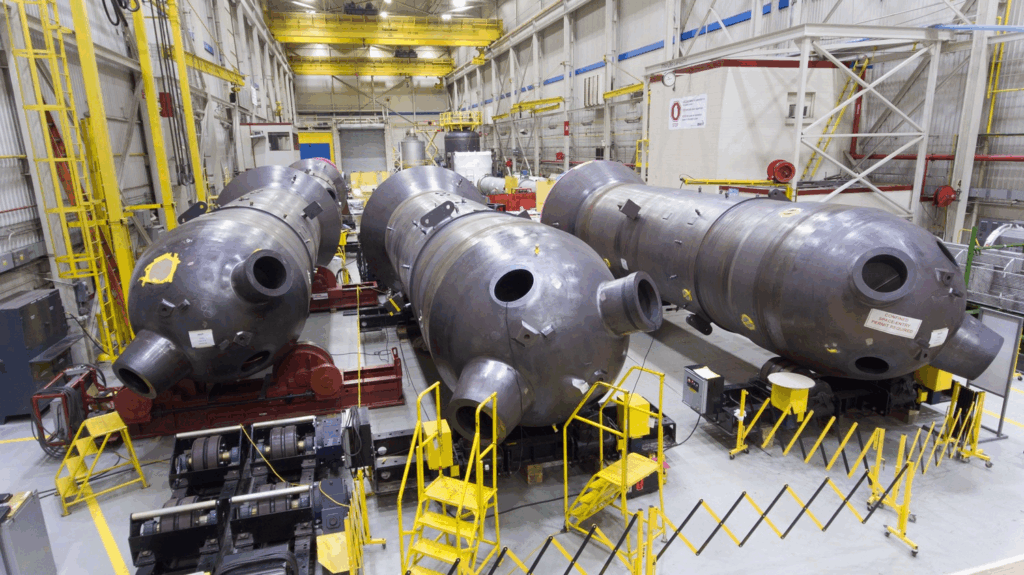

📊 American BWX Technologies — the leading supplier of nuclear reactors and components for the U.S. Navy — has reported its strongest quarterly results in years.

The company shows explosive growth across all key metrics: profit up 20%, revenue up 29%, and a record-high order backlog of $7.4 billion.

Yet despite the impressive figures, the stock fell by more than 5% in after-hours trading. Why didn’t the market appreciate this “nuclear breakthrough”?

What the report showed

- EPS: $1.00 vs. $0.85 expected

- Revenue: $866M vs. $793M forecast

- Earnings outlook: raised to $3.75–3.80 per share

- CEO comment: “Demand is unprecedented.”

