📱 Remember when Apple confidently set the iPhone price at a thousand dollars? People grumbled and protested — and then got used to it. Later it climbed to fifteen hundred — and again, everyone adapted. Now the story repeats itself in a new dimension: humanoid robots are becoming as consumer-oriented as smartphones.

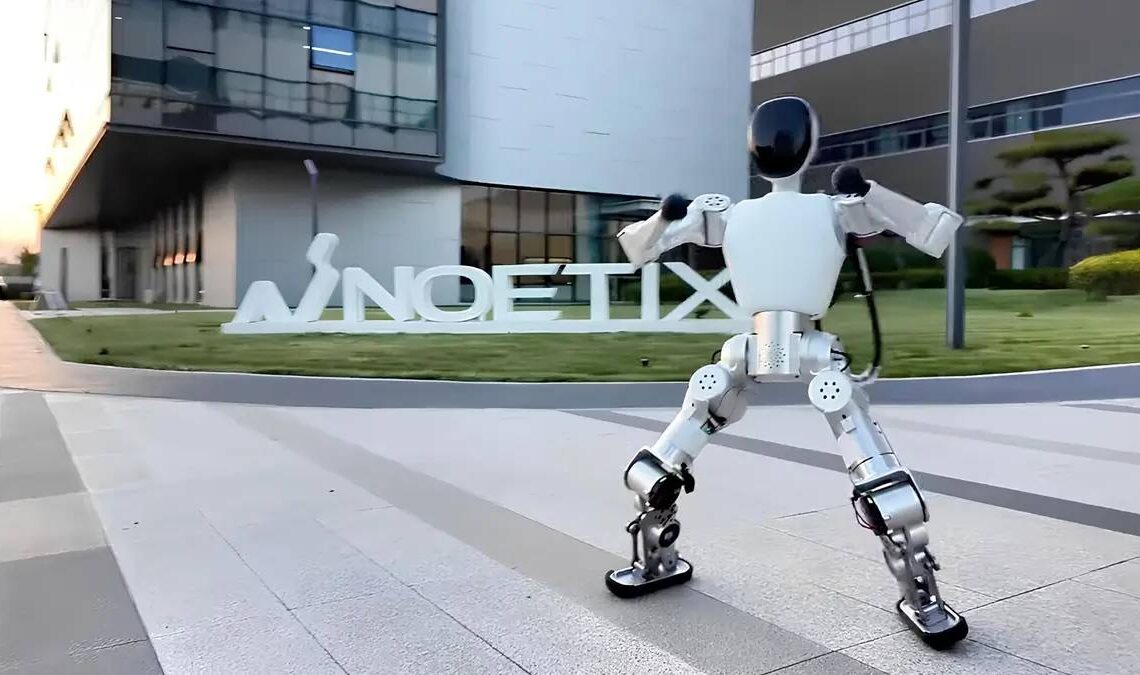

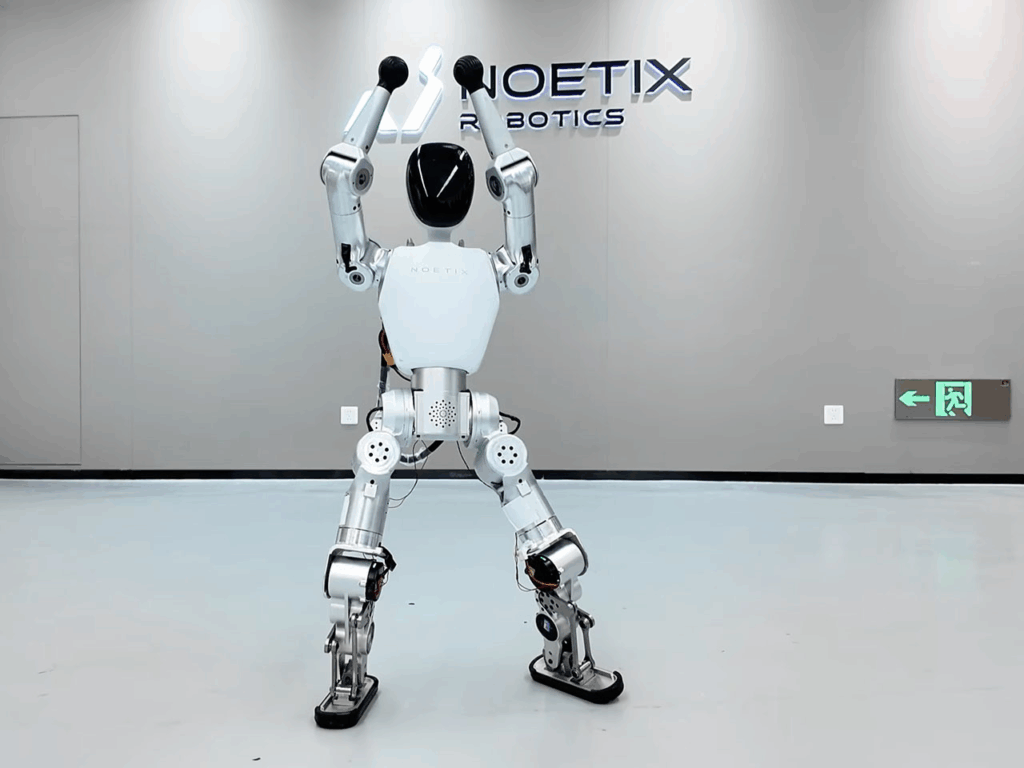

While some companies showcase futuristic prototypes with flawless movement and synthetic faces, others have quietly started selling their first models. Today you can buy a Noetix Bumi humanoid for about $1,300 — cheaper than a new iPhone.

Next comes Unitree R1, costing around five to six thousand and intended for learning and simple tasks. More advanced options like the 1X NEO go for around $20,000 or can be leased for $499 a month. Professional models like Apptronik Apollo are estimated at around $50,000 in mass production.

Agility Robotics is already testing its Digit robot in retail and logistics, while Figure is partnering with automakers and AI teams. In Europe, companies like PAL and NEURA specialize in collaborative robots, while Canada’s Sanctuary bets that machines will “learn faster than humans.” China, as usual, takes a different path — cutting prices and speeding up development cycles.

For the first time in two decades, robots are no longer exhibition wonders. “Movie hardware” is becoming a retail product.

America, China, and Europe — Three Paths Forward

Today, the global robotics landscape is divided into three directions.

The U.S. focuses on industrialization: robots work in warehouses, factories, and inspection sites. The formula is simple — the human stays in the loop. Full autonomy remains a myth, but hybrid systems are profitable and stable.

China prioritizes scale and speed. Manufacturers supply educational kits and basic models to universities, colleges, and labs. The goal: mass learning, cheap chassis, fast software iteration, and accessibility.

Europe builds around safety and human-machine integration. It values certification, reliability, compliance, and algorithmic transparency. Unlike China’s speed-first model, European robotics is built on trust.

The price curve for humanoids now resembles what drones and 3D printers once went through — from a few thousand for basic devices to fifty thousand for industrial ones. Yet the key shift isn’t in price, but in revenue source: profits move from “hardware” to skills, software, updates, and services.

The Economics of the New Era

A robot stops being a capital asset — it becomes an operational unit. What matters to businesses is not purchase price but cost per operating hour at a given uptime. Automation makes sense when the machine performs reliably, not just “cheaper than a human.”

