♻️ Metaplanet plans to raise about $100 million backed by Bitcoin collateral to buy even more BTC — an aggressive move that underscores its “Bitcoinization” of corporate capital strategy.

The Japanese company, already dubbed the “Asian MicroStrategy,” intends to use its existing Bitcoin reserves as collateral to obtain financing on traditional capital markets. The funds raised, according to Metaplanet’s representatives, will be used for further Bitcoin acquisitions, reinforcing the company’s balance sheet via digital assets.

The company has repeatedly stated that it views BTC as a strategic reserve asset and a long-term hedge against inflation and the depreciation of the yen. Thus, Metaplanet is effectively doubling down on Bitcoin’s growth and continues to build its business model around accumulating crypto assets rather than traditional yield instruments.

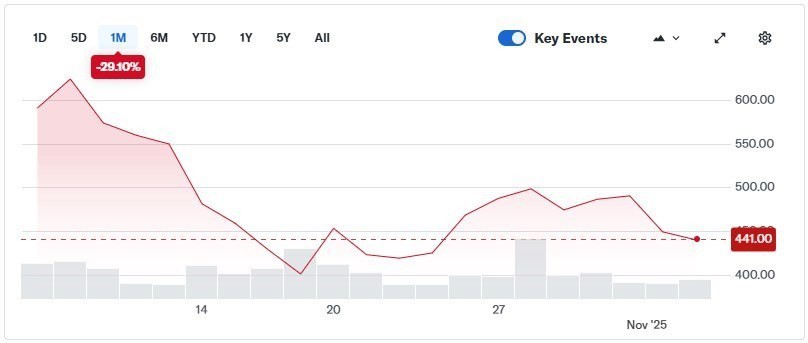

However, not everything appears flawless. Despite bold announcements and growing interest from the crypto community, Metaplanet’s shares have fallen nearly 29% over the past month. Investors are concerned about Bitcoin’s high volatility and the risks of the company’s heavy reliance on the crypto market’s dynamics. Some analysts warn that Metaplanet’s strategy could backfire in a BTC correction: a drop in the cryptocurrency’s price would not only reduce the value of its assets but also increase the debt load pledged against Bitcoin.

Nevertheless, the company’s management remains optimistic. According to board members, the current strategy is not a short-term speculation but a long-term bet on a digital future. They believe that Bitcoin will continue to strengthen its position in the global financial system, and buying aggressively now will give the company a competitive advantage in the future.

In the crypto community, Metaplanet’s move is seen as symbolic and historic for Japan: it is the first public issuer in the region using BTC as a core corporate investment instrument and as collateral for financing.

⚡ In this way, Metaplanet continues to act on the principle “Bitcoin is bought at any dip,” despite market pressure and its own share price decline. The company seems ready to play the long game — even if short-term it looks risky.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.