📈 Over the past two months, the price of the anonymous cryptocurrency Zcash (ZEC) (we wrote about it earlier) has risen by more than 1500%, reaching $750. Our editorial team has already drawn attention to this rapid growth, emphasizing that such movements look abnormal even by crypto market standards.

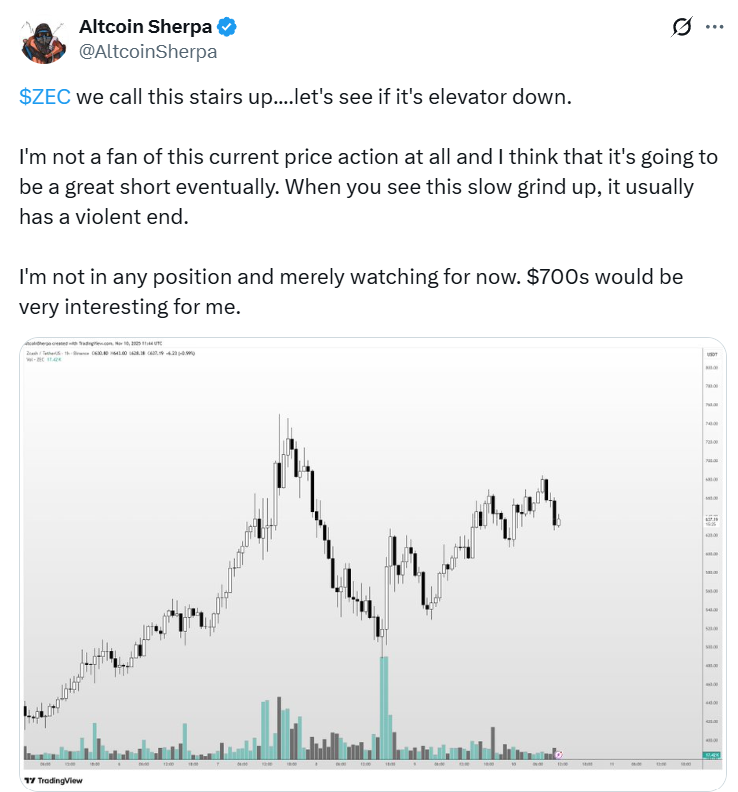

Analysts warn of risks. Altcoin Sherpa stated that after such a surge, Zcash may face a “painful collapse”.

He added that one should not get overly carried away with this asset and enter it without caution. Despite popular memes like “to the moon” and talk of a “new bitcoin”, signs of overheating are already forming in the market.

“I absolutely do not like the current price dynamics. I am sure that in the end this will become an excellent opportunity for opening a short. Such slow, creeping rallies usually end with a sharp and painful collapse,” Altcoin wrote.

The Zcash rally has several reasons. First, it coincided with the sideways movement of Bitcoin, when investors are looking for new directions for speculation. Second, interest in privacy coins is growing amid increased attention to confidentiality and transaction anonymity. Finally, technical indicators such as RSI show overbought conditions, which traditionally foreshadow an imminent cooling of the market.

“Textbook rally”: the psychological side of the surge

If you set emotions aside, the current growth of Zcash is an excellent example of crowd psychology in the market. First, an unexpected spark of growth appears, attracting speculators’ attention. Then active traders and short-term investors join the movement, increasing volatility. After this, bloggers and influencers begin shouting about a “new bitcoin”, creating hype on social media.

The next stage is FOMO among retail investors: the fear of missing out involves more and more participants, pushing the price even higher. And in the end comes the inevitable “letdown” for those who entered last. Such spikes rarely end with a smooth decline: the market prefers shock corrections that wipe out excessive optimism and bring the price back to a more realistic level.

This Zcash rally is not just a price jump. It is a textbook on crowd psychology and market participant behavior. Any investor following privacy coins can see here not only opportunities but also lessons in caution.

🧭 Conclusion

Caution comes first: although Zcash has shown impressive growth, investing in such assets requires attention and an understanding that a correction inevitably follows a rapid rise.

But it is important to remember: privacy coins often become a playground for aggressive speculation, and such movements are not a new cycle but a short-term hype wave. The coin may continue to surprise, but perceiving its rise as a “safe entry” or a “new era” is a dangerous illusion.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.