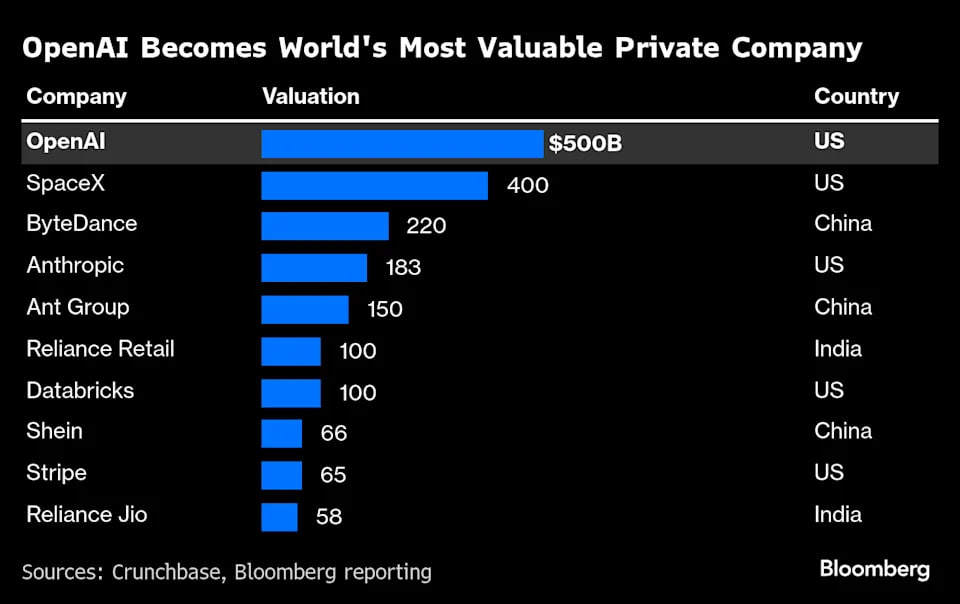

🤖 OpenAI, the company behind ChatGPT, has officially become the most valuable private technology company in the world. According to Bloomberg, the company’s valuation has reached $500 billion, making it more valuable than giants such as SpaceX ($400 billion) and ByteDance, and far exceeding Stripe ($70 billion).

For comparison, before its IPO, Google was valued at only $25 billion.

OpenAI’s growth over the past six months has been phenomenal: in just half a year, the company’s valuation increased by $200 billion. Despite multi-billion-dollar losses, investors continue to bet on the startup and are willing to “turn a blind eye” to its current financial opacity.

Secondary share sale — a record deal for Silicon Valley

A recent transaction allowed current and former OpenAI employees to sell shares worth $6.6 billion to investors. This very deal cemented OpenAI’s position as the largest private tech company in the world.

Experts note that this practice of secondary share sales — rather than a traditional IPO — is becoming increasingly popular in Silicon Valley. It allows employees to secure profits and investors to acquire stakes in a closed company without going public.

Why OpenAI is valued so highly

Investors are betting that OpenAI is not just another trendy tech firm, but a potential new industry standard. To justify its current valuation, the company must not only maintain leadership in generative AI but also catch up with giants like Google in key financial metrics.

At present, the revenue gap between them is huge — around 30 times. Yet the AI market is so “hot” that investors are willing to pay a premium for the chance to back the creation of a “new Google” in advance.

OpenAI as an industry standard

Today, OpenAI is far more than a research lab. Its GPT models are integrated into Microsoft, Salesforce, and Stripe products and are used by thousands of startups worldwide.

Experts say OpenAI is gradually becoming an industry standard, setting trends for the entire tech ecosystem.

Competition with Anthropic, Elon Musk’s xAI, and Google DeepMind only increases its relevance.

Challenges and the company’s future

OpenAI’s main challenge now is not just technological leadership but turning that leadership into profit. Potential monetization sources include:

- Pro subscription for individual users;

- Corporate solutions and integrations;

- Agent protocols for business process automation;

- Advertising and technology licensing.

If OpenAI manages to monetize its dominance as successfully as Google did with search, its $500 billion valuation could be just the beginning.

💡 Conclusion

OpenAI has become a symbol of a new Silicon Valley mindset — companies grow not only through profit but through strategic market influence, technological leadership, and the ability to define industry standards.

Investors willing to pay for the promise of future technological dominance have made OpenAI the most valuable private company in history.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.