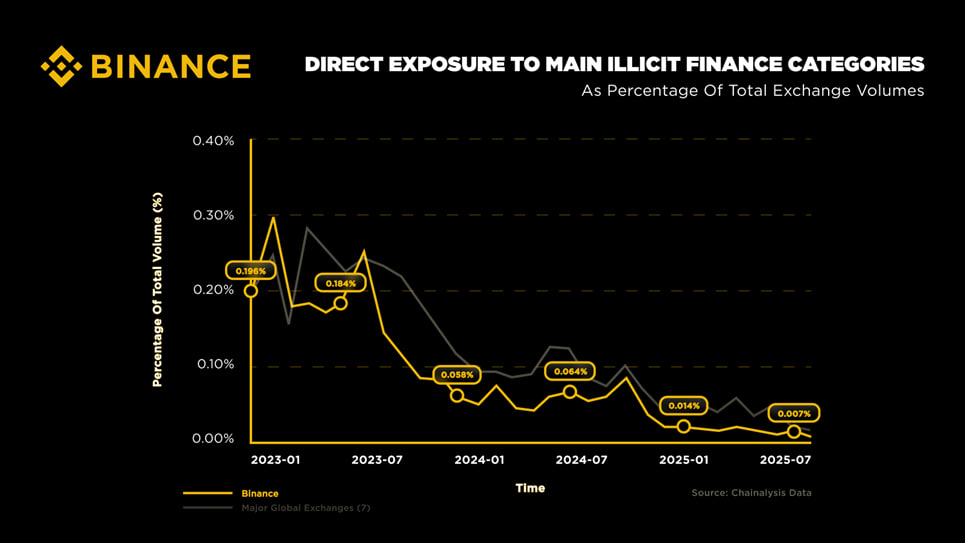

Binance demonstrates even more impressive metrics. According to Chainalysis, only 0.007% of transactions on the platform in June were linked to illegal addresses. This is more than 2.5 times lower than the global average among CEX, which stands at 0.018%.

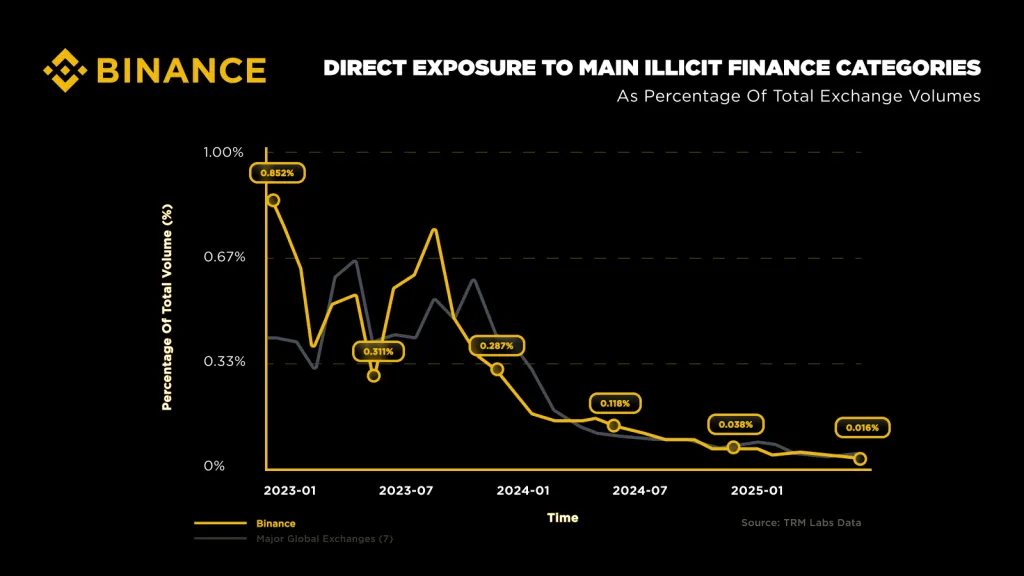

An independent report from TRM Labs confirmed this trend: on Binance the share of illegal activity is around 0.016%, while on other leading exchanges it is about 0.023%. Thus, competitors show results almost 30% worse.

The company emphasizes that from January 2023 to June 2025 it managed to reduce the volume of interaction with illegal crypto funds by a record 96-98%. This is 4-5 percentage points more effective than the average results of the six other largest global platforms.

Binance notes that the reduction of illegal activity plays a strategic role not only in strengthening the safety of users and institutional partners, but also in the global adoption of cryptocurrencies. The less shadow capital flows through trading platforms, the more willingly regulators enter into dialogue, and banks and corporations integrate blockchain-based solutions.

🔍 Separately, the company highlights the scale of its operational load. Every day Binance processes about $90 billion in transactions and an average of 217 million trading operations. Against this backdrop, the ability to maintain a minimal level of contact with illegal funds becomes not just an achievement, but a significant argument in favor of the maturity of the platform’s entire infrastructure.

Here, by the way, you can buy the legendary hardware wallets for beginners with all basic functions!

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.