- Backlog growth: +119% year-over-year

- Rolls-Royce contracts: modular SMR reactors worth about $100M each

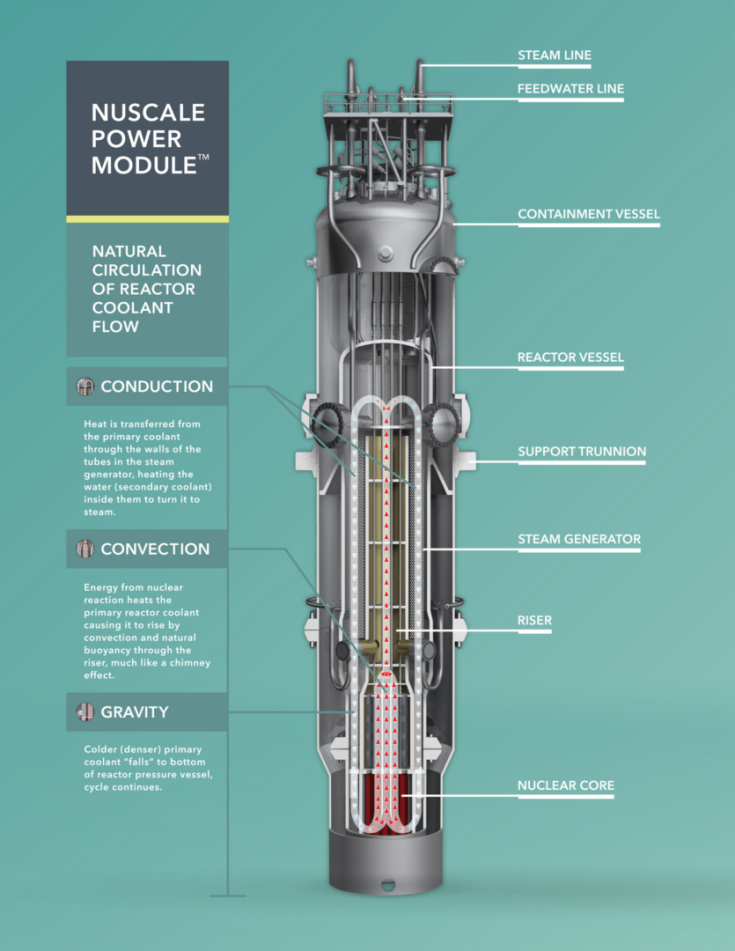

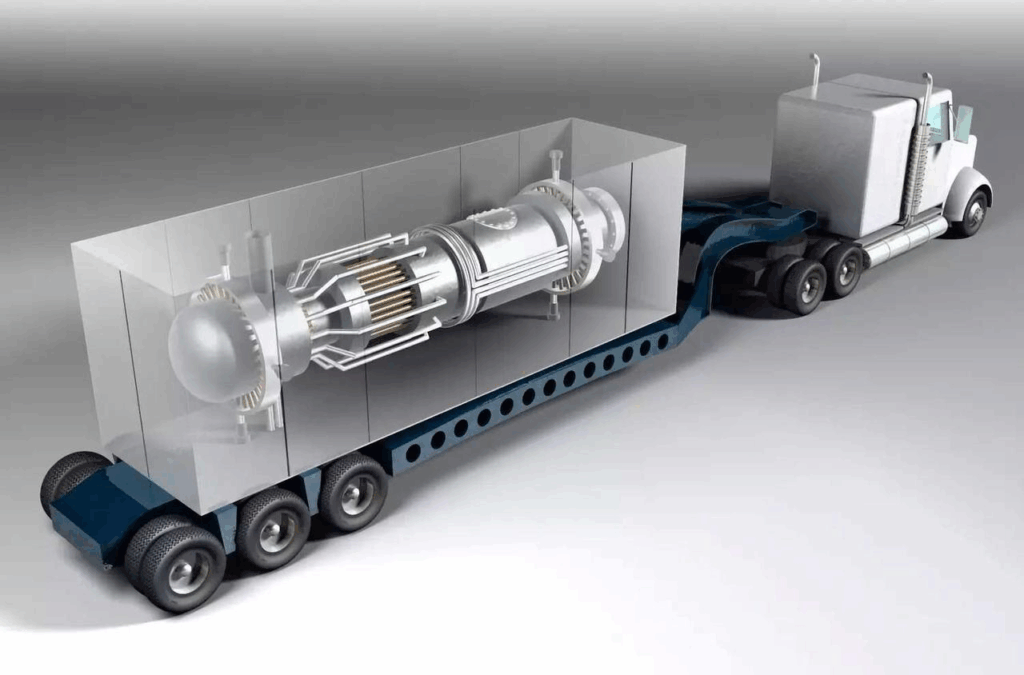

Essentially, BWXT is strengthening its position not only as a defense contractor but also as a key player in the modular nuclear reactor (SMR) segment — widely seen as the future of civilian nuclear energy.

Why the Stock Dropped:

Despite record performance, investors reacted by selling. Reasons include:

- 1. Profit taking.

Shares are up more than 116% year-to-date — a tempting level for investors to lock in gains after such a strong report. - 2. “Priced-in” effect.

Market expectations were already sky-high. Investors had largely priced in the company’s success, making even positive surprises a trigger for short-term corrections. 3. Sector-wide tension.

Major peers — Vistra, Constellation Energy, and Cameco — are about to release earnings, prompting investors to temporarily reduce exposure until the full sector picture emerges.

Strategic Outlook:

BWX Technologies continues to expand in two core directions:

- Defense programs.

The company remains the exclusive supplier of nuclear propulsion systems for U.S. Navy submarines and aircraft carriers, as well as a key contractor for the Department of Defense. - Next-generation modular reactors (SMR).

Its partnership with Rolls-Royce is already paying off — contracts worth hundreds of millions of dollars.

Talks with Westinghouse over AP1000 reactors could pave the way for small-scale nuclear plants.

If the MOU transitions into real orders, BWXT could secure a decade-long stream of contracts.

Financial Strength

The company maintains strong margins and cash flow. Net income is rising, leverage remains moderate, and EBITDA margins exceed industry averages.

The $7.4B backlog ensures 3–4 years of production visibility — a rare stability in the volatile industrial sector.

What’s next

Analysts expect continued growth in 2026, driven by government contracts and expansion into the commercial nuclear market.

BWXT is well-positioned to benefit from the ongoing “nuclear revival” in the U.S., Europe, and Japan — amid the shift toward low-carbon energy and demand for reliable power sources.

If the correction continues, the $195–205 range may attract long-term investors.

For Investors:

- The current pullback appears to be a technical correction, not a trend reversal.

- Fundamentals remain strong: stable defense contracts, a rapidly growing SMR segment, record margins, and solid earnings visibility.

- Analysts’ mid-term target: $240–260 per share, assuming steady demand for defense and civilian reactors.

🎯 Bottom line:

BWX Technologies delivers everything institutional investors like — earnings growth, predictable cash flow, and technological leadership in a niche with minimal competition.

The post-earnings drop is not a sign of weakness, but a natural pause after a powerful rally.

In the long run, BWXT remains one of the strongest plays on the “new nuclear age.”

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.