🚀 The quantum computing sector, which recently went through a cooling period after rapid growth between 2021 and 2023, is once again in the global spotlight.

According to The Wall Street Journal, several leading companies in the field — IonQ, Rigetti Computing, D-Wave Quantum, and others — are in talks with the administration of U.S. President Donald Trump to transfer equity stakes in exchange for federal funding.

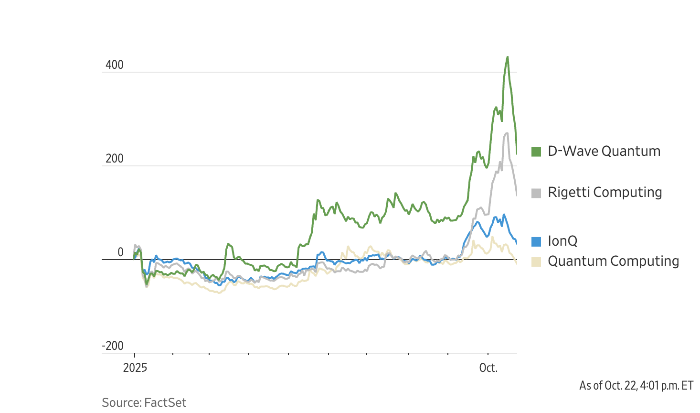

Shares of quantum computing companies. Source: The Wall Street Journal

The discussion involves potential government investments in exchange for ownership stakes — a model Washington views as a tool for strategic control over the key technologies of the future.

What’s happening

According to WSJ sources, U.S. officials are studying funding models that would allow the government not merely to subsidize quantum projects but to acquire equity participation — similar to the approach already used in strategic sectors like defense and semiconductors.

The goal is to strengthen national technological leadership and reduce dependence on private and foreign investors, especially amid growing competition with China, which is heavily investing in quantum computing and quantum communications.

Why it matters

- Government support as a growth driver

The quantum sector has gone through a revaluation phase: after the IPO boom of 2021–2022, company valuations dropped, and many startups faced funding shortages.

Government involvement could signal renewed confidence and provide a growth impulse, particularly through long-term grants and defense contracts. - Quantum technologies as part of the AI ecosystem

Quantum computing is not an isolated niche — it’s a key component of the future infrastructure of artificial intelligence.

Its development will enable faster data processing, molecular modeling, financial forecasting, and machine learning — areas where classical processors are nearing their limits. - The geopolitical dimension

The U.S. seeks to prevent the loss of leadership in technologies that could define the global balance of power in the coming decades.

Quantum research is becoming a new front in the global tech race, where the stakes extend far beyond economics.

What does it mean for investors?

For investors, this news is a signal that interest may return to a sector that has remained in the shadow of AI giants for the past two years.

While companies like IonQ and Rigetti remain unprofitable and trade well below their peak valuations, government investment could reshape risk perception and attract new capital.

Analysts note that if the project receives White House approval, share prices could rise — similar to how government subsidies previously boosted chipmakers and renewable energy firms.

Possible Scenarios

- Optimistic: the U.S. government approves the program, establishes a fund or agency to finance quantum startups, and the sector gains new momentum.

- Moderate: discussions drag on, and the effect is limited to a temporary spike in stock interest.

- Cautious: bureaucracy and investor skepticism slow progress, and the market slips back into stagnation.

What Investors Should Do

Beginners should start by studying the fundamentals of quantum technologies — what problems they solve, their limitations, and the industry’s current stage of development.

Buying stocks “on rumors” could lead to losses: the sector remains volatile, and actual company revenues are minimal.

Experienced investors should closely monitor official announcements and deals involving the U.S. government. Any confirmation of negotiations could act as a catalyst for stock growth, especially among small-cap publicly traded firms.

💡 The Outlook

Quantum technologies are still far from mass adoption, but for Washington, they are becoming a symbol of technological sovereignty and a response to the challenges of the new computing era.

If the government indeed takes equity stakes in quantum companies, it could mark the start of a new growth cycle — not only for the sector itself but for the entire U.S. high-tech ecosystem.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.