🚗 According to Bild, Germany’s largest car manufacturer, Volkswagen, is facing major financial troubles. The company has developed a funding shortfall of about €11 billion, which it needs to maintain stable operations in 2026.

Sources within the company’s management say the deficit stems from a combination of factors: declining car demand in Europe, a prolonged transition to electric vehicles, and rising production and raw material costs.

It is also noted that spending on new model development and factory modernization has already exceeded planned budgets.

“The situation is causing serious concern. If decisive cost-cutting measures are not taken, the company could face a cash gap as early as next summer,” Bild reports, citing internal company documents.

Electrification — an expensive toy

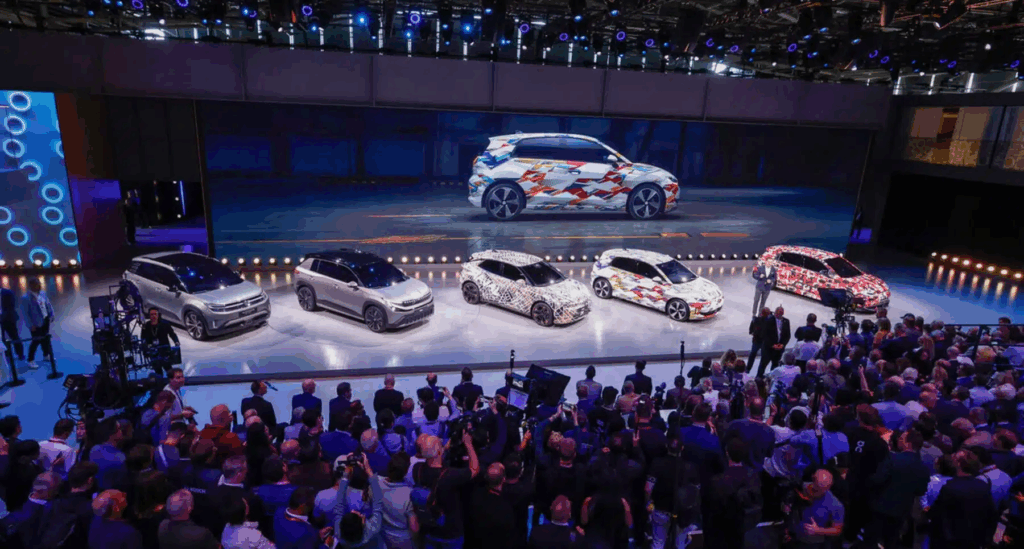

In recent years, Volkswagen has heavily invested in the transition to electric vehicles, trying to catch up with Tesla and Chinese manufacturers like BYD and NIO.

However, the project has turned out to be more expensive and slower than expected: a series of technical failures, battery supply delays, and high energy costs in Europe have undermined profitability.

At the same time, sales of traditional internal combustion models continue to decline amid growing pressure from “green” initiatives and upcoming EU bans.

Pressure from China and the U.S.

The Chinese market, which long remained Volkswagen’s main profit source, has also stopped being a “cash cow”: the German automaker’s market share there is shrinking rapidly.

Local brands now offer cheaper and more advanced EVs tailored to Chinese consumers’ needs.

In the U.S., VW’s position has weakened due to fierce competition from Tesla and General Motors, as well as a weak presence in the crossover and pickup segments — the most profitable categories of the American market.

Tesla Model Y. Volkswagen

💥 What’s next?

Volkswagen’s management is considering several anti-crisis scenarios.

Among them are large-scale cost cuts, freezing some investment projects, reviewing staff, and optimizing production capacities.

The company is also weighing external financing options, including bond issuance or partial sales of subsidiary assets.

Experts believe the situation around Volkswagen could become a litmus test for the entire German industry.

The automotive sector is a cornerstone of Germany’s economy, and the flagship’s difficulties could trigger a chain reaction among suppliers and related manufacturers.

“If Volkswagen catches a cold, the entire German economy will sneeze,” one Handelsblatt analyst quipped.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.