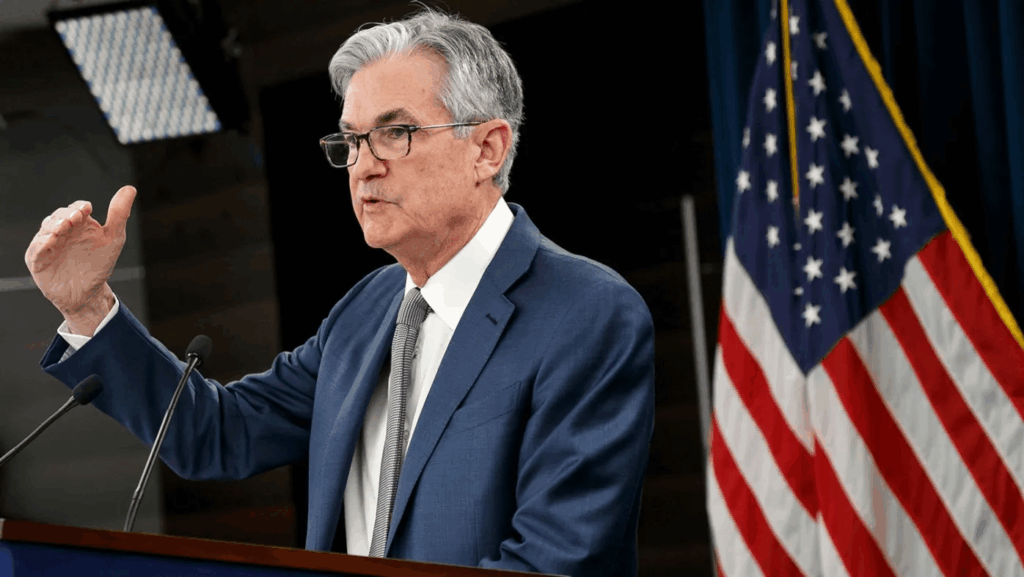

⚡️In this article, we’ll take a look at the fresh (October 29, 2025) speech by our favorite Jerome Powell. The U.S. Federal Reserve (Fed) went for a second consecutive rate cut, but instead of euphoria on Wall Street — nervous tension. Fed Chair Jerome Powell made it clear: a December policy easing is far from guaranteed. And markets immediately turned from green to red, as if someone suddenly turned off the lights.

What happened:

Following the Federal Open Market Committee (FOMC) meeting, the federal funds rate was lowered to a range of 3.75–4%. In addition, the Fed announced the end of its quantitative tightening (QT) program — starting December 1, the central bank will stop shrinking its balance sheet, which has ballooned to $6.6 trillion since the pandemic.

Two dissenters:

Not everyone agreed. Steven Miran pushed for a deeper 0.5% cut, while Jeffrey Schmid of Kansas City argued that the rate shouldn’t be changed at all.

Why it matters:

The Fed rate is essentially the “price of money” in the U.S. economy. When it’s lowered, borrowing becomes cheaper, markets rally — but inflation tends to rise. And right now, with inflation stubbornly holding near 3% (vs. the 2% target), the move looks more preventive than necessary.

Powell cooled the excitement:

“An additional rate cut in December is not a foregone conclusion. Far from it,” Powell emphasized.

Before his statement, markets priced in an 85% chance of a December cut — after the press conference, that dropped to 71%.

Why the Fed is “flying blind”:

Due to the partial U.S. government shutdown, the Fed has lost access to fresh macro data — no updates on employment, retail sales, or business activity. Analyzing the economy without these numbers is like flying a plane at night without instruments.

The only available indicator is the Consumer Price Index (CPI), which showed a modest slowdown in inflation.

What the Fed says:

The statement noted moderate economic growth, a slightly weaker labor market, and still-low unemployment.

Inflation remains above target but is getting closer, while tariffs from the Trump administration add 0.2–0.4 percentage points to price growth.

QT is over — but not forever:

From December 1, the Fed will stop “drying out” its balance sheet. Assets will no longer decline and will gradually be reinvested — mainly into short-term Treasury bills — to stabilize liquidity and money markets.

Why markets are nervous:

Investors see a contradiction: rates are falling, inflation is above target, tariffs are rising, and the economy doesn’t seem to need stimulus. Powell is walking a tightrope between supporting growth and preventing overheating.

According to Krishna Guha (Evercore ISI), by 2026 the Fed may even resume asset purchases “to support organic growth.”

Historically, rate-cutting cycles have coincided with stock market rallies. But the longer cheap money lasts, the higher the risk of an inflation surge — and a painful correction later.

The Fed’s core dilemma remains:

how to achieve full employment without triggering runaway inflation. The labor market remains solid, but hiring is slowing and manufacturing is cooling. The December meeting is shaping up to be one of the most anticipated in recent years.

Key takeaways from Jerome Powell’s remarks:

- Inflation remains above target.

- Employment and inflation forecasts unchanged since September.

- The economy is resilient but hampered by the shutdown.

- December rate cut is not guaranteed.

- QT ends on December 1.

- Labor market steady but new risks emerging.

- Trump’s tariffs are pushing prices higher.

- AI could impact jobs but effects remain limited.

- High uncertainty calls for caution.

According to CME Group, the probability of a December rate cut fell to 71% (from 90% earlier).

🔥 Around $300 million in positions were liquidated during Powell’s speech — the market reaction was swift.

🎥 The official FOMC broadcast is available here.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.