💻 Microsoft is making its biggest bet on the future of artificial intelligence — and appears determined to secure its role as the undisputed leader of a new technological era. The corporation has signed a new agreement with OpenAI, reshaping the structure of their strategic partnership, according to a statement published on Microsoft’s official website.

The tech giant has increased its stake in OpenAI to 27%, valuing the company at $135 billion. This makes OpenAI one of the world’s most valuable private firms and positions Microsoft as its key strategic partner — and, effectively, a co-owner of the leading developer of generative AI.

According to CNBC, OpenAI’s capital structure now looks as follows:

- 27% of shares belong to Microsoft,

- 26% to the non-profit OpenAI Foundation,

- 47% to current and former employees and investors.

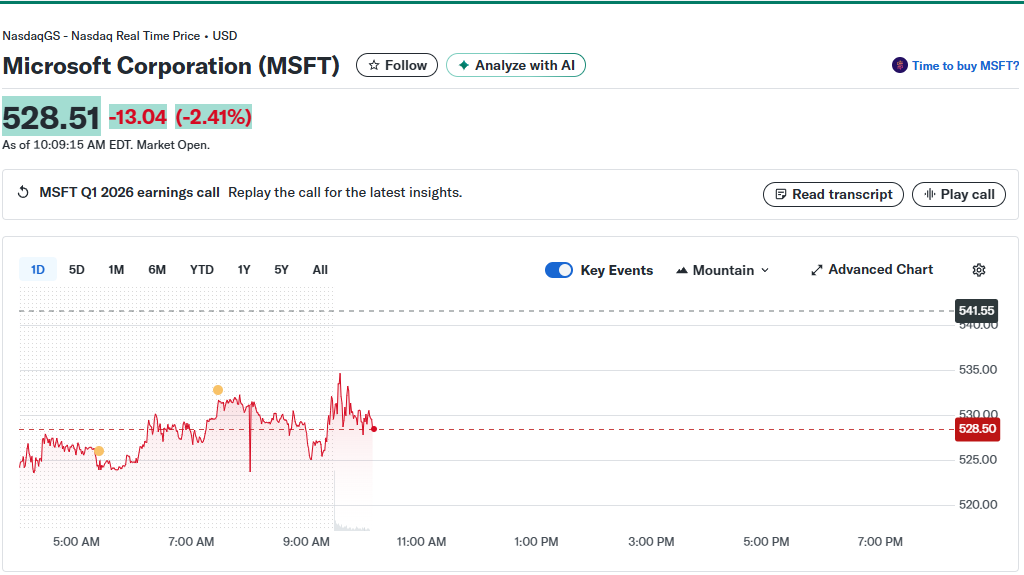

Microsoft’s stock jumped 4.2% to $553.72 at its peak; by 17:05 Moscow time, the gain had slowed to 2.7%. The company’s market capitalization stands at $4.055 trillion.

Beyond expanding its ownership, Microsoft also secured exclusive access to OpenAI’s key technologies through 2032 — including top-tier models powering ChatGPT, Codex, and DALL·E.

A Powerful Boost for the Cloud Business

One of the most striking parts of the deal is OpenAI’s commitment to purchase $250 billion worth of Azure cloud services. This marks the largest contract in Microsoft’s history, instantly strengthening its position in cloud computing and making Azure the world’s primary AI infrastructure hub.

Essentially, OpenAI becomes not just a client but a growth engine for Microsoft Cloud. The volume of orders guarantees steady revenue streams and bolsters Microsoft’s competition with Amazon AWS and Google Cloud.

Stock Surge and New Horizons

The market reacted immediately: Microsoft shares surged 4.2% to $553.72, holding steady at $553 by the end of the day. The company’s market cap exceeded $4.05 trillion, making it the world’s second-most valuable corporation after Nvidia.

Investors see the deal as “a confident bet on AI monopoly,” and analysts highlight three key advantages for Microsoft:

- Exclusivity — OpenAI remains Microsoft’s strategic partner until the achievement of AGI (artificial general intelligence).

-

general intelligence).

Technological leadership — integration of ChatGPT and Copilot across Microsoft’s ecosystem (Windows, Office, GitHub) provides a unique competitive edge.

-

- Financial potential — a possible future IPO of OpenAI could further boost Microsoft’s market value and investor returns.

The ChatGPT Effect and the “Golden Touch”

OpenAI now holds AI-related contracts worth over $1 trillion, and every company it partners with has seen rapid stock growth. Analysts have already dubbed this the “OpenAI effect” or the “ChatGPT golden touch.”

In early October, OpenAI became the most valuable private company in the world, reaching a $500 billion valuation after an employee share sale. Now, following its new deal with Microsoft, that valuation has effectively risen by another third.

The Big Question — Who Will Win the AI Race?

Today, three corporations are shaping the technological future: Nvidia controls the hardware, Microsoft runs the infrastructure and software, and Apple dominates devices and user experience. Yet Microsoft appears the most resilient — it has embedded AI across all its products and retains exclusive access to the world’s most advanced generative AI models.

Thus, Microsoft is transforming from a mere investor into a systemic architect of a new technological order — one where artificial intelligence becomes the defining asset of the 21st century.

🧠 And the question now gripping Wall Street: will Microsoft become the ultimate winner in the global race for artificial intelligence — or is another round ahead, with even higher stakes?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.