💊 BeOne Medicines is rapidly transforming from a little-known company into one of the key players in the global biotechnology industry. Its shares (ticker ONC) have risen 86% since the beginning of the year — and this is not just the result of a lucky quarter, but a sign of systemic growth and strategic advancement in the oncology drug market.

Formerly known as BeiGene, the company underwent a massive rebranding and restructuring, aiming for leadership in cancer therapy. According to analysts, BeOne Medicines has already surpassed pharmaceutical giants such as AbbVie, Johnson & Johnson, and AstraZeneca in sales growth rates and clinical trial results.

BeOne’s flagship product remains Brukinsa — one of the most successful anti-cancer drugs of recent years. In Q2 2025, its sales reached $950 million, up 49% year-over-year. Brukinsa has officially outperformed its main competitors — Imbruvica from AbbVie and J&J, and Calquence from AstraZeneca. Moreover, physicians are increasingly favoring BeOne’s drug — clinical studies have confirmed its superior tolerability and efficacy in treating certain hematologic malignancies.

Another impressive candidate is sonrotoclax. This drug blocks the BCL-2 protein, triggering apoptosis — the natural self-destruction of cancer cells. The potential of sonrotoclax is enormous: it may become a direct competitor to AbbVie’s Venclexta, one of the most profitable oncology drugs on the market. Analysts project peak annual sales of $2.6 billion, with approval expected in China as early as 2026 and in the US a year later.

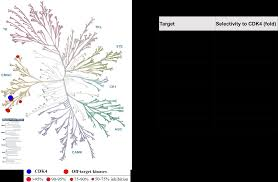

The company is not limiting itself to blood cancers. In the solid tumor segment, BeOne is betting on its BGB-43395 drug, which blocks CDK4 — a key protein responsible for cell division. Its goal is to improve efficacy and reduce toxicity compared to existing drugs such as Pfizer’s Ibrance, Novartis’s Kisqali, and Eli Lilly’s Verzenio. If clinical trials confirm the lab results, BeOne could capture a significant share of a market worth tens of billions of dollars.

Financially, BeOne Medicines impresses. Its stock carries a rating of 97 — placing it in the top 3% of all traded equities for combined quality and growth metrics. Over the past 12 months, BeOne has ranked among the top 10% in market cap growth and is now considered one of the elite growth stocks in the biotech sector.

The conclusion is clear: BeOne Medicines is not just a new biotech star — it’s a potential industry leader ready to challenge the old pharmaceutical empires.

The company’s main strength lies in its blend of innovation, steady profitability, and strategic agility. BeOne is actively expanding its pipeline: more than 20 key R&D milestones are planned for the next 18 months. This means investors can expect new data releases, partnerships, and possibly regulatory approvals. In the high-risk biotech industry, BeOne stands out for its maturity and systematic approach. The company is not betting on a single breakthrough — it’s building a long-term growth platform.

The conclusion is clear: BeOne Medicines is not just a new biotech star — it’s a potential industry leader ready to challenge the old pharmaceutical empires.

🔬 The question remains: do you invest in biotechnology? And which companies do you think will become the next leaders in cancer treatment?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.