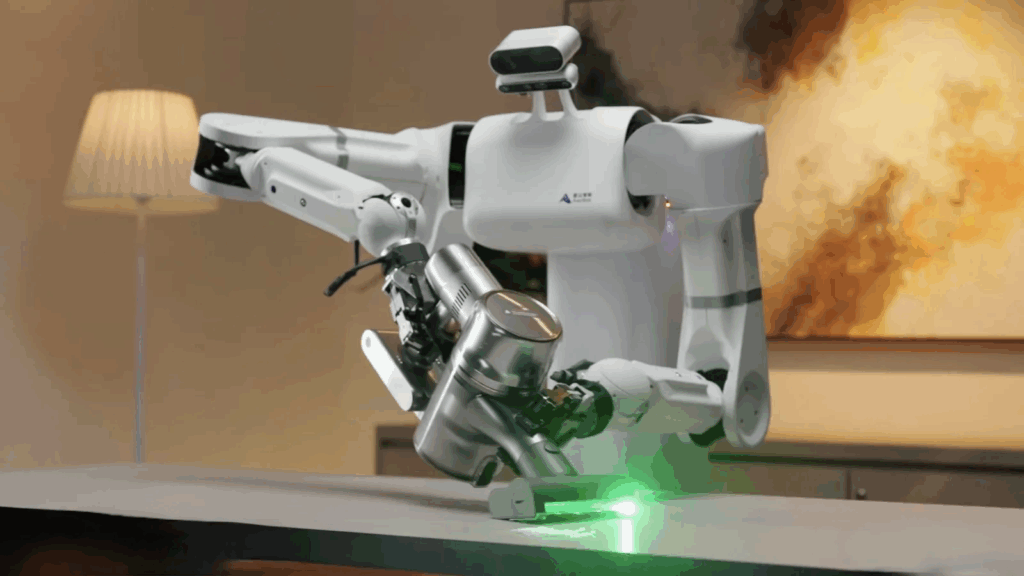

Early use cases are simple — move, deliver, inspect — but soon evolve into “skill stores”: internal libraries of commands and behaviors adaptable to specific companies.

Previously, robots required complex integration; now they can be “taught” new tasks through an interface. They’re becoming more like iPhones — universal platforms with updates, plugins, and subscription-based features.

Efficiency metrics are shifting too — focus is now on autonomous minutes, uptime, task completion rate, and recovery time. Without local service, spare parts, and maintenance, no project will scale — no matter how advanced the tech.

What Investors Should Watch

Investors should look beyond elegant mechanics to revenue sustainability. In modern robotics, the data and simulation layer is more valuable than the physical device. The best companies are those ensuring recurring revenue through skills and service contracts.

Risks remain operational: dependence on human oversight, high deployment costs, unpredictable field performance. Yet these same barriers create upside potential. Partnerships with factories, logistics operators, and automakers, along with “skills-as-a-service” platforms, are forming a new market.

The key is disciplined cash flow. The winners aren’t those talking the loudest about “the AI of tomorrow,” but those consistently selling useful actions today.

Impact on People

The entry threshold for robotics is dropping to the level of a smartphone. Where students once saw humanoid robots only at expos, schools and makerspaces now receive real units for experimentation. This builds a new education infrastructure where programming, electronics, and AI become hands-on fields.

New professions are emerging: robot operator, skill trainer, service technician, solution integrator — modern equivalents of early PC-era roles.

But mass robotization brings new risks too. Cameras, microphones, and sensors in homes and schools make privacy a real issue. Local access profiles, offline modes, and transparent data settings are essential.

Where Adoption Looks Most Promising

Warehouse logistics and retail lead the way. Monotonous tasks — inspections, restocking, transport — fit perfectly with humanoids under tele-supervision. The next step is retraining staff as robot operators and trainers, managing “human + machine” teams.

In low-wage countries, robotization may trigger production relocation closer to markets. It’s not the end of jobs, but a shift in skill structure — rising demand for engineers, service specialists, and integrators.

💡 A New Equilibrium

We’re entering an era where prices fall, tasks simplify, and value shifts toward software and data. Robots are becoming tools, not marvels.

Whoever first turns “iPhone-priced hardware” into repeatable workflows and sustainable service will secure the next layer of the market — where technology finally meets discipline.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.