🚨BlackRock sold more than $523,000,000 in Bitcoin – the largest outflow since the launch of the iShares Bitcoin Trust

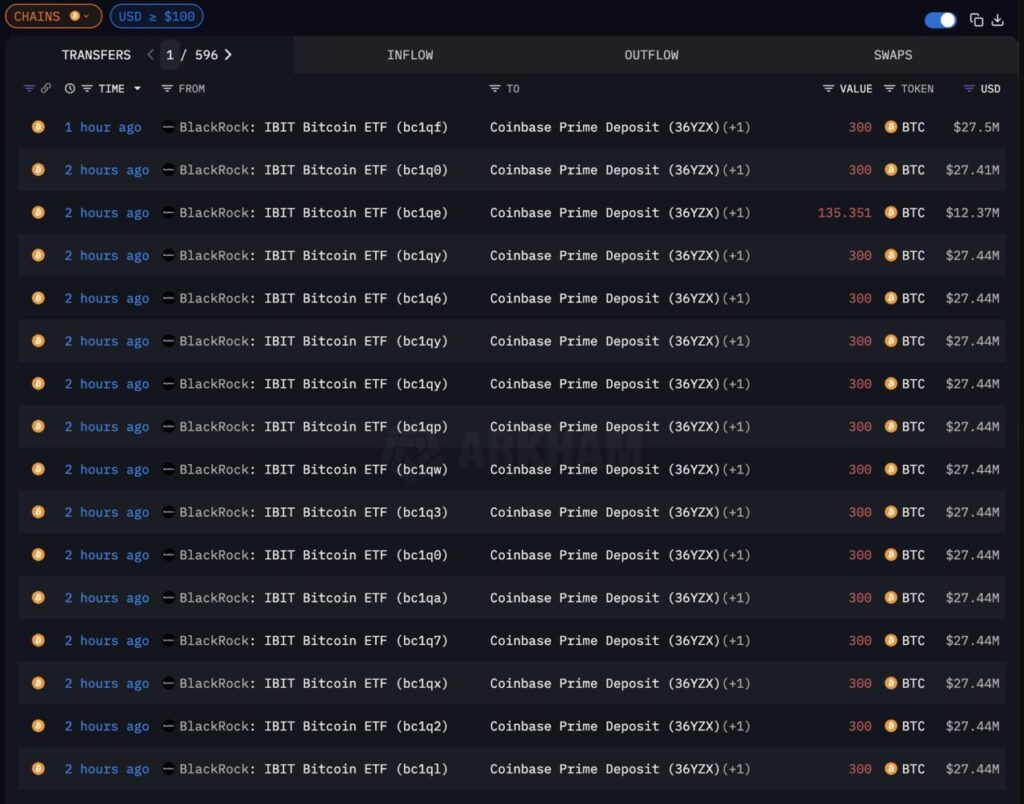

In recent days, the financial world has once again been shaken: BlackRock, the world’s largest asset manager, recorded a record outflow of funds from its spot bitcoin ETF iShares Bitcoin Trust (IBIT). According to Arkham, on November 18 alone, the fund saw $523.15 million withdrawn, beating last week’s record ($463 million on November 14).

This event became the culmination of a series of negative movements: the fund has been losing investor money for five consecutive days, with the total outflow for this period reaching $1.43 billion.

The largest ETF and liquidity issues

Despite this, IBIT remains the largest spot bitcoin ETF in the world with $72.76 billion in net assets, but recent weeks have been extremely unfavorable. Since late October, the fund has shown a persistent negative trend, and over the past four weeks the total capital outflow has reached $2.19 billion.

