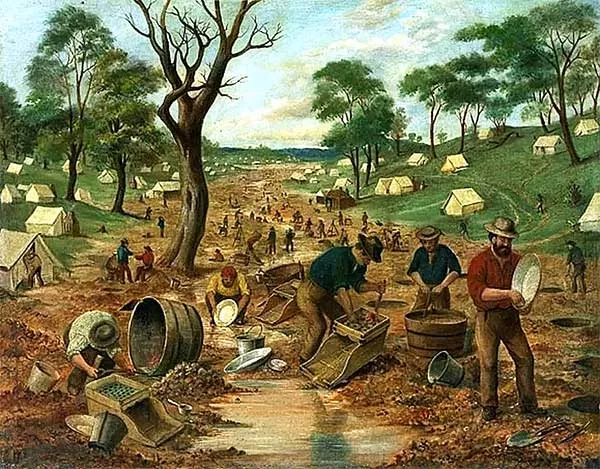

💥 In recent weeks, the gold market has staged a real spectacle: first a furious gold rush, where everyone wanted to buy gold, pushing the price to new highs, and then — a sudden drop that made many investors clutch their hearts. What is happening behind the scenes of this gold boom, and should we expect new surges?

Why Gold Is Back in the Spotlight

Several factors are driving gold’s rise simultaneously:

- Inflation concerns — central banks around the world continue to fight inflation, and investors seek safe-haven assets.

- Geopolitical instability — alarming news from various regions makes gold a “safe harbor.”

- Weak dollar — when the dollar loses strength, gold becomes more attractive for holders of other currencies.

These factors created a snowball effect: demand grew rapidly, crowds of investors rushed into the market, sending prices to historic highs.

But After the Rush Came the Drop

Immediately after the record rise, gold sharply corrected. Why?

- Profit-taking — those who bought gold early began selling to lock in gains.

- Speculative bubbles — growth is not always supported by fundamentals; when “pyramids” reach their peak, they inevitably collapse.

- Return of interest in stocks and cryptocurrencies — some investors moved funds into riskier but more profitable instruments like Bitcoin.

What’s Happening Behind the Scenes

Behind the official numbers are large players: hedge funds and institutional investors actively manage capital flows, creating “swings” in the market. Their goal is to maximize profit both on rises and falls, leading to strong price fluctuations.

Interestingly, these movements often confuse ordinary investors — it may seem the market is “going crazy,” but in reality, it’s a calculated game of the big players.

Forecast: Dollar, Gold, and Bitcoin

- Dollar — likely to remain volatile. If central banks continue tight-rate policies, the dollar may strengthen, temporarily lowering gold prices.

- Gold — despite the recent drop, long-term prospects remain positive. In times of global uncertainty, gold can once again be a safe haven.

- Bitcoin — the cryptocurrency sometimes behaves like “digital gold,” so part of the capital leaving the gold market may flow there.

⚡ Conclusion

Gold fever is a reminder of how investor emotions and expectations can push prices up or down. Behind the pretty charts lies strict logic: supply, demand, and the actions of major players.

For investors, it is important to remember: haste and panic are poor advisers. Real gains come to those who observe, analyze, and act calmly.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.