📉 At first glance, the picture looks almost ideal: the Fed is easing policy, quantitative tightening (QT) is coming to an end, stock indices are rising, and inflation is slowing. One would think all this should fuel interest in risk assets — including cryptocurrencies. Yet the crypto market shows surprising weakness: Bitcoin and altcoins are moving sideways, while volatility has dropped to its lowest levels in two years.

Global liquidity is expanding — but not flowing into crypto assets.

The key factor is liquidity, and it explains the current divergence between the stock and crypto markets.

Indeed, global monetary flows are expanding: dollar liquidity in the global financial system has increased following the Fed’s policy shift and balance sheet growth among Asian central banks. However, that capital is not flowing into the crypto industry.

- Institutional capital is cautious.

After the rally earlier this year, large investors have paused, watching bond yields and macro signals. - Retail investors aren’t returning.

Despite lower interest rates and a booming stock market, retail interest in crypto remains muted — especially in the US and Europe, where regulatory pressure is increasing.

ETF inflows have stalled.

After a strong start early in the year, Bitcoin ETF inflows have effectively stopped.

The total assets under management at major funds (BlackRock, Fidelity, Ark, etc.) have stopped growing and are fluctuating within a narrow range. This means new institutional money isn’t entering the market — existing investors are merely holding positions.

For comparison: in April, the average daily inflow into BTC ETFs exceeded $150 million, while in October it dropped below $15 million.

The reason isn’t waning interest in Bitcoin but the concentration of liquidity in traditional assets — equities and bonds.

DAT deals are on pause.

The Digital Asset Treasury (DAT) market — where companies hold tokens in corporate treasuries or investment portfolios — is in decline.

In the first half of the year, such deals were frequent (Tesla, MicroStrategy, Marathon Digital), but in the second half, activity dropped sharply.

Companies prefer to hold dollar reserves rather than allocate liquidity into crypto. In essence, DAT reflects corporate sentiment: interest in crypto exists, but action is minimal.

The only engine left — stablecoin growth.

Amid stagnation in ETF and DAT segments, only stablecoins are expanding.

The total supply of stablecoins (USDT, USDC, DAI, FDUSD, etc.) has grown by more than 50% since the start of the year, confirming that this segment remains the main channel of capital inflow into the crypto space.

However, it’s crucial to note: the growth of stablecoins doesn’t mean investment inflows — it’s merely liquidity accumulation waiting to be deployed. Until this capital rotates into Bitcoin and altcoins, the market will stay in a state of waiting.

Market structure is cleaner, but growth requires fresh capital.

After a wave of liquidations and the washout of speculative positions, the crypto market looks relatively “healthy”:

- leverage has decreased,

- open interest on derivatives exchanges has dropped,

- margin pressure is minimal.

Yet that’s not enough to trigger a new bull cycle.

Without new capital from ETFs and DAT markets, growth will remain capped.

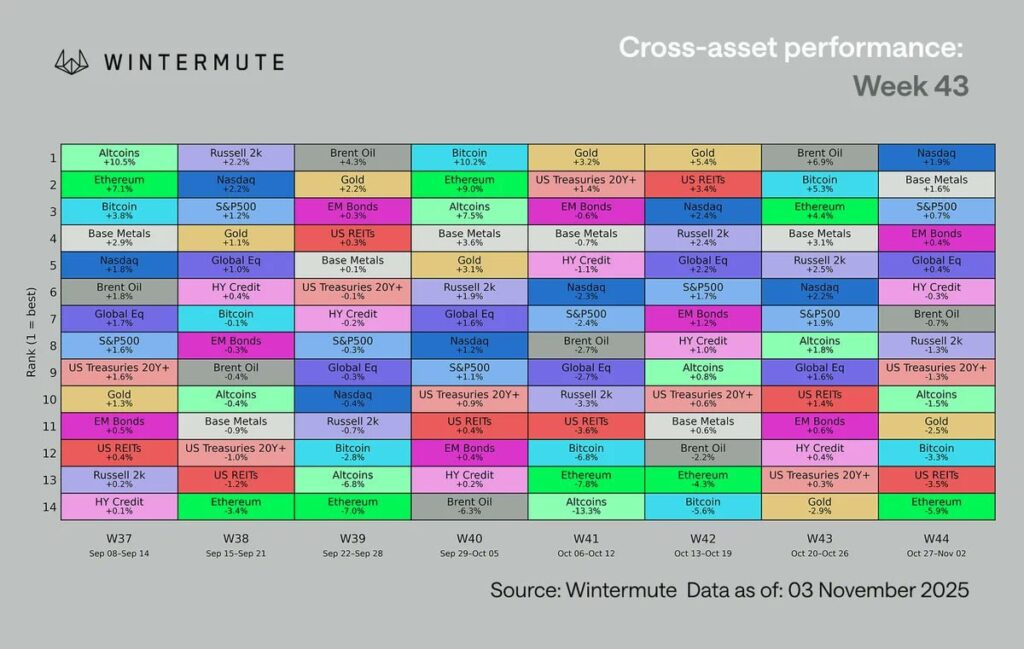

What Wintermute says.

According to the latest Wintermute report, the traditional four-year Bitcoin cycle has lost relevance.

Now, the market is driven not by halving events or timing but by liquidity.

- As long as dollar liquidity remains concentrated in traditional assets, the crypto market will stay in consolidation mode.

- A new wave of growth will begin only when capital starts flowing into digital assets — through ETFs, corporate treasuries, and DeFi.

✍️ Bottom line:

The crypto market isn’t in decline — it’s in a liquidity pause.

The macro backdrop is favorable: rates are falling, money is cheaper, risk assets are rising. But capital hasn’t yet reached crypto.

When that flow shifts — that’s when the next growth cycle will begin, driven not by halving, but by global liquidity.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.