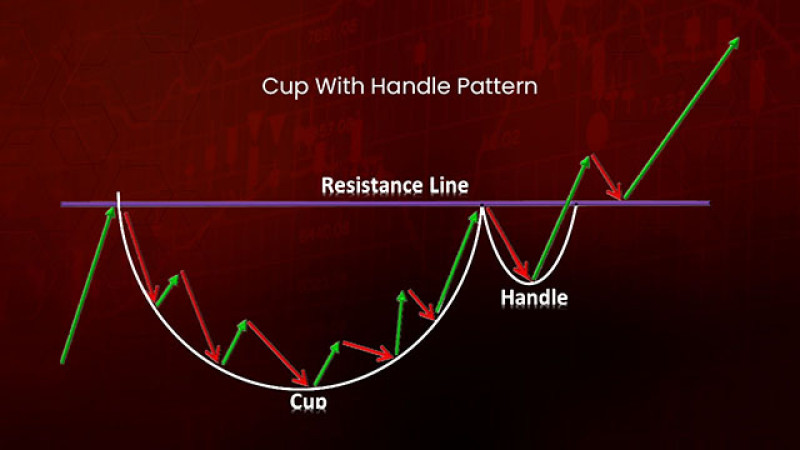

🚗 Tesla is once again in the spotlight, and this time the reason is more than serious. The company’s stock is forming a classic technical pattern known as the “cup with handle” – a signal often viewed by experienced investors as the potential start of a new upward trend. However, as always in the market, potential growth comes with risks.

What’s important to know:

- In the third quarter, Tesla delivered nearly 500,000 vehicles – an all-time record for the company. This confirms strong demand despite the slowdown in the global economy and rising competition in the electric vehicle segment.

- According to analysts’ forecasts, the company’s revenue could grow by about 5%. However, quarterly profit is expected to be lower than last year due to higher spending on new projects and reduced prices for some models.

- Tesla’s large-scale projects – such as the robotaxi and the humanoid robot Optimus – have yet to generate tangible revenue. Nevertheless, the market is already pricing their future potential into the company’s valuation, making the stock vulnerable to any delays or setbacks.

- Investor sentiment is also influenced by overall stock market volatility and uncertainty around U.S. interest rates.

Conclusion:

From a technical standpoint, Tesla’s shares are indeed ready for potential growth, but the market remains extremely sensitive to news and earnings reports. New investors should show patience – wait for the quarterly results and market reaction. This will help avoid emotional decisions and possible losses.

Aggressive traders who prefer to move ahead of the curve may consider entering at the “handle,” but only with strict risk management and protective stop-losses.

💡Keep an eye on key indicators: sales volumes, margin dynamics, and robotaxi project updates. These will be the main guideposts in the coming months and will show whether Tesla can confirm its status as a technological leader – or whether the market will have to adjust its expectations.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.