🏆 The precious metals market is experiencing a moment that has already entered history. Gold capitalization has exceeded $30 trillion for the first time, and the price per ounce reached nearly $4,380 — an all-time historical high. For comparison, the total market value of Bitcoin today is estimated at around $2.1 trillion, making gold 14.5 times more expensive than its digital competitor.

But the contrast does not end there. The combined value of the world’s largest tech giants — Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla — is just over $20 trillion, less than the total capitalization of gold. For the first time in decades, the precious metal has surpassed even the combined tech sector, long considered the main symbol of global growth.

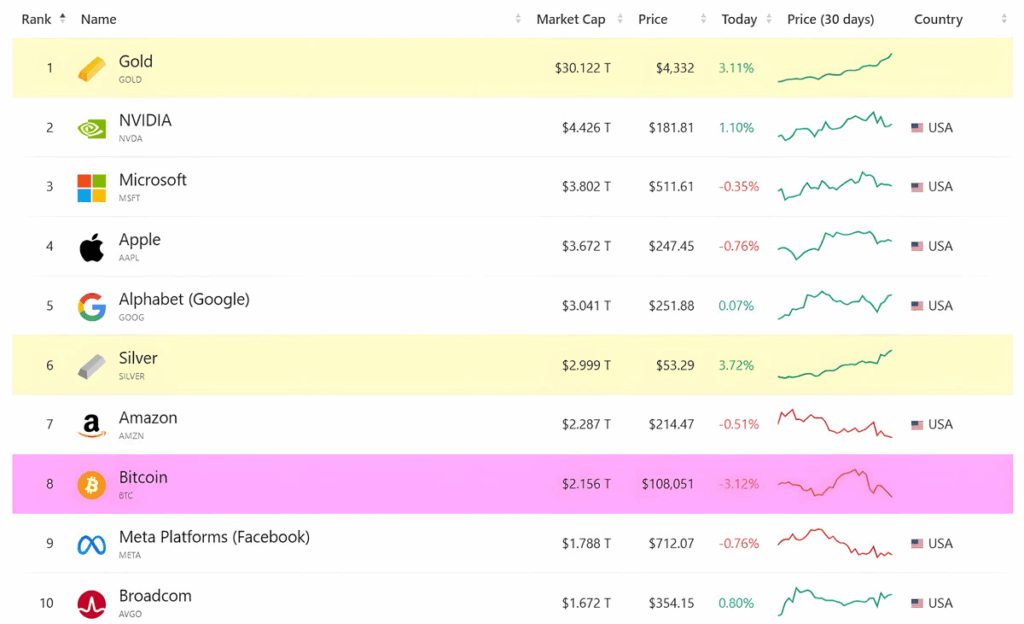

Top 10 largest assets in the world. Source: Companiesmarketcap

What drives this record

Experts cite a whole set of factors that created ideal conditions for gold’s growth.

First, geopolitical tension is increasing — trade conflicts, new tariffs, and global military risks are prompting investors to seek safe-haven assets.

Second, inflation expectations and a weakening dollar make gold more attractive as a store of purchasing power.

Third, economic uncertainty is rising — from stock market instability to declining confidence in U.S. debt instruments.

According to the World Gold Council, about 216,000 metric tons of gold have been mined worldwide, and at current prices, the total value of this metal exceeds $30.4 trillion.

Interesting figures and comparisons

Particularly impressive is the pace: gold capitalization increased by more than $300 billion in a single day. This is equivalent to the entire value of companies like Netflix or Coca-Cola.

Over the course of a week, gold’s growth added roughly the same to its capitalization as the total value of all Bitcoin.

It’s no surprise that the market immediately started talking about a possible “flow effect”: when gold rises too quickly, some investors look for alternative assets — increasingly turning to Bitcoin. Often called “digital gold,” if historical trends repeat, cryptocurrency could become the main beneficiary of an overheated gold market.

Bitcoin vs. gold: old and new havens

Since the beginning of 2025, gold has risen approximately 66%, while Bitcoin — only 16%. However, the digital asset remains in a steady trend and is currently trading around $107,000.

Many analysts believe that at the first sign of a slowdown in the gold rally, capital will begin flowing into the crypto market. For institutional investors, Bitcoin becomes a convenient tool for exposure to “alternative assets,” especially when bond yields are falling and the stock market is volatile.

If Bitcoin can finally break its correlation with U.S. equities, it may become the new “safe haven” — the same role gold has played for decades.

Gold as a warning signal

However, not everyone sees gold’s rise as a reason for optimism.

Citadel hedge fund CEO Ken Griffin warned that the rapid rise in precious metal prices is not a sign of economic health, but rather a symptom of declining confidence in the dollar and the global financial system.

He reminded that gold does not pay interest, dividends, or generate cash flow, unlike stocks or real estate. The rising price of gold essentially means one thing: investors don’t believe in growth — they are buying safety.

💥 What’s next

Analysts expect continued high volatility in the coming months. If the dollar continues to weaken and tensions in U.S.-China trade relations persist, gold could remain above $4,400 per ounce.

If the global economy shows signs of stabilization, some capital may return to the crypto market, especially Bitcoin and Ether. For investors, this is a time not for panic, but for strategy reassessment: we may now be seeing the start of a new balance between physical and digital gold.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.