🚀 Western Union embraces stablecoins: global remittances enter a new era

Global money transfer giant Western Union has launched a pilot program for stablecoin settlements — a move that aims to make cross-border transactions faster and cheaper. Just a few years ago, such a step from a century-old company would have seemed unthinkable.

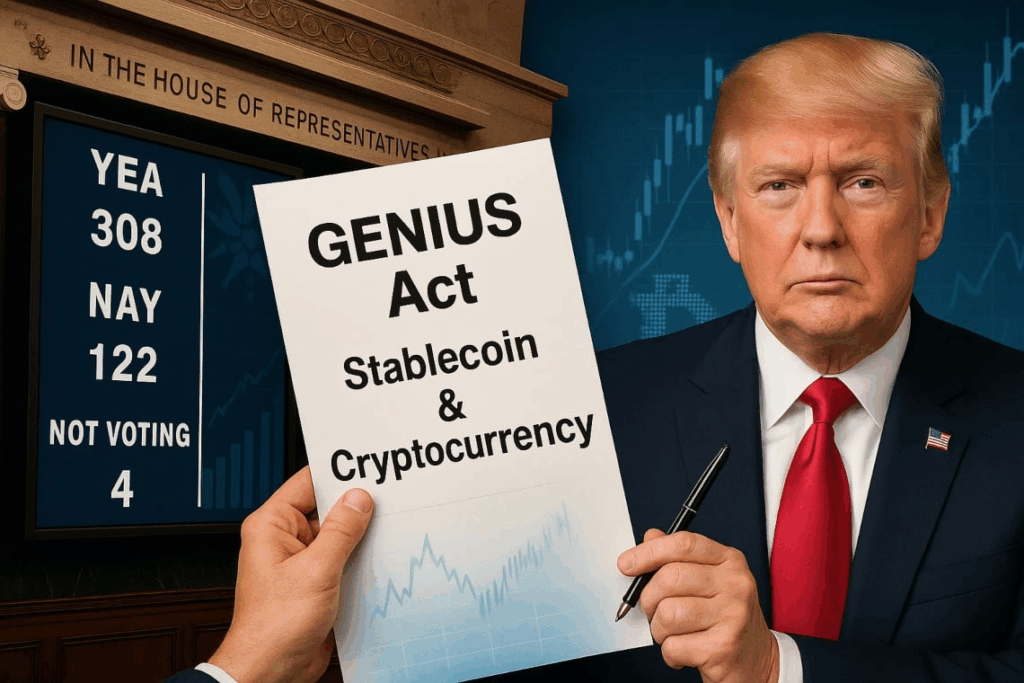

Now, with the U.S. passing the GENIUS Act — the first federal law regulating the issuance and circulation of stablecoins — Western Union and other fintech firms finally have long-awaited regulatory clarity.

From Caution to Action

Earlier this year, Western Union CEO Devin McGranahan told Bloomberg that the company is “moving from observation to action.” “We see stablecoins more as an opportunity than a threat,” McGranahan said.

The firm is already running pilot projects in South America and Africa, where traditional banks are slow and transfer fees remain painfully high. The global average remittance fee is around 6.6%, more than twice the UN target of 3%.

A New Model for Global Payments

Western Union is testing hybrid settlement models in which stablecoins serve as an intermediate layer between fiat currencies. This allows the company to:

- cut settlement times from days to minutes;

- reduce transaction costs by dozens of percentage points;

- ensure full transparency through blockchain tracking.

The company is also in talks with blockchain infrastructure providers and crypto payment processors to integrate fiat on/off ramps, and it is considering launching its own stablecoin wallet in select jurisdictions.

Regulatory Milestone

The signing of the GENIUS Act by President Donald Trump marked a turning point for the entire crypto-financial ecosystem. Stablecoins now hold the status of regulated digital dollars.

Major corporations — including Amazon, Walmart, JD.com, and Alipay — are already experimenting with digital settlements.

However, skeptics remain. Senator Elizabeth Warren warned of “serious systemic risks” and privacy threats associated with the launch of private stablecoins: “And then they’ll come asking for help when it all inevitably collapses,” she said.

Nevertheless, the growing interest from the corporate sector suggests the opposite — the race has already begun, and Western Union has no intention of staying on the sidelines.

The Global Perspective

According to Frank Combay from Next Generation, legal clarity (especially in Europe under MiCA) has removed the key barrier to stablecoin adoption — uncertainty.

Forecasts suggest that the stablecoin ecosystem could cut transaction costs by over 90%, and its market capitalization could grow from $250 billion to $2 trillion in the coming years.

Ripple CEO Brad Garlinghouse echoed this view, saying the market is “entering an exponential growth phase.”

Why it matters

Western Union is effectively reinventing its business model, shifting from a network of physical agents to a blockchain-based digital infrastructure.

Stablecoins enable the company to:

- make transfers nearly instant;

- maintain stability in inflation-prone economies;

- offer new services to the unbanked population with smartphones.

🌍 In short, Western Union is turning crypto from a threat into a tool — taking the first step toward a new era of global remittances, where money moves not through wires but across the blockchain.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.