💰 Every word he utters can trigger an instant storm across financial markets. One statement from him — and Bitcoin’s price can soar by 10% or crash by 20%. A single sentence spoken from the U.S. Congress podium or during a Federal Reserve press conference becomes a catalyst: some people earn millions in minutes, while others lose everything in an instant.

We’re not talking about a billionaire, a hedge fund CEO, or even a crypto visionary like Elon Musk. This is the man at the helm of the most powerful financial institution in the world — the U.S. Federal Reserve System. His name is Jerome Powell, and we’ve written about him many times before

. The Fed Chair is a figure whose decisions determine not only the fate of the dollar but also the movement of all global currencies, the cost of borrowing, interest rates, inflation trends — in short, the entire global economy.

“People hang on every word Jerome Powell says. What he says can move the markets in the opposite direction,” says Patrick Curtis, founder of WSO. “Yet, in total compensation, he makes only slightly more than a junior analyst fresh out of college. That shows just how high salaries are on Wall Street.”

Every speech by Powell is analyzed word by word:

- When he talks about potential rate cuts — Bitcoin and stocks rise as investors see a chance for “cheap money.”

- When he warns about fighting inflation and tightening monetary policy — the market instantly turns red.

- When he mentions a “strong U.S. economy” — the dollar strengthens while cryptocurrencies, on the contrary, lose ground.

That’s why for crypto traders, Jerome Powell is almost like a “financial oracle.” No one else on Earth has such a direct impact on the price of Bitcoin, Ethereum, and the entire digital asset market.

But how much does the man who can shift the world economy’s trajectory with a single statement actually earn?

Here are the official figures for the salary of the Fed Chair:

- Executive Schedule, Level I (as of January 2024) — $246,400 per year.

- According to OPM.gov (October 2022) — $226,300.

- According to Forbes (October 2021) — $203,500.

- According to Fox Business (June 2020) — The U.S. Congress sets the salaries of Fed board members. In 2019, the chair earned $203,500 annually, while vice chairs and other members earned $183,100.

In other words, the man whose words move trillions of dollars in the crypto market officially makes less than a quarter million dollars a year. Roughly the same as a mid-level corporate executive in the U.S., but far less than those whose fortunes fluctuate daily because of his statements.

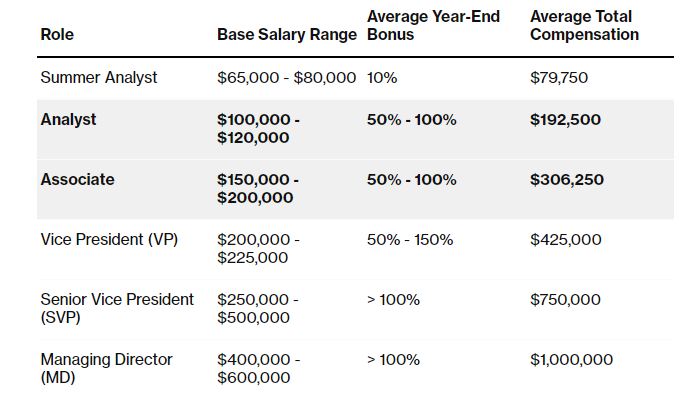

Average Wall Street incomes. Source: Wall Street Oasis, Bloomberg.

Of course, Jerome Powell is not a poor man. Before joining the Fed, he worked in investment banking, held executive positions at Carlyle Group, and his net worth is estimated in the millions. But as the head of the Federal Reserve, he operates not for personal profit but as the key regulator of the financial world.

His power lies not in his paycheck — but in his word.

A single phrase from him can change the price of Bitcoin, gold, oil, bonds, and even mortgages. That’s why every one of his appearances becomes a global event watched by everyone — from Wall Street to Telegram crypto chats.

What you can do if you trade or invest:

- Watch not only the Fed’s decisions but also Powell’s transcripts and Q&A sessions — that’s where the real signals often are.

- Use hedging tools during rate decision days and press conferences (options, stop limits).

- For long-term investors — focus on institutional trends (ETF flows, capital movement) and macro money cycles rather than short-term post-speech noise.

🌍 Jerome Powell doesn’t “program” Bitcoin’s price directly — he manages liquidity and expectations. And the markets, including crypto, respond instantly: easing means growth in risk assets; tightening brings declines and revaluations.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.