📈 This week, analysts from leading investment banks and brokers provided fresh evaluations of key stocks, disclosed target prices, and identified main growth drivers and risks. Below is a detailed review.

Apple (AAPL)

Loop Capital upgraded Apple to Buy, setting a target price of $315.

The main driver remains strong demand for the new iPhone 17 models, as well as the upcoming anniversary iPhone 20 expected next year. Analysts note that Apple continues to maintain leadership in the premium smartphone market, and the strengthening of the services segment (App Store, subscriptions, and Apple TV/Apple Music) provides an additional revenue source. Risks include potential component supply delays and competition from Android manufacturers.

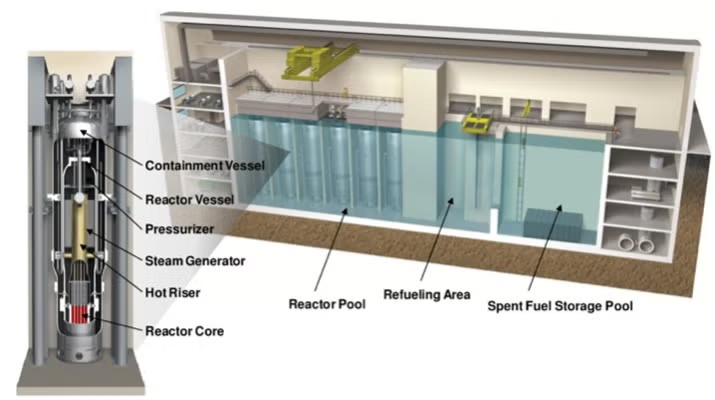

NuScale Power (SMR)

Cantor Fitzgerald initiated coverage of NuScale Power with an Overweight rating and a target price of $55. The company specializes in small modular nuclear reactors, considered a key tool for transitioning to cleaner energy.

Experts highlight the high potential of the global small nuclear energy market, relatively low capital costs compared to traditional nuclear plants, and growing demand for safe, stable energy sources. Main risks include regulatory delays, long licensing cycles, and high project capital intensity.

Dell Technologies (DELL)

Piper Sandler maintained an Overweight rating for Dell with a target price of $172. The main drivers are corporate data center upgrades, rising demand for AI infrastructure, and the end of Windows 10 support, which encourages corporate clients to upgrade equipment.

Analysts emphasize that Dell combines a strong position in servers and workstations with growing cloud infrastructure potential. Key risks include high competition from HPE, Lenovo, and Cisco, as well as volatility in corporate IT investment.

Enphase Energy (ENPH)

Mizuho downgraded the company to Neutral, setting a target price of $37. Reasons include declining solar panel demand in certain regions, as well as uncertainty in financing and incentives for new renewable energy projects.

Analysts note that despite Enphase’s technological leadership in microinverters and solar management systems, the market faces high competition and possible component price fluctuations.

Amazon (AMZN)

Keybanc reaffirmed an Overweight rating for Amazon with a target price of $300. Main growth drivers include strong advertising potential, acceleration of AWS cloud business, and attractive stock valuation amid long-term profit growth.

Analysts note that logistics network expansion and automation investments provide competitive advantages. Key risks include macroeconomic factors, changes in consumer spending, and digital platform regulation.

Overall conclusion

According to analysts, the Big Tech segment continues to set the tone for the market and remains a key investment driver. However, new growth areas are forming in energy, innovative technologies, and infrastructure. Companies in renewable energy, small nuclear energy, and AI infrastructure attract heightened attention despite risks related to regulation, competition, and global economic fluctuations.

This week, it is important to follow reports: Microsoft, Google, and Meta on Wednesday; Apple and Amazon on Thursday. These reports may determine short-term stock dynamics and influence the overall market.

📌 Analysts recommend that investors regularly update their watchlists, monitor key indicators, and consider both short-term and long-term drivers for each company. Which stocks are currently in your focus?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.