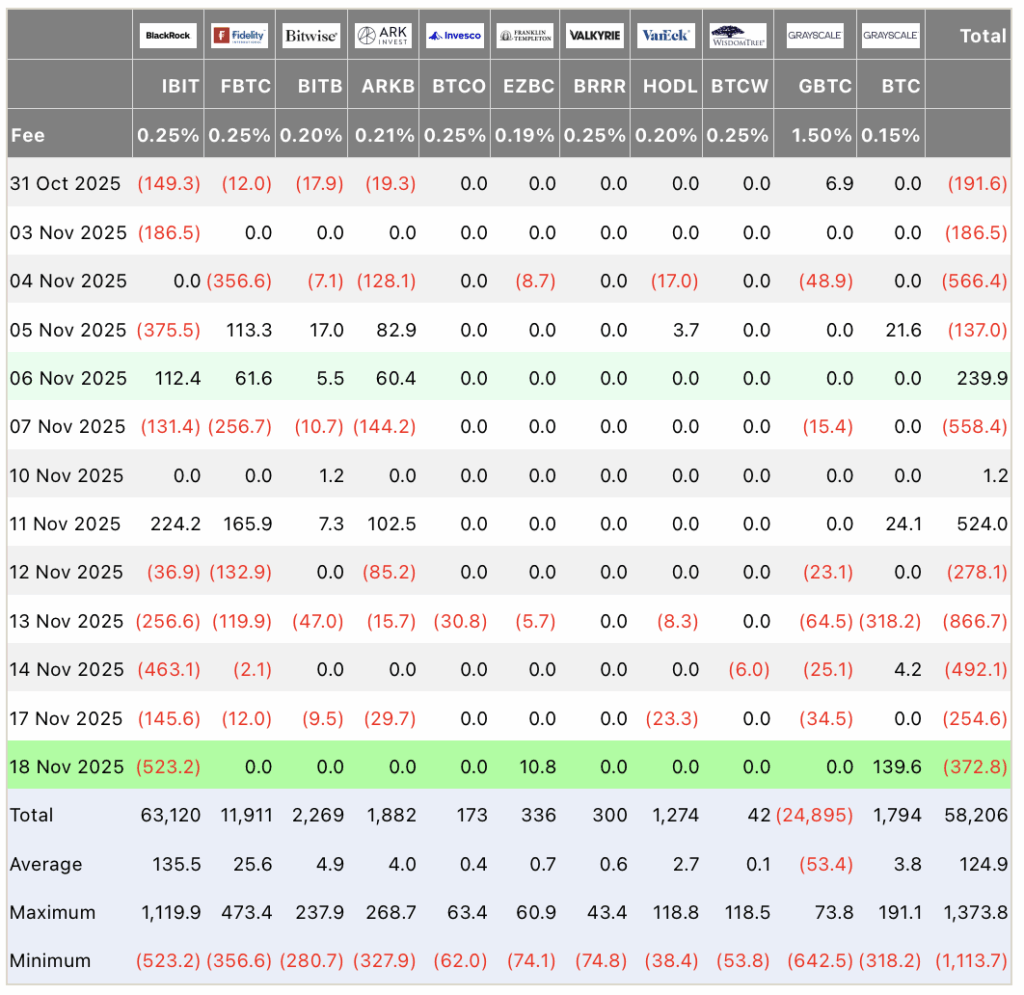

Движение капитала в биткоин-ETF США. Источник: Farside Investors

The mass exit coincided with the recent drop in bitcoin, which this week fell below $90,000 after hitting its all-time high of $126,080 in early October.

The market pressure factors are clear:

- The prolonged U.S. government shutdown reduces liquidity, creating uncertainty for institutional and retail investors.

- Expectations regarding the Federal Reserve’s interest rate decision increase caution. According to the CME Group’s FedWatch Tool, the probability of a 25 basis point rate cut in December is 49% – too close to even to give the market clarity.

The $523 million outflow from IBIT on November 18 outweighed the inflows into the Grayscale and Franklin Templeton funds, resulting in a total net outflow of $372.7 million across all spot bitcoin ETFs for the day.

