⚖️ U.S. President Donald Trump unexpectedly announced on Friday that the previously proposed 100% tariffs on Chinese goods “will not be implemented.” The statement signaled a possible de-escalation of the trade war between the world’s largest economies and immediately affected global markets — including the cryptocurrency market.

Context: A Week of Panic in the Markets

Last week, global markets went through a real storm. After Trump threatened to impose 100% tariffs and new export restrictions against China, investors began to dump risk assets en masse.

U.S. stock indices fell by 3–5%, while the crypto market saw its largest liquidation of the year — over $19 billion. Bitcoin lost more than 12% of its value within hours, followed by Ethereum and other major altcoins. Analysts noted that the escalation of trade tensions between the U.S. and China in 2025 became the most severe since the “tariff war” of 2019.

A Turn in Rhetoric

However, in an interview with Fox News, Trump softened his stance:

“They (China) have been robbing our country for years, but I think we’ll be just fine with China,” the president said.

When asked if he was still considering imposing 100% tariffs on top of existing ones, Trump replied:

“No, we’re not going to do that. It would be unsustainable.”

These words came as a surprise to both political observers and investors, as just a week earlier Trump had promised to “punish Beijing hard” and “protect American manufacturers at any cost.”

Immediate Crypto Market Reaction

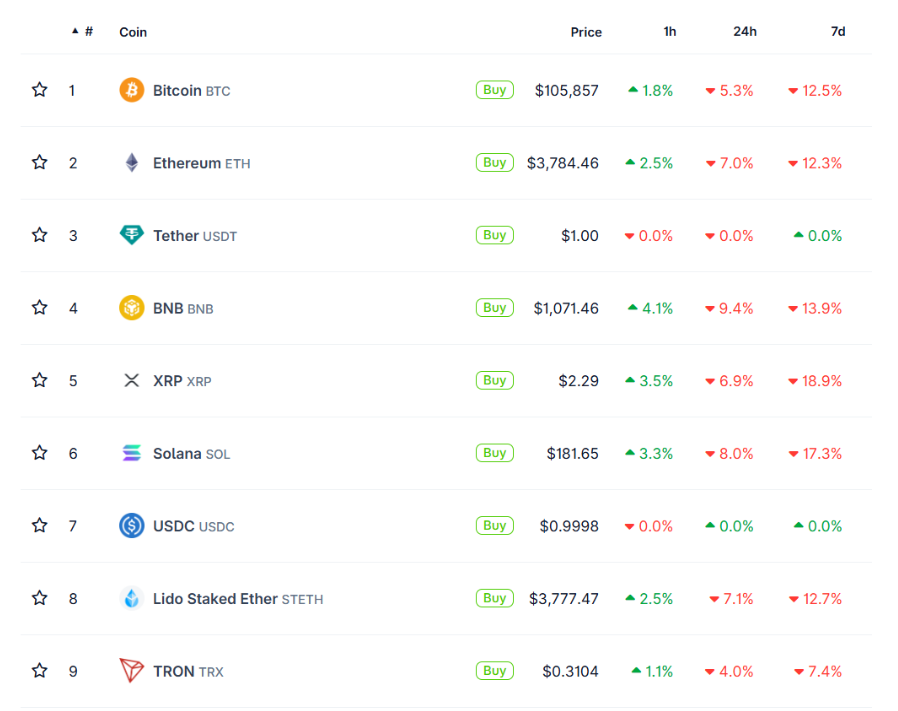

As soon as the interview aired, the crypto market began a sharp recovery. Within the first hour after Trump’s comments, Bitcoin rose nearly 2%, climbing back above $106,000. Ethereum and Solana also gained about 1.5–2%.

Performance of major cryptocurrencies. Source: CoinMarketCap

Traders called it a “relief rally” — a typical rebound following a panic-driven sell-off. Investors took Trump’s comments as a sign of stabilization, boosting confidence in risk assets.

CoinMetrics analyst Daniel Levina noted:

“We’re seeing a classic market reaction to reduced geopolitical tension. Cryptocurrencies, especially Bitcoin, have become a kind of fear barometer. When rhetoric softens, prices rebound faster than in traditional assets.”

Why Crypto Reacts So Sharply

Although cryptocurrencies are often described as “independent from politics,” in practice the digital asset market increasingly moves in sync with other risk assets — tech stocks, Nasdaq futures, and even oil.

This happens because institutional investors trading crypto follow broader risk management strategies. When geopolitical uncertainty rises, they reduce exposure across all markets — from equities to digital assets. When stability returns, capital flows back.

What’s next

The next key event will be U.S.-China trade talks scheduled for the end of the month in Seoul. If the dialogue is constructive, analysts expect the crypto market to continue rising, with Bitcoin possibly returning to the $110,000 level.

However, risks remain: Trump is known for sudden policy shifts — especially depending on domestic political dynamics and labor market data.

“Investors should remember that any new flare-up in the trade conflict could trigger an instant sell-off. It’s crucial now to stay cautious and respect support levels,” warned Emily Ho, a strategist at Binance Research.

Conclusion:

Trump’s reversal on 100% tariffs brought relief to global markets and served as a reminder of how deeply intertwined politics and cryptocurrencies have become.

Bitcoin, Ethereum, and other digital assets reacted with gains — proving that even in the age of decentralization, markets still depend on political decisions and White House sentiment.

🚀 Main takeaway: The crypto market runs not only on numbers and algorithms but also on human emotions — fear, hope, and faith in stability. And as long as Trump says “we’ll be fine,” investors seem ready to take risks again.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.