Ethereum ETFs follow the trend

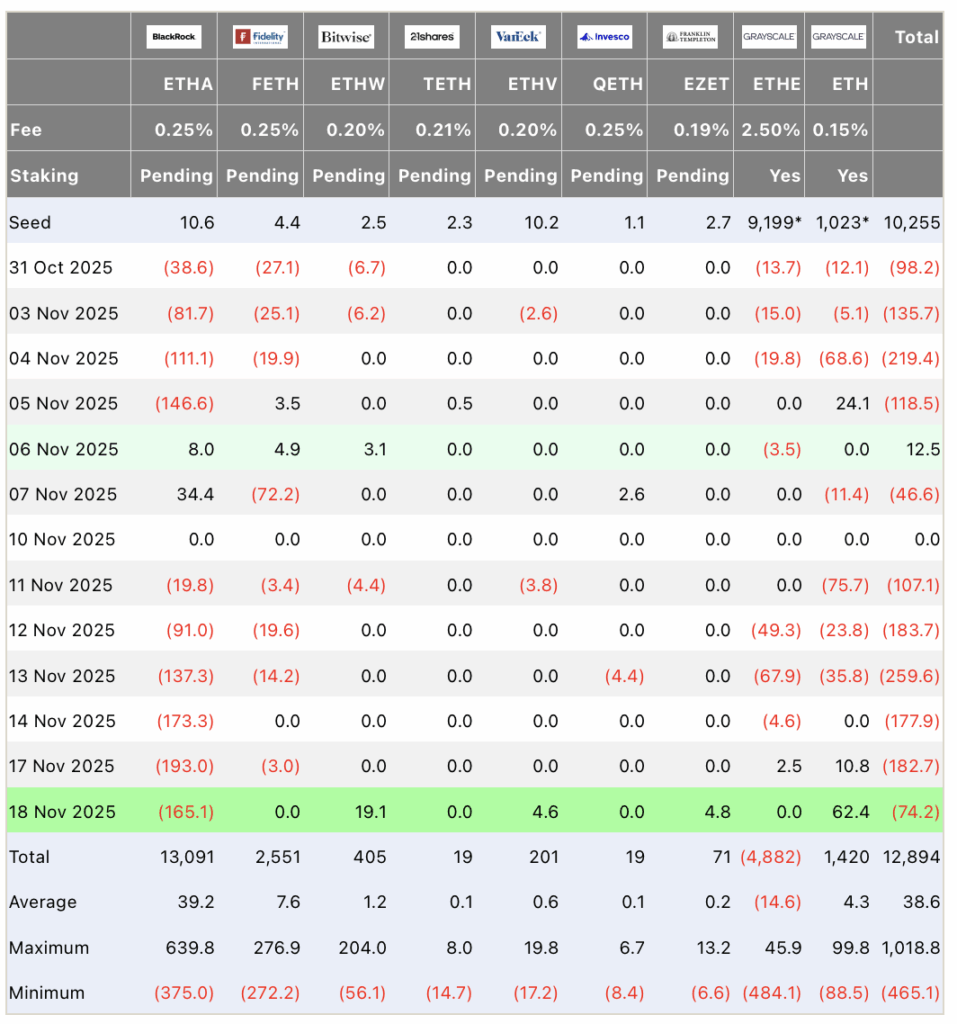

Движение капитала в Ethereum-ETF США. Источник: Farside Investors

A similar situation was observed in the Ethereum market:

- BlackRock’s ETHA recorded a $165 million net outflow, offsetting the combined $91 million inflow into the Grayscale, Bitwise, VanEck, and Franklin Templeton funds.

- Two new Solana ETFs – Fidelity’s FSOL and Canary Capital’s SOLC – also debuted on November 18. FSOL attracted $2.07 million on its first trading day, while SOLC showed no fund movement.

- Bitwise BSOL, the first spot Solana ETF in the U.S., has shown a 16-day inflow streak since its launch on October 28, accumulating $420.4 million in total net inflows.

A similar dynamic was seen in XRP ETFs: Canary’s spot fund attracted $8.32 million, while Litecoin and Hedera ETFs showed no activity.

Market split: old leaders vs new altcoins

The current situation clearly demonstrates a market split:

- Traditional Bitcoin and Ethereum ETFs are under pressure and seeing capital outflows.

- New altcoin ETFs (Solana, XRP) are finding their niche and showing stable inflows.

Institutional investors appear to be using the moment to rebalance their portfolios, optimizing capital allocation ahead of key macroeconomic events – such as the Fed’s decisions, liquidity recovery after the shutdown, and potential tax and regulatory changes.

What it means for the market

- Liquidity and investor sentiment are key drivers of short-term dynamics in Bitcoin and Ethereum ETFs. Massive outflows create price pressure, especially when the market is already experiencing a decline after October highs.

- Growing interest in altcoins and new ETFs – institutional players are seeking new opportunities for diversification and better returns, opening the way for projects like Solana and XRP.

- A signal of market maturity – the outflow of capital from the largest ETFs and the parallel rise of altcoin funds show that investors are acting strategically, focusing on balanced portfolios and long-term goals rather than panic movements.

⚡ Bottom line: the crypto ETF market is going through a phase of intense correction, where old leaders are losing ground and new players are actively attracting capital. This process reflects not just short-term volatility – it signals structural shifts in the allocation of institutional investments in crypto assets.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.